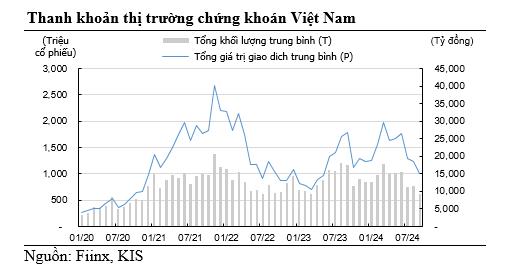

Lowest Liquidity in a Year

According to statistics from KIS Securities, the market’s liquidity is low, with a total trading volume (matched and agreed) of just over 620 million shares per session in September 2024. In contrast, the total trading value has dropped to only VND 15 trillion per session. If we consider only the matched volume, the situation is even more negative, with an average matched volume of just 520 million shares per session—the lowest since December 2020.

This raises concerns about a potential capital outflow from the stock market. KIS Securities believes that market liquidity is determined by various factors; for instance, liquidity tends to weaken during a downward trend. Therefore, the current low liquidity is not necessarily a negative sign.

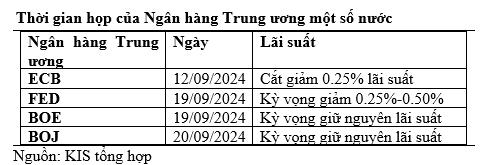

Investors Await Fed’s Decision

KIS Securities observes that investors often become cautious and reduce their trading activities while awaiting crucial information. In this case, it is the Fed’s decision on interest rates. Analysts anticipate the Fed will decide to cut rates by 0.25% to 0.50% during its meeting on September 17-18. This decision will mark a reversal of the Fed’s current monetary tightening policy and signal a new phase. Consequently, the Fed may implement additional measures to support the US economy in the coming months. As this decision significantly impacts the global economy, investors will exercise caution and await the official announcement.

Additionally, several other central banks, including the European Central Bank, the Bank of England, and the Bank of Japan, will also meet this month to decide on their interest rate policies. As these are essential pieces of information for investors, many will likely adopt a wait-and-see approach until the official announcements are made before making their next moves.

“Investor Distraction”

Apart from the above factors, KIS Securities also identifies another element that may contribute to a decline in investor trading: “investor distraction.” Specifically, investors are human and have diverse interests beyond just stocks. They also pay attention to other socio-economic events. During periods with many significant happenings, investors may focus more on these events than the market or reduce their attention to market developments. This inadvertently leads to a decrease in trading activity, and the more critical the event, the more investors it attracts, further weakening liquidity. KIS Securities observes that the Tet holiday is a classic example of this phenomenon, with trading values tending to decline one to two weeks before and after the holiday.

KIS Securities believes that a string of socio-economic events since the beginning of September may have distracted investors from the market. Firstly, the four-day holiday on September 2 affected investors from August 31 to September 6. Following this, Super Typhoon Yagi made landfall in the North from September 7 to 8, and subsequent flooding in the North further captured the nation’s attention. These events inadvertently caused investors to “shift their focus,” impacting the market’s trading activities.

KIS Securities attributes the “coincidence” of the Fed’s rate cut hints and the socio-economic events in September as factors influencing investor trading behavior. Once these events pass, investors will refocus on the stock market, leading to an increase in liquidity.

Analysis Team of KIS Vietnam Securities