ETF Rebalancing Slump: A Visual Guide. Graphic by Tuan Tran

|

By Yen Chi

The Stock Market: Riding the Wave of Uncertainty

Week 09-13/09 saw a stagnant performance in the stock market. The VN-Index ended the week at 1,251.71 points, with a notable decline in trading liquidity. The average trading value of the HOSE and HNX floors was VND 13.2 trillion, a significant drop from the VND 23.6 trillion recorded in the first six months of the year.

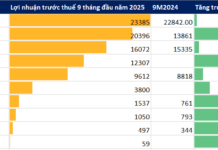

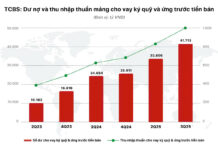

[Infographic] A Comprehensive Overview of Bank Performance in H1 2024

The credit market showed signs of recovery in the final month of Q2 2024, with interest income remaining the primary driver of bank profit growth. However, in a macro environment that is yet to fully rebound, the government and the State Bank continue to maintain supportive policies for businesses, and non-performing loans continue to rise.

The Stock Market Soars: A Dramatic Rise

The VN-Index surged by almost 30 points on August 16th, reaching an impressive 1,252.53. This significant increase showcases a promising trajectory for the index and underscores the potential for further growth in the Vietnamese stock market.

![[Infographic] A Comprehensive Overview of Bank Performance in H1 2024](https://xe.today/wp-content/uploads/2024/09/info-kqkd-ngan-hang-6T-150x150.jpg)