A bird’s-eye view of the meeting. (Photo: SBV)

Approximately 73,000 customers impacted by Storm No. 3

On the morning of September 18, in Hanoi, Mr. Dao Minh Tu, Permanent Vice Governor of the State Bank of Vietnam (SBV), chaired a meeting with credit institutions to discuss and deploy solutions to support businesses and people affected by Storm No. 3.

At the conference, the Vice Governor informed that, on September 17, 2024, the Government issued a resolution on key tasks and solutions to urgently overcome the consequences of Storm No. 3, quickly stabilize the situation of the people, restore production and business activities, and promote economic growth.

The Government assigned the SBV to “(i) Report to the Prime Minister on the classification of assets, provisioning for risks, methods of provisioning for risks, and the use of risk provisions to support customers facing difficulties and damage due to the impact of Storm No. 3; (ii) Direct credit institutions to proactively calculate support plans, restructure repayment periods, maintain the debt group, consider waiving and reducing interest rates for affected customers, develop new credit programs with suitable preferential interest rates, and continue to lend to customers to restore production and business activities after the storm in accordance with current legal regulations.”

To implement the above tasks, the SBV organized a meeting with credit institutions to deploy solutions to support businesses and people affected by Storm No. 3. The Vice Governor requested that the discussions focus on the following main contents:

First, preliminarily assess the impact/damage of customers (in terms of outstanding debt, collateral, etc.) due to Storm No. 3;

Second, the solutions that credit institutions have deployed to promptly support and overcome the damage caused by the storm and flood in localities and remove difficulties for customers to restore production and business activities and repayment capacity;

Third, propose specific solutions for customers in terms of interest rates, credit, etc., and other solutions (if any);

Fourth, propose recommendations to the Government, ministries, agencies, localities, and the SBV to promptly support customers.

According to a report at the meeting by Ms. Ha Thu Giang, Director of the Credit Department for Economic Sectors (SBV), as of September 17, 2024, according to the statistics of SBV branches in provinces/cities, about 73,000 customers were affected, with an estimated outstanding debt of about VND 94 trillion. A preliminary statistic from 04 commercial banks (BIDV, VCB, Agribank, and VietinBank) showed that there were about 13,494 affected customers with an estimated outstanding balance of VND 191,457 billion. The number of affected customers and outstanding debt is expected to increase in the coming days as credit institutions and SBV branches continue to collect and update data.

Agribank, Vietcombank, BIDV, and VietinBank announce support policies

Agribank’s representative said that, according to preliminary statistics up to September 16, 2024, Agribank had over 12,600 affected borrowing customers, with an estimated affected outstanding debt of VND 25 trillion, and expected damaged outstanding debt of over VND 8 trillion. To urgently overcome the consequences of Storm No. 3, Agribank reviewed, compiled statistics, and contacted customers to understand the credit amounts falling due but customers could not repay due to natural disasters; promptly deployed measures to support borrowing customers according to the direction of the SBV.

Based on the level of damage of customers, Agribank adjusted to reduce the interest rate from 0.5 – 2%/year and waive 100% of overdue interest and late payment interest during the period from September 6, 2024, to December 31, 2024. The expected affected outstanding debt is about VND 40 trillion; reduce the lending interest rate by 0.5%/year for loans disbursed from September 6, 2024, to December 31, 2024, with an expected volume of about VND 30 trillion; coordinate with ABIC Insurance Corporation and other insurance companies to promptly determine and compensate for customers’ damage according to regulations (According to ABIC’s preliminary statistics, the compensation amount is about VND 150 billion)…

The representative of VCB said that, since September 9, VCB has been collecting damage statistics and, at the same time, proposing functional departments to build support programs for people and businesses affected by the storm. After reviewing, VCB proceeded to support by reducing the interest rate by 0.5% for affected subjects. It is expected that VCB will reduce the interest rate for a total outstanding debt of about VND 130 trillion.

The VCB representative also said that businesses affected by the storm need support from competent agencies and other sectors such as insurance, and it is necessary to quickly implement and speed up the handling, appraisal, and compensation.

According to the BIDV representative, the bank plans to reduce the lending interest rate and support the interest rate for new borrowing customers, especially short-term loans, to restore production and business activities arising from September 6. The expected interest rate support for new loans is about 1%; for existing loans, consider reducing the interest rate by 0.5%; issue a credit package of VND 200,000 billion to support individual customers to borrow capital to recover activities after being affected by the storm, including short, medium, and long-term loans with preferential interest rates compared to common loans.

Similarly, the representative of VietinBank said that it is also implementing preferential interest rate programs, supporting credit by reducing the lending interest rate for old customers and supporting the borrowing interest rate for new customers according to the direction of the Government to support customers to restore production and business activities.

Concluding the conference, the Vice Governor requested credit institutions to continue to accompany, share, and support customers in many aspects, not only in terms of financial resources and capital but also in terms of consulting and encouraging, not turning their backs on customers in this difficult time; organize the implementation of solutions synchronously and publicly, transparently, absolutely not taking advantage of policies and applying them to the right subjects; comply with the direction of the Central Committee, the Government, the Prime Minister, and the Governor of the SBV.

The Vice Governor also requested credit institutions to build a mechanism to fully and promptly report and supervise information with competent agencies, the SBV, and local authorities; continue to promote and strengthen the communication of mechanisms, policies, and implementation plans through the media.

In addition, the Vice Governor requested credit institutions to objectively and transparently review and classify damaged subjects to build appropriate support programs; build support programs suitable to the capacity of each credit institution in the spirit of being proactive and highly responsible, focusing on policies to extend and postpone the debt repayment period; policies to reduce interest rates for old loans affected by storms and floods and new loans; continue to coordinate with ministries, branches, localities, and the SBV to join hands in overcoming the consequences caused by Storm No. 3…

The Storm’s Aftermath: Hải Phòng Shuts Down 41 Old Apartments, Prioritizing Resident Safety and Relocation Assistance.

The city of Haiphong is home to over 70 old apartment blocks, many of which were constructed in the 1960s and have since fallen into disrepair. The passage of time and the elements have taken their toll on these structures, and their condition has further deteriorated following the recent Typhoon No. 3. These apartments are now in a state of severe disrepair and are at risk of collapse at any moment.

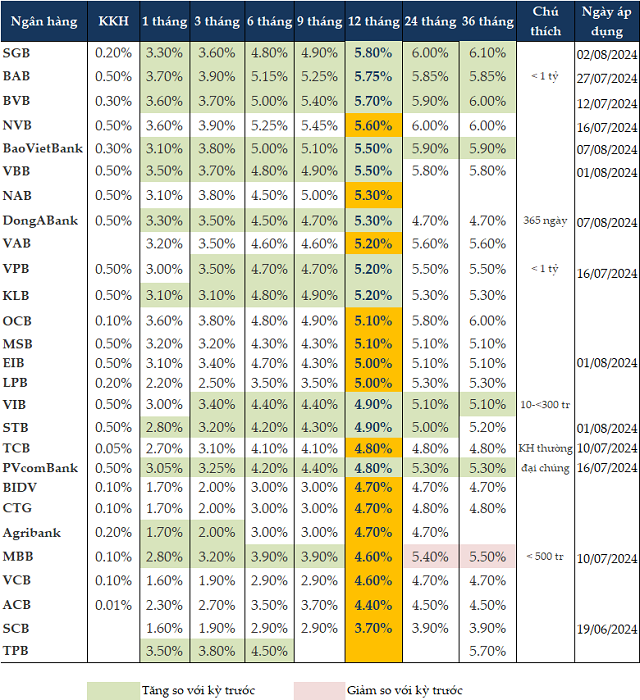

The Central Bank Adjusts a Key Interest Rate in the Monetary Market

The OMO rate cut is a clear indication of the State Bank’s intention to support the liquidity of the banking system, paving the way for lower interbank interest rates in the near future.