Capital Cost Pressures

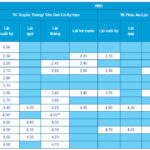

Banks are also competing by adjusting their deposit interest rates to attract customers. This competition has led to a wave of interest rate increases across the banking system, putting pressure on capital costs – a perennial challenge for bank executives.

In this context, the State Bank’s directive to continue reducing lending rates may not be easily implemented across the board, as commercial banks grapple with liquidity and capital mobilization challenges.

When deposit rates increase, but banks are forced to reduce lending rates, profit margins inevitably shrink, especially for banks with thin capital structures or those reliant on short-term funding.

Before deciding to lower lending rates, banks will carefully consider the potential impact on their profits, as funding costs remain unchanged. Instead of reducing rates for all customer segments, banks may opt to lower rates for select priority groups or special loan packages while maintaining higher rates for others to safeguard their profits.

Individual Bank Strategies

Each commercial bank has its own strategy for managing capital costs and interest rates. Better-capitalized banks or those with flexible capital structures (such as state-owned groups) can immediately lower lending rates as directed by the State Bank.

However, banks with weaker financial positions or those heavily reliant on deposit funding may not be able to reduce lending rates instantly. They might opt for a slower adjustment pace or only reduce rates for a limited number of carefully selected segments, demonstrating their agility in management and ability to navigate the heterogeneous market conditions.

While the State Bank can issue directives to lower interest rates, the actual implementation depends on the level of supervision and initiative taken by individual commercial banks. Some banks may enhance their loan packages for small and medium-sized enterprises or individual customers, but a uniform reduction across their entire loan portfolio is unlikely.

The success of lowering lending rates also relies on the State Bank’s supervision and management policies regarding credit and liquidity control. If stricter regulations and tighter supervision are enforced, there is a higher likelihood of achieving lower lending rates. However, if the supervisory environment is more flexible, banks may choose to implement uneven rate reductions.

Non-Performing Loan Risks

An important factor that prevents many commercial banks from immediately reducing lending rates is the risk of non-performing loans. Following the economic challenges posed by the COVID-19 pandemic, many businesses and individuals are still struggling to recover their operations. This situation prompts banks to exercise caution in expanding credit or rapidly lowering lending rates to avoid a surge in non-performing loans.

Banks may continue to favor customers with strong credit histories while maintaining higher rates for riskier borrowers, thus optimizing their credit portfolio management.

To support businesses, commercial banks will base their decisions on their capabilities and business orientation, taking into account capital costs and non-performing loan risks.

The agility in strategies employed by individual commercial banks will also determine the rate reduction ratio and pace. Banks might opt to lower rates for specific customer segments or promotional loan products while maintaining reasonable rates for riskier customers to protect their profit margins.

“Caution Advised: VIB Chairman Đặng Khắc Vỹ Cautions Against Loosening Credit Conditions for Short-Term Growth”

“VIB’s Board Chairman, Dang Khac Vy, cautioned against pursuing credit growth at all costs by relaxing lending conditions. He emphasized the potential adverse consequences on the safety and stability of the banking sector, citing increased non-performing loans and diminished profits as key concerns.”