Illustration

The Banking Sector’s Massive Investment in Digital Transformation

In recent years, digital transformation has become a pivotal strategy for the global financial and banking industry, and Vietnam is no exception. With the rapid advancement of technology, customers increasingly demand fast, convenient, and personalized banking services. These factors have driven banks to invest billions of dollars in digitalization to enhance their competitiveness, optimize operational processes, and provide the best customer experience.

According to the State Bank of Vietnam, by the end of 2022, the banking sector had invested more than VND 15,000 billion in digital transformation activities.

It is estimated that the Vietnamese banking sector invests hundreds of millions of dollars annually in digital transformation, spread across multiple banks. These investments are not limited to developing online banking systems but also include upgrading infrastructure related to security, big data, artificial intelligence (AI), blockchain, and more.

For instance, from 2021 to 2025, Techcombank plans to spend over $500 million (approximately VND 11,500 billion) on digital transformation and technology infrastructure development to create a comprehensive digital financial ecosystem. VPBank and MB have also invested thousands of billions of VND in implementing core banking systems, upgrading digital platforms, and optimizing online customer experiences. Meanwhile, ACB’s leadership revealed that the bank has been investing approximately VND 1,000 billion annually in its digital transformation journey.

State-owned commercial banks, such as Vietcombank, VietinBank, and BIDV, have also been proactive in developing mobile applications and online infrastructure, enabling customers to conduct transactions anytime, anywhere.

In addition to investing in their systems, banks are also focusing on developing new products and services based on digital technology. A notable example is the development of AI applications to support data analysis and credit decision-making processes, optimizing loan approval procedures and minimizing risks.

Digital transformation goes beyond improving the interface and features of online banking applications. It presents an opportunity to restructure the bank’s operating procedures, optimizing everything from internal operations to customer service. This not only reduces costs but also enhances flexibility and adaptability to market changes.

One of the critical applications of digital transformation is the digitization of operational processes, from account opening and online transactions to loan approvals. In the past, opening a bank account or applying for credit required customers to visit a branch, fill out numerous papers, and wait for an extended period. However, with digitization, these processes have become automated and much faster. Customers can now open accounts, apply for credit cards, or register for online banking services in just a few minutes without leaving their homes.

Additionally, the utilization of AI and big data enables banks to analyze customer behavior and needs, offering tailored and optimized financial solutions. This enhances customer satisfaction and loyalty while also minimizing loan risks through more accurate credit predictions.

Thanks to well-planned strategies and massive investment, many banks in Vietnam have achieved a digital transaction rate of over 90%. Basic operations have been fully digitized (savings deposits, fixed-term deposits, opening and using payment accounts, bank cards, e-wallets, money transfers, lending, etc.).

According to the State Bank of Vietnam, approximately 77.41% of Vietnamese adults now have bank accounts, with over 35 million payment accounts and about 14.9 million cards opened using the eKYC electronic identification method. In 2023, mobile payments increased by 59.86% in volume and 12.73% in value, while QR code payments rose by 242.46% in volume and 157.2% in value compared to the same period in 2022.

These results have propelled Vietnam to become one of the fastest-growing countries in the region in terms of digital banking adoption.

The Sweet Fruits of Digital Transformation

The strong investment in digital transformation has yielded sweet fruits for banks, both in terms of customer acquisition and business efficiency.

For instance, with its VPBank NEO digital ecosystem, VPBank has witnessed a surge in online transactions, and revenue from digital services now accounts for a growing proportion of the bank’s total revenue. According to the bank’s disclosed data, as of the end of 2023, VPBank’s customer base has exceeded 30 million people. This figure has more than doubled during the 2019-2023 period, with a compound annual growth rate of 21%.

Similarly, Techcombank has experienced a significant increase in the number of customers using digital banking services, and profits from cashless services have risen considerably. In 2023, Techcombank attracted 2.6 million new customers, double the number of new customers acquired in previous years. Approximately 94% of transactions by individual customers are conducted online, and the bank’s digital platform records more than 50 logins per customer per month.

At ACB, General Director Tu Tien Phat shared that thanks to a strong focus on digital transformation over the past decade, the bank’s scale has quadrupled, profits have increased 17-fold, while personnel have only increased by 0.3 times. In the last five years, ACB has witnessed a significant turning point in its digital transformation journey, with transaction volume and value increasing up to 12-fold. ACB’s credit scale grew by 50% in the last three years without increasing staff.

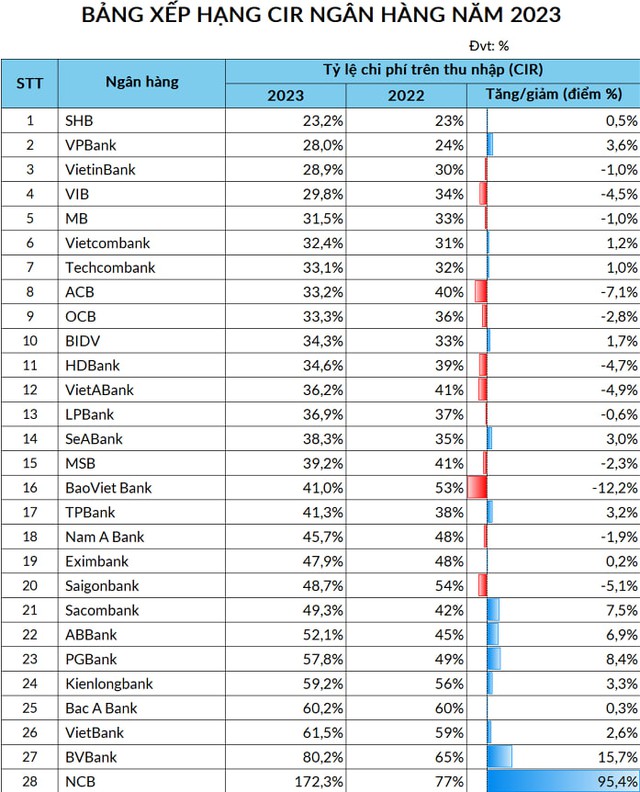

Digital transformation has not only led to growth in the number of customers using digital services but has also helped reduce operating costs and improve the cost-to-income ratio (CIR). According to bank reports, in 2023, the CIR of many banks dropped below 40%, with some even approaching the 30% threshold that many regional and international banks undergoing digital transformation strive for. Notably, the banks that have invested most heavily in digital transformation, such as VIB, ACB, OCB, MB, and Techcombank, have also achieved the fastest reduction in CIR.

Additionally, digital transformation has enabled banks to optimize risk management. By leveraging new technologies like AI and blockchain, banks can detect fraud early on, enhance system security, and ensure the safety of each transaction for their customers.

The social benefits of digital transformation in the banking sector are also significant. Digitization not only helps banks serve their customers better but also contributes to the development of the digital economy. Small and medium-sized enterprises, especially in rural areas, can more easily access capital and financial services through digital platforms, promoting sustainable development and balance across economic regions.

Dr. Can Van Luc, Chief Economist of BIDV, assessed that the benefits of digital transformation for commercial banks are evident. The process has helped accelerate the system’s operational speed, increased productivity and efficiency, reduced the cost-to-income ratio, and boosted CASA (current accounts and savings accounts). As a result, banks have improved liquidity stability, reduced capital mobilization costs, and enhanced operational efficiency.

Overall, digital transformation brings numerous advantages. However, challenges remain for banks in their digital transformation journey.

According to a leading expert in the banking industry, the first challenge is the lack of skilled human resources for digital transformation. Attracting and retaining talent with digital transformation expertise is one of the most significant difficulties.

Another challenge is that, along with digitalization, banks must enhance information security to protect personal and national information. Information security directly impacts customer trust, especially for depositors. Vietnam is among the top 10 countries most vulnerable to information security breaches globally. Therefore, a comprehensive legal framework that supports the digitalization process in the banking sector is necessary.

Better Choice Awards 2024

The Better Choice Awards recognize and honor innovation that serves the practical interests of consumers. This award is organized by the National Innovation Center in collaboration with VCCorp, under the guidance of the Ministry of Planning and Investment. The Better Choice Awards comprise three main award systems: Smart Choice Awards, Car Choice Awards, and Innovative Choice Awards.

In 2024, the Innovative Choice Awards will, for the first time, expand to include Smart Home, Fashion, Transportation Services, and, notably, Finance and Banking. The award criteria have been collaboratively developed by experts from PwC Vietnam.

The award has started accepting nominations through the website: https://betterchoice.vn/. The official information and voting portal will be launched on September 9, 2024, following a press conference at the headquarters of the Ministry of Planning and Investment, 6B Hoang Dieu.

The Comprehensive Partnership Agreement: Dealtoday and BIDV

On September 20, 2024, the Bank for Investment and Development of Vietnam (BIDV) and EBIS, the operator of the e-commerce platform Dealtoday.vn, signed a comprehensive cooperation agreement at the BIDV’s Branch Office of Transaction Center No.1, located at 191 Ba Trieu, Le Dai Hanh, Hai Ba Trung, Hanoi.

“Vinamilk and FPT Collaborate to Elevate Financial Management with Tech-Driven Solutions”

Vinamilk and FPT Corporation recently joined forces to unveil the FPT CFS – a comprehensive financial reporting solution. This innovative system promises to revolutionize the way businesses manage their financial operations, with a particular focus on streamlining the complex process of ledger closure and financial report consolidation. The official launch event marked a significant step forward for both companies, showcasing their commitment to harnessing technology to drive efficiency and progress.