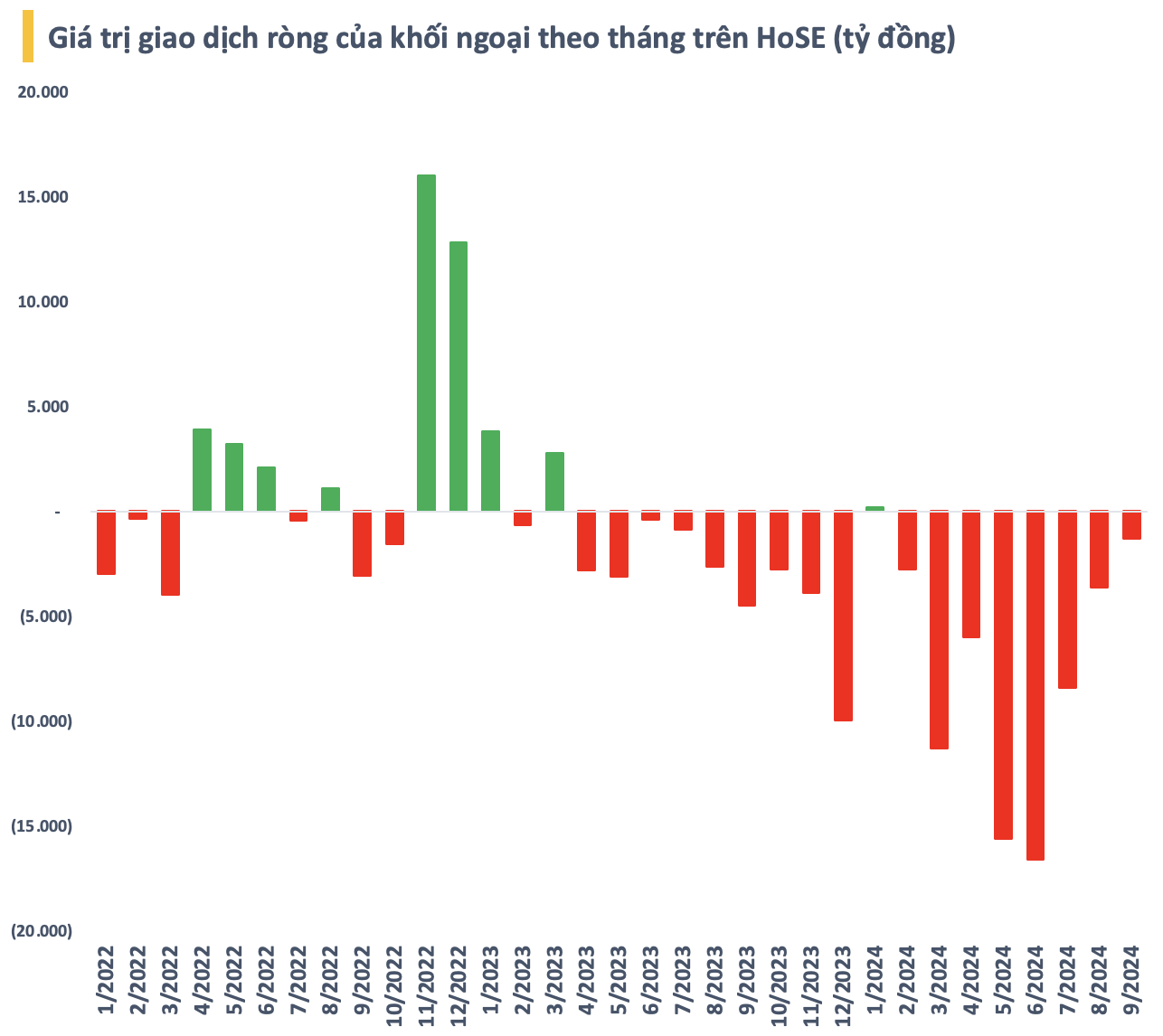

The net selling value of foreign investors on HoSE since the beginning of 2024 has been a record-breaking $2.6 billion, and this outflow of capital shows no signs of stopping. Cumulatively, since the Vietnamese stock market began operating in 2000, the net buying value of foreign investors on HoSE has dropped to less than VND 700 billion.

In the past, foreign investors continuously pumped money into buying Vietnamese stocks, with the net buying value reaching nearly VND 140,000 billion at the end of 2019. However, this achievement was quickly wiped out when the trend reversed from 2020. Especially in the last 18 months, foreign investors only temporarily stopped net selling for one month at the beginning of 2024.

According to some assessments, the recent net selling by foreign investors is due to: (1) profit-taking actions; (2) interest rate differentials causing capital outflows from emerging and frontier markets, including Vietnam; and (3) exchange rate pressure affecting the investment performance of foreign funds in the Vietnamese stock market.

However, these reasons are mostly short-term and cannot explain a long-term trend in the Vietnamese stock market. Sharing his thoughts on this issue at the Talkshow The Investors, Mr. Dominic Scriven, Chairman of Dragon Capital, said that $2.6 billion is a surprising figure and worth pondering.

Mr. Dominic Scriven, Chairman of Dragon Capital Vietnam

According to the Chairman of Dragon Capital, the cause may lie in both internal and external factors. The world is full of challenges, and even fears and threats, such as geopolitical issues in the Middle East and Russia-Ukraine. Typically, when foreign investors get scared and sense risks, they will sell and bring their money back to their home countries for safety.

Another concerning issue, according to the head of Dragon Capital, is the financial bubble. Many countries, especially developed ones, have been printing money non-stop in the last decade, leading to public and private debt, inflation, asset values, and, most importantly, the cost of living skyrocketing. As an analyst, he finds this incomprehensible, and it has caused surprises. A typical example is how the Japanese yen and the Japanese stock market changed very quickly in a short time. These factors have caused large global funds to adjust their investment strategies.

Mr. Dominic Scriven also pointed out that domestic factors influence foreign capital. In the last two years, Dragon Capital analyzed 80 large companies, accounting for more than 80% of the market capitalization, and found no profit growth. A market with no profit growth for two years (2022-2023) will drive investors away. This is a significant factor in the recent foreign investors’ outlook.

“We in Vietnam think about the Vietnamese stock market 24/7, but for foreign investors, the Vietnamese stock market is just one factor, a small player on their stage. I heard that some foreign investors are unclear about Vietnam’s direction”, shared the Chairman of Dragon Capital.

According to Mr. Dominic Scriven, Vietnam needs to improve its message to foreign investors. For foreign direct investors (FDI), Vietnam is a superstar, and no one can compete. Many countries dream of having a competitiveness like Vietnam. But when it comes to financial investors, Vietnam’s message needs to be clearer.

Although foreign investors have been net selling continuously, a positive note is that domestic money is still “backing up” the market. Ms. Pham Minh Huong, Chairman of VNDirect, said that the market’s resilience in the face of foreign selling pressure shows the maturity of Vietnam’s stock market.

“During the currency crisis in 2008, foreign investors also sold a lot, and at that time, assets became opportunities for domestic investors. Sometimes, foreign capital does not tell everything. The market is still very interesting, and there is a large amount of money waiting to be invested at securities companies”, emphasized Ms. Pham Minh Huong.

Sharing this view, Mr. Dominic Scriven said, “Foreign investors can be the earliest, but sometimes they are also the latest. So, don’t worry too much”.

“The Investors” is an inspirational talk show series co-organized by CafeF and VPBank Securities (VPBankS), broadcast at 10:00 every Tuesday.

VPBank Securities Joint Stock Company (VPBankS) is the only securities company in the VPBank ecosystem with a leading charter capital in the market of VND 15,000 billion. VPBankS is also in the top 10 securities companies with the largest margin loans in the market and has much room for growth in the future. Moreover, VPBankS has built a comprehensive ecosystem, integrating full-fledged products, platforms, and personalized services according to each client’s risk appetite, fully meeting the investment needs of customers.