The Vietnamese stock market recorded 4/5 positive trading sessions in the week of September 16-20, buoyed by positive news regarding the Fed’s interest rate cut and the recovery seen across most global market indices, led by the US.

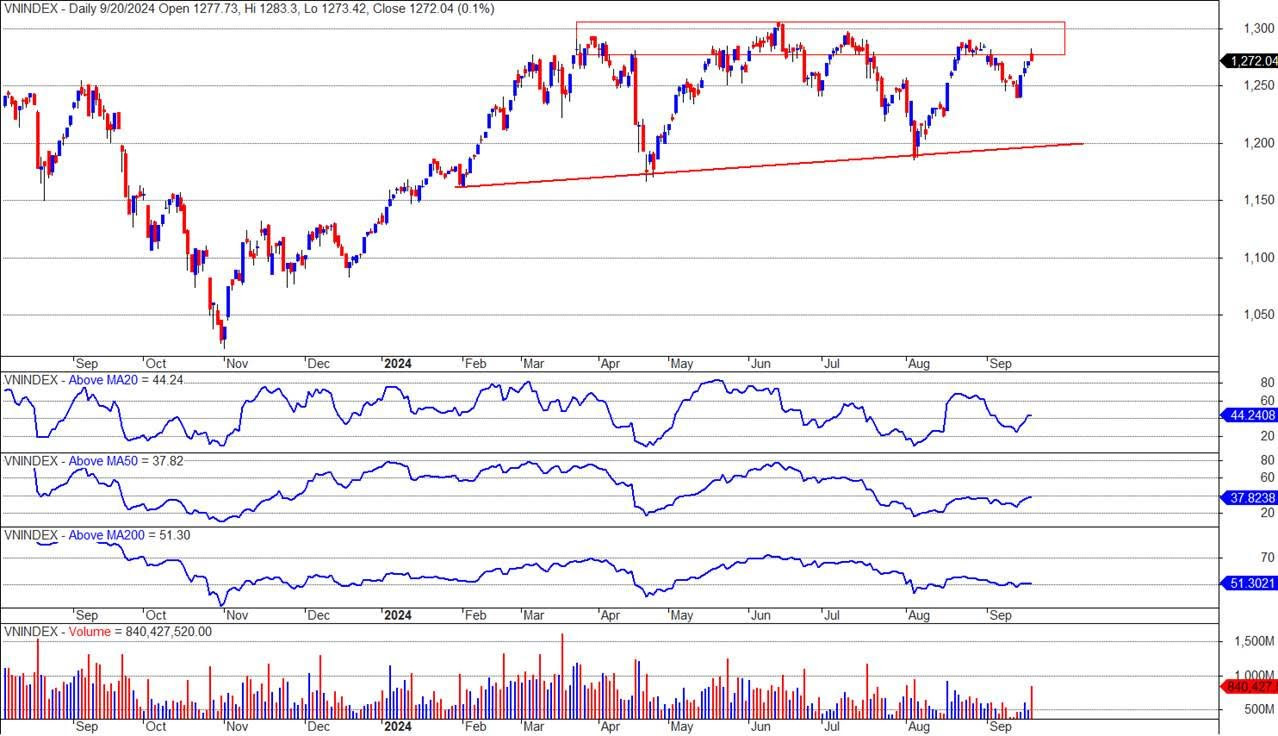

For the week, the VN-Index gained 20 points (+1.6%) compared to the previous week, closing at 1,272.04 points. As a result, the index quickly regained almost all the points lost in the previous week, led by Bluechip stocks.

Looking ahead to the new trading week, most experts hold a positive outlook for the VN-Index, expecting it to advance towards the 1,300-point resistance level. However, despite their desire to see the VN-Index surpass 1,300 with improved liquidity, DSC experts lean towards a scenario of a sideways market with low volatility and stock differentiation in the coming week.

Stable Market with Stock Differentiation

Mr. Bui Van Huy – Director of Ho Chi Minh City Branch, DSC Securities Corporation

According to Mr. Huy’s observations, global developments are quite positive, with the FED cutting interest rates by 0.5% in its September meeting. This has led to new highs in US stock indices, which tend to be relatively positive around election time.

The domestic stock market also has many positive factors, including the FED’s interest rate cut and the recent issuance of Circular 68/2024 by the Ministry of Finance, which removes the pre-funding requirement, an important step in the market upgrade story.

However, if we look at last week’s performance, the market doesn’t seem overly optimistic when considering liquidity and breadth. While liquidity improved, it remained relatively low, and the gains were concentrated in a few stocks with specific stories, indicating weak overall market breadth.

The story about the FED’s interest rate cut has likely been priced in to some extent, and the market upgrade story, though repeatedly mentioned, only seems to be heating up a group of related stocks. The market lacks a compelling narrative to encourage investors to put more money in.

Despite their desire to see the VN-Index surpass 1,300 with improved liquidity, DSC experts still lean towards a scenario of a sideways market with low volatility and stock differentiation in the coming week. Stocks with their own stories will continue to differentiate and attract money. For the market to surge further, a new narrative is needed to attract capital and improve breadth and liquidity.

Last week’s index gain was driven by large-cap stocks, so if these stocks continue to perform well, the index may remain positive. However, the overall market is likely to exhibit low volatility and differentiation, as mentioned earlier. The probability of a negative scenario is low, and there aren’t many overly negative factors for the market at this point.

Regarding the market upgrade story, Mr. Huy believes that when the upgrade happens, foreign investors will be expected to participate more actively, benefiting securities companies with a large foreign ownership ratio in terms of business performance. In terms of the market, stocks included in the FTSE Emerging and MSCI Emerging indices will benefit.

With many significant news events now in the past, the upcoming Q3 earnings season will set the market’s direction in the near term. Vietnam’s economy is still in the recovery phase, so Mr. Bui Van Huy expects cyclical sectors such as Finance, Retail, Consumer, and Technology to continue their profit growth trajectory.

However, investors should pay attention to the valuation of individual companies, as many stocks have surged despite the sideways market during the stock differentiation phase.

Foreign Selling Pressure to Ease, Making Way for a More Positive Phase

Mr. Nguyen Minh Quang – Market Analyst, PSI Securities Corporation

It can be seen that the index lost some steam towards the end of the week due to the structural adjustments of ETFs and profit-taking after consecutive gains.

Overall, Mr. Quang believes that the market has stabilized, and a balance is gradually being established. It’s normal to see short-term selling during an uptrend, so this is not a significant concern.

In the short term, he maintains a positive view, expecting the market sentiment to improve further. Technical indicators are turning positive, and with the support of Bluechip stocks,

the VN-Index is likely to advance towards the 1,300-point level in the coming sessions.

The past week was important, with several events taking place both domestically and internationally, such as the FOMC meeting, the expiration of VN30F2409 futures contracts, and ETF restructuring. Therefore, the decline in liquidity can be attributed to investors’ caution amid these events and the index approaching a strong resistance level.

Additionally, we are currently in a quiet period for earnings reports, and investors seem to be awaiting Q3 results to be announced soon. However, the low liquidity has not affected the VN-Index’s uptrend, as selling pressure has been weak, and buying demand is gradually improving.

Regarding foreign investors’ trading activities, they have shown positive signs in recent sessions, with four consecutive net buying sessions before turning to net selling on the last day of the week. The main reason for the continued net selling by foreign investors is the interest rate differential between economies and short-term profit-taking.

However, in the long run, as the Fed begins its interest rate cut cycle and the US dollar weakens, foreign capital will tend to flow into other markets.

“When the interest rate cut cycle begins, foreign capital will flow into emerging markets, boosting growth in the Asian region, including Vietnam. Therefore, we can expect selling pressure to ease, making way for a more positive phase with the return of foreign investors,” said Mr. Nguyen Minh Quang.

On September 18, the Ministry of Finance issued Circular 68/2024/TT-BTC, which allows foreign institutional investors to buy stocks without requiring sufficient funds when placing orders from November 2, 2024. This is expected to be an important step in the process of upgrading Vietnam’s stock market.

If the market upgrade is successful, Vietnam’s stock market is expected to attract an estimated $1.5 billion. Mr. Quang believes that the Securities sector, including leading stocks such as SSI, VCI, and HCM, will be the first to benefit.

Additionally, investors should pay attention to other sectors such as Banking, Real Estate, and Retail. The Banking sector, with its large market capitalization, has a significant impact on the index, and its trading volume sometimes accounts for nearly 30% of the total market liquidity.

Retail stocks are likely to maintain their positive momentum thanks to domestic economic stimulus policies that drive the recovery of consumer demand, including maintaining the 8% VAT rate until the end of 2024 and increasing the minimum wage from July 2024.

For the Real Estate sector, potential investment opportunities will come from companies with projects that meet all legal requirements. The early application of the three laws will create a foundation for the recovery of the real estate market.

Moreover, sectors related to import and export will also show positive signals, as this sector is currently experiencing rapid growth. In the first eight months, the total import and export value increased by 16.7% year-on-year, a very positive sign for Vietnamese enterprises in the import-export value chain. In addition, the implementation of projects will support the business activities of Oil and Gas enterprises in the short and medium term.

VN-Index Surpassing the 1,300-Point Level by the End of the Year is Feasible

Mr. Dinh Quang Hinh – Head of Macroeconomics and Market Strategy, VNDIRECT Research Department

Recently, the US Federal Reserve (Fed) officially started monetary easing on September 18, a long-awaited move, by deciding to cut the policy rate by 0.5 percentage points. This move by the Fed has sparked some controversy, as most economists expected a 0.25 percentage point cut immediately after the meeting.

Some argue that the Fed’s aggressive rate cut is due to the risk of a US economic recession. According to Mr. Hinh, with “inflation lower than expected” and “the labor market showing some concerns” despite being under control, the Fed’s decision to cut rates by 0.5 percentage points is logical.

The 0.5 percentage point cut in the policy rate is like “an early intervention” by the Fed rather than “firefighting” when it’s too late.

Domestically, Mr. Dinh Quang Hinh assesses that the Fed’s rate cut trend will positively impact the economy and the financial and monetary market. The rate cut will support the US economy and boost consumer demand, thereby positively affecting Vietnam’s export prospects to the US.

It is important to emphasize that the US is Vietnam’s largest export market, accounting for nearly 30% of the country’s total imports. The Fed’s rate cut also weakens the US dollar, easing pressure on Vietnam’s exchange rate and inflation, thereby providing more flexibility for the State Bank in monetary policy management and prioritizing supporting system liquidity and maintaining a low-interest-rate environment to promote economic growth.

With these expectations, Mr. Hinh maintains a positive view of the Vietnamese stock market in the medium term until the end of the year.

“Therefore, I maintain a positive view on the prospects of the Vietnamese stock market in the last months of the year, and the scenario of the VN-Index surpassing the 1,300-point level this year is entirely feasible thanks to (1) a more accommodative monetary policy, (2) improved earnings of listed companies, and (3) new developments in the market upgrade story,” said Mr. Hinh.

Any market corrections in the coming period will be a good opportunity for long-term investors to accumulate more stocks, prioritizing sectors with positive growth stories in the last months of the year, such as banking, securities, import-export (garments, seafood, wood), and industrial real estate.