As of September 13, 2024, the VN-Index’s average trading value per session reached approximately VND 13,673 billion, a 17.5% decrease compared to the average trading value in August 2024. Photo: LE VU

|

New account openings continue to surge

According to statistics from the Vietnam Securities Depository, by the end of August 2024, the total number of securities accounts held by investors reached 8.7 million, marking a 1.4 million increase compared to the end of 2023.

Following the Covid-19 pandemic, the number of new account openings tripled in less than five years. Specifically, in August 2024, the number of new accounts exceeded 330,000, the highest monthly figure so far this year.

The exceptional growth in the number of accounts can be attributed not only to the post-pandemic boom in the stock market but also to technological advancements. Instead of having to physically present at a securities company, investors can now easily open an account anywhere thanks to electronic KYC verification.

However, the rapid increase in trading accounts does not necessarily equate to an identical rise in the number of investors in the stock market, as each investor can hold accounts with multiple securities companies. Assuming that, on average, each investor currently holds accounts with 3-5 different companies, the estimated number of investors participating in the market is between 1.8 and 2.9 million.

This assumption holds ground considering the attractive promotional programs offered by securities companies to attract investors, coupled with the ease of opening additional accounts. Moreover, with improved financial literacy, a large number of university students have proactively entered the stock market, contributing to the expansion of the account base.

Market liquidity remains lackluster

As of September 13, 2024, the VN-Index’s average trading value per session was approximately VND 13,673 billion, a 17.5% decrease compared to the average trading value in August 2024. The average trading value in Q3 only reached about VND 15,738 billion per session, a 29.5% decrease compared to Q2.

Even when compared to the same period in Q3 2023, the current liquidity is lower by 26%, equivalent to the liquidity during Q4 2022, a crisis period for the Vietnamese stock market.

In reality, the number of new account openings does not represent new capital inflows into the market. This indicates that a large number of new accounts are a result of investor migration between securities companies, and the new account openings group does not bring in significant capital.

During this period, the market has not formed a clear trend, and valuations are not attractive. On the one hand, investors anticipate a reversal in monetary policy from developed countries, but on the other hand, they remain concerned about a potential global economic recession. Domestically, while the prospects for economic recovery are brighter, due to the high level of economic openness, investors are still apprehensive about the impact of external factors on the market. As a result, investors maintain a cautious stance, awaiting further data to determine the market trend.

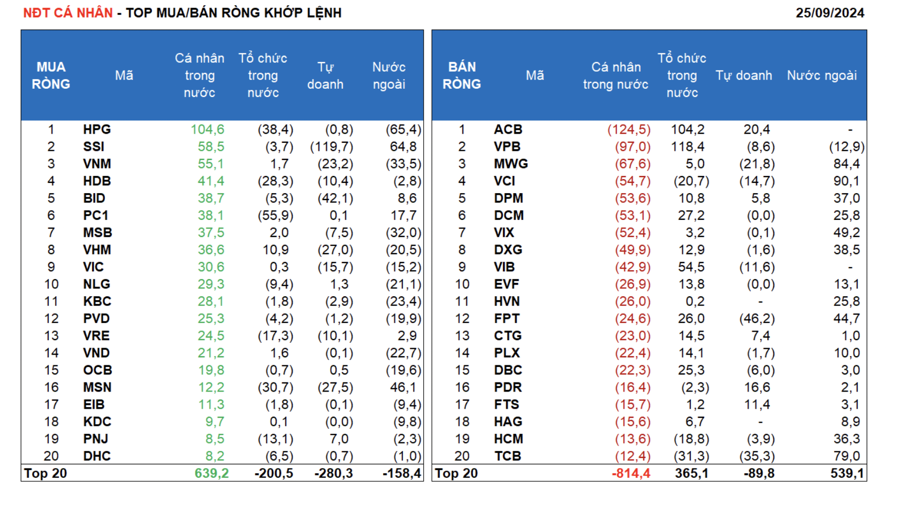

Meanwhile, in the first half of September, foreign investors net sold over VND 2,300 billion, and the cumulative net sell value since the beginning of the year has reached nearly VND 66,400 billion. The continuous net selling by foreign investors in Vietnam, while they have returned to net buying in some other Southeast Asian countries, has raised questions among domestic investors.

Additionally, it is possible that a portion of investment funds has been redirected to the real estate and gold markets. These two investment channels can compete with the stock market for short-term capital. In the past period, these two markets have regained momentum, with real estate prices surging in certain areas, and gold prices fluctuating, attracting speculative investments.

Lastly, the substantial credit growth, which reached 7.79% as of September 7, up from 5.14% at the end of July, may also limit short-term capital inflows into the stock market. As credit growth becomes more substantial and flows into businesses, short-term capital inflows into the stock market may be affected.

Numerous expectations ahead

In the short term, authorities are actively revising several circulars related to the stock market upgrade process, which could lead to a positive outlook from FTSE Russell in the upcoming review and a potential upgrade in March 2025. In the longer term, the government plans to submit a draft amendment to the Securities Law, aiming for an upgrade by MSCI in 2025, which would positively impact the market.

The trend of reversing monetary policies in developed countries is becoming more apparent, and foreign investment flows may start to return to net buying in the Vietnamese market from Q4 onwards. Furthermore, the macroeconomic pressure on Vietnam’s monetary policy has eased, and the recovery trend in production and business activities is becoming more evident, providing a foundation for listed companies to increase profits.

While the short-term recovery of the stock market may not always align with the performance of the real economy, the current economic rebound will undoubtedly lay the groundwork for the market’s growth in 2025.

Trinh Duy Viet