The stock market recorded a relatively positive trading session on September 19, which was the expiration date for derivatives. The upward momentum expanded towards the end of the session, with the VN-Index gaining 6.37 points to close at 1,271.27, the highest level of the day. Foreign investors’ trading activities were positive, with a strong net buying value of nearly VND434 billion across the entire market.

Proprietary trading by securities companies returned to net buying, with a value of VND96 billion on the three exchanges.

On the HoSE, proprietary trading by securities companies net bought VND111 billion, including a net buy of VND198 billion on the matching order channel but net sold VND89 billion on the negotiated trading channel.

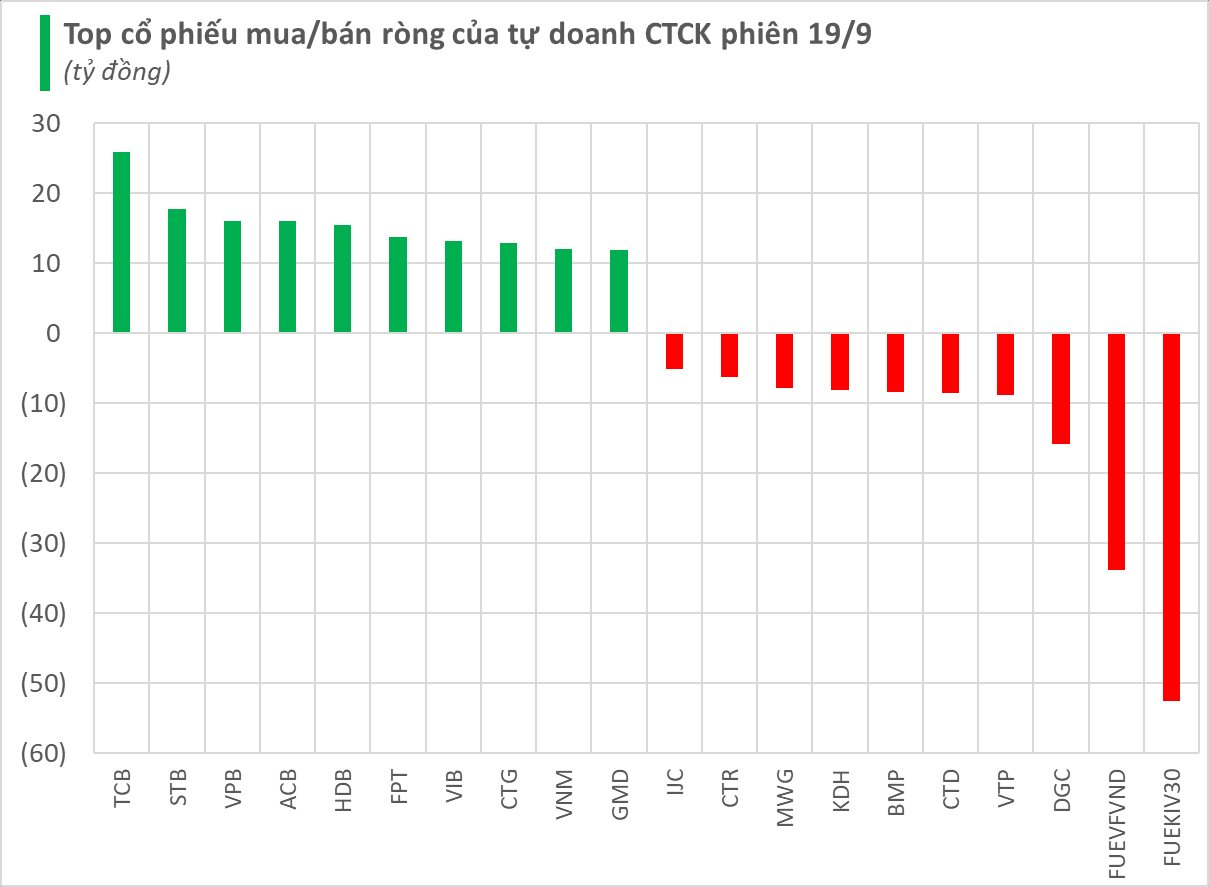

Specifically, the securities companies’ strongest net buying was in TCB and STB, with values of VND26 billion and VND18 billion, respectively. Additionally, stocks such as VPB, ACB, HDB, and FPT were also net bought during the September 19 session.

On the other hand, the securities companies’ strongest net selling was in two fund certificates, FUEKIV30 and FUEVFVND, with values of VND53 billion and VND34 billion, respectively. Other stocks that were net sold during this session included DGC, VTP, CTD, and BMP…

On the HNX, proprietary trading by securities companies net sold VND4 billion, with VCS being the most net sold stock at over VND2 billion. TNG, PVS, and IDC also experienced minor net selling.

On the UPCoM, proprietary trading by securities companies net sold VND11 billion, with AFX being the most net sold stock at VND4 billion. MCH and QNS were also net sold by approximately VND3 billion each.

The New Account Openings Surge: Why is Liquidity Still Low?

The stock market remains stagnant as investors continue to observe economic developments and the actions of foreign investors. The stock market is also competing with other investment avenues to attract short-term capital.