Post-Yagi Bank Stock Health Check

Despite hesitancy in the derivatives expiry session (Sept 19), the Vietnamese market timely recovered its short-term upward trend to join the global stock market rally after the Fed rate cut. The VN-Index (+0.5%) closed just above the MA20 after climbing to 1,271 points.

However, investors’ concerns about the impact of Yagi on the economy and the stock market remain. Examining the reactions of large-cap stocks, especially the pillar sectors of the economy such as banking, will provide investors with additional insights for their investment decisions.

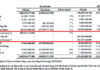

According to statistics, after the Sept 19 session, out of 27 listed and registered trading stocks on the three exchanges, 18 still maintained their long-term upward trend, equivalent to 67%.

2/3 of bank stocks on the three exchanges maintained their long-term upward trend.

|

Compared to the beginning of September, this ratio has even shown signs of improvement, indicating that the long-term upward trend of bank stocks has not really been adversely affected.

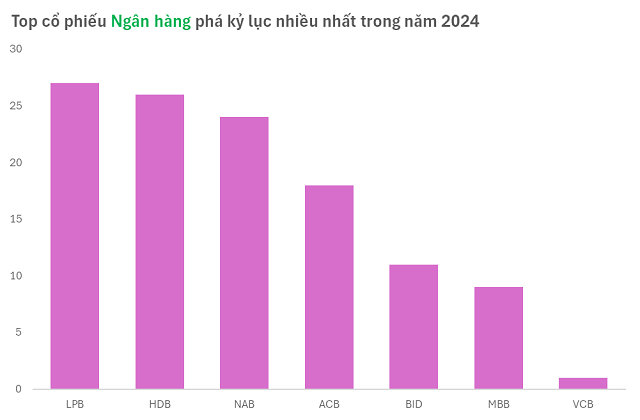

In addition, another statistic on the strength of bank stocks shows that 2024 is the year with the third-highest number of times breaking the closing price record in the history of the stock market. In total, there have been 116 times that bank stocks have broken the closing price record, ranking behind only 2021 and 2018.

In the two trading sessions of Sept 16-17, the group of banks still recorded NAB stock with two new closing price records. Thus, NAB has had a total of 24 record breaks in 2024.

However, NAB is still only ranked third in the top stocks with the most record breaks in 2024. Ranked above NAB are LPB (27 times) and HDB (26 times).

Yagi’s Impact on Banks

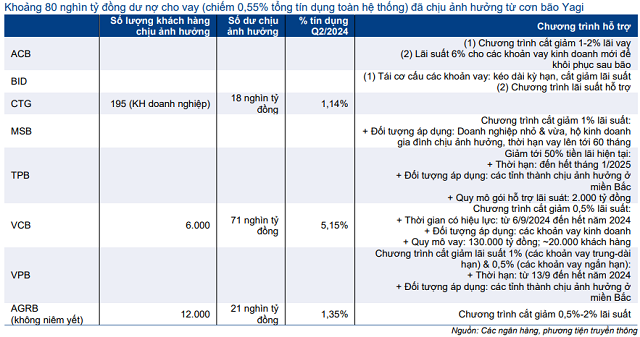

According to a recent report by the State Bank of Vietnam (SBV), about VND 80 trillion of loan balances were affected by Yagi (equivalent to 0.55% of total credit balances). Specifically, in Quang Ninh and Hai Phong, 11,700 customers were affected, with loan balances of about VND 23 trillion.

According to a preliminary assessment by CTG, 195 corporate customers in Quang Ninh and Hai Phong were affected by Yagi, with loan balances of VND 18 trillion, accounting for 1.1% of CTG’s total loan balance.

Meanwhile, VCB estimated that 6,000 affected customers had loan balances of VND 71 trillion (equal to 5.1% of VCB’s total loan balance), of which 230 customers in Quang Ninh and Hai Phong had loan balances of VND 13.3 trillion (accounting for 1% of VCB’s total loan balance).

On the other hand, Agribank (Unlisted) also announced that 12,000 customers with loan balances of VND 21 trillion (equal to 1.35% of Agribank’s total loan balance) were affected.

Specific information from other banks has not been published, but according to Ho Chi Minh City Securities Corporation (HSC), state-owned commercial banks are more affected than private joint-stock banks.

For private joint-stock banks, banks that focus more on the North, such as MBB, TCB, and VPB, may have more affected customers than banks that focus more on the South, such as ACB and STB.

To cope with the difficulties of customers, some state-owned commercial banks and private joint-stock banks have implemented interest rate reduction programs ranging from 0.5-2%, depending on the bank, as well as the terms and types of loans.

These support programs are expected to last for 4-5 months, applicable to both new and existing loans, providing temporary financial support to affected customers.

In addition to the interest rate reduction program, HSC predicts that the SBV will have additional supportive moves, such as loan term extension, interest payment postponement, and loan restructuring.

Overall, HSC believes that the following trends will mainly occur in the fourth quarter of 2024: a slight decrease in the NIM ratio, a slight increase in bad debts, and moderate credit demand as affected customers need capital to rebuild their homes and restore production and business.

HSC estimates that the impact of these support programs on banks’ interest income and profits will be relatively small. For example, VCB estimates that the cost of the support program that it applies will be about VND 100 billion, equivalent to 0.72% and 1% of VCB’s net interest income and pre-tax profit in the second quarter of 2024, respectively.

The Art of Liquidity: Why Low Trading Volume Isn’t Always a Bearish Sign

The recent decline in liquidity can be attributed to investors awaiting pivotal monetary policy decisions by major central banks globally, according to KIS Vietnam Securities (KIS Securities). A series of socioeconomic events have also diverted investors’ attention, leading to reduced trading activity.