Continuous Eviction from Premises

McDonald’s has announced the closure of its Ben Thanh branch, located at 2-2A Tran Hung Dao, Pham Ngu Lao Ward, District 1, Ho Chi Minh City. This was one of the first outlets of the fast-food chain in Vietnam.

“Although we are reluctant to say goodbye, at 2 am on September 19, McDonald’s Ben Thanh will conclude a decade-long journey of emotional companionship,” McDonald’s stated.

McDonald’s Ben Thanh branch closes its doors.

McDonald’s entered the Vietnamese market in February 2014 with its first outlet at 2-6 Bis Dien Bien Phu, Da Kao Ward, District 1, Ho Chi Minh City. At that time, the American fast-food brand stated its plan to open 100 outlets within 10 years.

However, a decade has passed, and McDonald’s currently operates only 36 outlets across provinces and cities such as Hanoi, Hai Phong, Da Nang, Khanh Hoa, Binh Duong, Dong Nai, and Ho Chi Minh City. With the closure of McDonald’s Ben Thanh, the fast-food chain now has 35 outlets nationwide and 17 in Ho Chi Minh City.

McDonald’s has not disclosed the reason for closing this branch, but speculation suggests that the American fast-food brand can no longer afford the rental costs for the premises located in the central area of Ho Chi Minh City.

Similarly, Starbucks has announced the cessation of operations at its Starbucks Reserve store, situated in a prime location on Han Thuyen Street, Ben Nghe Ward, District 1, Ho Chi Minh City, effective August 26. Exorbitant rental costs are believed to be the primary reason.

Thus, the Starbucks Reserve store closed after seven years of operation. Starbucks Reserve was positioned as a premium coffee destination for Starbucks in Vietnam. In addition to table service for customers who placed orders, the Han Thuyen Reserve store featured mostly staff wearing black aprons known as “Coffee Masters,” specialized baristas trained through an internal program. In contrast, most staff at other stores wear green aprons, indicating standard baristas.

Back in 2021, Starbucks Vietnam also closed its store located in one of the most advantageous corners of Ho Chi Minh City, at the Rex Hotel. This was the third store Starbucks opened when it first entered Vietnam.

Previously, the Starbucks store at President Place (the intersection of Nguyen Du and Nam Ky Khoi Nghia, District 1) also ceased operations. This was the second store Starbucks opened after its inaugural outlet at New World, District 1.

In November 2023, the Starbucks store at 38 Dong Du, District 1, also shut down. This outlet, which opened in March 2014, was the brand’s fourth store in Ho Chi Minh City, established about a year after Starbucks entered the market. Before that, the unexpected closure of the Starbucks store on De Tham Street, District 1, also made headlines.

Starbucks consecutively closes multiple outlets.

Recently, several expensive premises in the central area of Ho Chi Minh City have seen a change in tenants. For instance, the intersection of Phu Dong (District 1), where six streets converge (Nguyen Thi Nghia, Pham Hong Thai, Ly Tu Trong, Cach Mang Thang 8, Le Thi Rieng, and Nguyen Trai), is considered one of the most prime locations in Ho Chi Minh City.

The property at 325 Ly Tu Trong, with a three-sided facade spanning 126 square meters, has been continuously offered high rents by various brands. However, many businesses that occupied this space, such as PhinDeli, the soy milk chain Soya Garden, and Phuc Long, have quickly moved out in recent years.

Similarly, the wave of evictions is spreading to areas around Notre Dame Cathedral, the Ho Chi Minh City Post Office, Turtle Lake, Phan Xich Long Street (Phu Nhuan District), Nguyen Trai Street (District 5), and Le Van Sy Street (stretching from District 3 to Tan Binh District)…

Why?

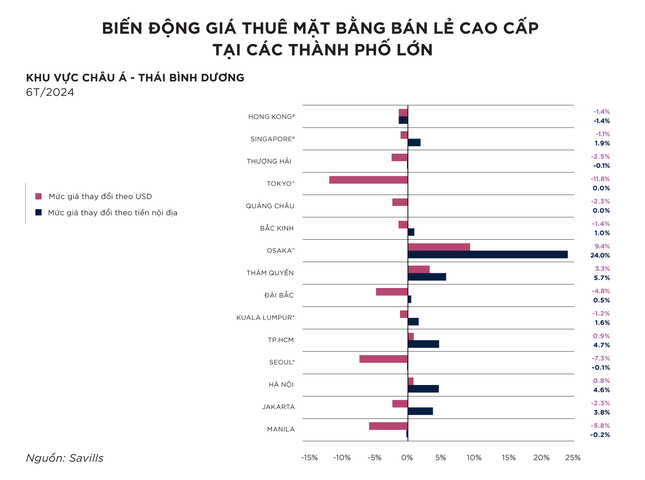

According to the Prime Benchmark report published by Savills Asia-Pacific, Hanoi and Ho Chi Minh City are among the markets with active retail real estate sectors in the first seven months of the year.

The report cites that rental prices for premium retail spaces in Osaka, Japan, increased by 24% year-over-year in the first half. Rental prices in Japan are expected to continue rising due to the weak yen and the attractive combination of tourism experiences.

Closely following Japan, three emerging markets in Southeast Asia—Ho Chi Minh City, Hanoi, and Jakarta (Indonesia)—also witnessed significant improvements in rental prices, increasing by 4.7%, 4.6%, and 3.8%, respectively. Experts attribute these results to the growth of the middle class and the recovery of the tourism industry.

Specifically, rental prices for premium spaces in the center of Hanoi are $96.4 per square meter, while in Ho Chi Minh City, they are $151 per square meter. In comparison, rental prices in Kuala Lumpur are $158.6 per square meter, $399.7 per square meter in Singapore, and $289.5 per square meter in Beijing.

Fluctuations in premium retail rental prices in major cities.

Ms. Do Thi Thu Hang, Senior Director of Consulting and Research at Savills Hanoi, assessed that the cost of renting premium spaces in Hanoi and Ho Chi Minh City remains competitive compared to many regional markets.

“The rental price of this segment in Hanoi in the coming time is quite positive, tending to be stable or increasing due to limited new supply. This means that existing projects in prime locations will continue to maintain high occupancy and may increase rental prices,” said Ms. Hang.

In contrast, in other cities in the region, the abundance of retail space supply has created intense competition, forcing owners to adjust prices to attract customers.

Data from the Savills Research department shows that the total area of retail space for lease in Ho Chi Minh City is currently about 1.52 million square meters, with an occupancy rate of 94%.

Ms. Tran Pham Phuong Quyen, Retail Leasing Manager at Savills Ho Chi Minh City, said that the limited supply of premium retail space leads to fierce competition among shopping centers located in prime locations.

“However, premium spaces in Ho Chi Minh City are still concentrated in the central area or developed districts, such as District 7. In the future, the market will tend to expand to adjacent areas. Additionally, in 2024, the appreciation of the US dollar has significantly increased the rental price of premises in local currency,” said Ms. Quyen.

Ms. Tran Pham Phuong Quyen also affirmed that the retail industry is being strongly promoted by demographic factors and the expansion of urbanization in provinces and cities, thereby stimulating economic growth. Ms. Quyen cited a KPMG Vietnam study that predicts that from 2020 to 2030, Vietnam will have an additional 23.2 million middle-class people, with a compound annual growth rate of 5.5%, ranking among the top countries with the fastest growth in Southeast Asia.