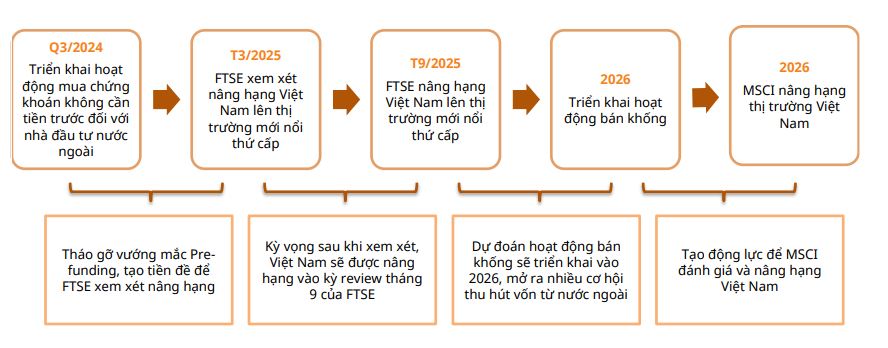

The recent Circular 68/2024/TT-BTC introduces a significant change, allowing foreign institutional investors to place buy orders for stocks without full payment upfront. This means they can now purchase securities on the same day (T+0) and settle the payment on the following days (T+1/T+2). The Circular will come into effect on November 2, 2024.

Currently, the Vietnam Securities Depository (VSDC), securities companies, custodian banks, and investors are working to finalize the necessary paperwork.

According to SSI Research, this move brings Vietnam’s stock market a step closer to meeting the requirements for an upgrade to emerging market status by FTSE Russell. SSI Research maintains its scenario that Vietnam will achieve this upgrade in the September 2025 review.

With the potential upgrade to emerging market status, it is estimated that inflows from ETF funds could reach up to 1.7 billion USD. This does not include the potential inflows from active funds, which FTSE Russell estimates to have total assets five times that of ETF funds.

As per a report by Mirae Asset Securities, the new mechanism for foreign institutional investors not only reduces financial costs and increases flexibility for investors but also serves as an important criterion for upgrading Vietnam’s market status to an emerging market according to FTSE Russell standards.

In the FTSE’s Q3 2024 review, Vietnam still had limitations in meeting the criteria for an upgrade. However, addressing the hurdles related to pre-trade margin requirements and improving the process of opening new accounts are expected to bring about positive changes and support the realization of emerging market status.

|

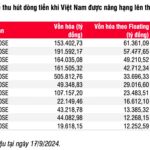

Vietnam’s Stock Market Upgrade Roadmap

Source: Mirae Asset

|

As of September 17, 2024, the market capitalization of the VN-Index stood at over 213 billion USD, which is quite comparable to some countries with low allocations in the FTSE Emerging Markets Index. For example, Chile’s market capitalization was 170 billion USD as of June 2024. Mirae Asset estimates that Vietnam’s weight in the index could be around 0.6% upon official inclusion. For context, the Vanguard FTSE Emerging Markets ETF has a size of nearly 79 billion USD. With a 0.6% allocation, Vietnam could attract inflows of approximately 474 million USD from this fund alone.

Mirae Asset believes that foreign inflows into Vietnam will come not only from funds that use the FTSE Emerging Markets Index as a reference but also from other funds once the market is upgraded.

According to Mirae Asset’s analysis, most markets show signs of an upward trend one to two years before the official upgrade. For instance, Qatar witnessed a rise of over 45% from September 2013 to September 2014, Saudi Arabia saw a more than 23% increase from March 2017 to March 2018, and Romania experienced an over 18% gain from September 2018 to September 2019.