On September 21st afternoon, at the meeting of the Government Office with banks, SBV Deputy Governor Pham Quang Dung reported on monetary policy management solutions and banking activities, promoting the role and contribution of joint-stock commercial banks.

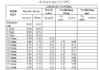

SBV stated that the average lending interest rates for new and outstanding loans of the whole system continued to decrease strongly, by August 2024, down more than 1% per year compared to the end of 2023. Of which, the lending interest rate of the joint-stock commercial bank group decreased by about 0.96%, currently at 9.17%, higher than the whole system and the state-owned commercial bank group.

In periods of high pressure, the SBV sold foreign currency intervention to support market liquidity, serve the economy, and stabilize the foreign exchange market. The joint-stock commercial bank group accounts for about 66% of the total foreign exchange transactions of the system and 30% of the market share of transactions with customers.

In terms of ensuring system liquidity, the open market operation transactions between the SBV and the joint-stock commercial bank group are smooth and timely, accounting for more than 60% of the total business volume of the system.

According to Deputy Governor Pham Quang Dung, credit growth of the whole system improved compared to the same period. As of September 16, 2024, it reached 7.26% compared to the end of 2023 (the same period reached 5.73%). Of which, outstanding loans of the joint-stock commercial bank group increased by 8.48%, accounting for 45% of market share, the highest increase in the system. Credit growth for all sectors improved compared to the same period in 2023, and the credit structure was in line with the orientation of economic restructuring…

In terms of credit quality, by the end of July 2024, the bad debt ratio of the credit institution system was at 4.75%, up from 4.55% at the end of 2023 and 2.03% at the end of 2022. By the end of June 2024, the bad debt of the joint-stock commercial bank group was VND 633 trillion, up 4.8% over the end of 2023, accounting for 79.65% of the bad debt of the whole credit institution system; bad debt ratio was 7.77%.

The after-tax profit of the joint-stock commercial bank group in the first 6 months of 2024 was about VND 44 trillion (if excluding the 2 commercial banks under special control, Dong A Bank and SCB) was about VND 77 trillion, up nearly 20% over the same period. Income from credit activities contributes the most to total income (about 76.1%).

Most credit institutions meet the ratios for safety in operation. By the end of Q2/2024, the capital adequacy ratio (CAR) of the system was 11.96%. In which CAR of state-owned commercial banks was 9.77%; CAR of joint-stock commercial banks is 11.86%…

Sure, I can assist with that.

## Empowering Borrowers and Unraveling the Complexities of Collateral: A Lender’s Perspective

“In a proposal to the government, the Chairman of TPBank emphasized the need for enhanced public awareness and borrower accountability regarding loan debts. The bank seeks to address the challenging situation where lenders find themselves ‘standing when granting loans but kneeling when collecting debts.’ This metaphor highlights the urgent requirement for a cultural shift in borrowing behavior and a more responsible attitude toward financial obligations.”