Spot gold prices rose on Friday, 20/9, surging 1.3% to $2,620.63 an ounce, while December 2024 gold futures climbed 1.2% to $2,646.20.

Gold prices reach new heights.

Over the past few days, gold prices have been on a steady rise, particularly gaining momentum after the Federal Reserve initiated a vigorous cycle of monetary policy easing by slashing interest rates by half a percentage point on Wednesday (18/9), boosting the appeal of gold.

In a bold move, the US central bank cut rates by 50 basis points, bringing the Fed funds rate down to 4.75% – 5%. This significant reduction marks the beginning of what the Fed refers to as “interest rate normalization,” with the ultimate goal of reaching a reference rate of 3% to 3.5% by 2025.

Fed policymakers predict a further half-percentage-point reduction in the reference rate by the end of this year, followed by a full percentage point cut in 2025 and another half-point reduction in 2026.

According to Alex Ebkarian, CEO of Allegiance Gold, “The market is factoring in larger and more frequent rate cuts from the Fed as the US economy grapples with both fiscal and trade deficits, which will further erode the overall value of the dollar.” He adds, “If you combine geopolitical risks with US deficits, a low-yield environment, and a weakening dollar, then the combination of all these factors is what’s driving the gold rally.”

Looking at the broader picture, the global monetary easing policies implemented by central banks, coupled with robust central bank purchases and geopolitical concerns, have propelled gold prices to record highs multiple times this year.

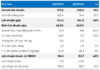

Interest rates of major economies.

The price of this metal has surged 27% in 2024, marking the largest annual increase since 2010, as investors seek out gold for another reason: a hedge against the uncertainties arising from prolonged conflicts in the Middle East and other regions (gold has traditionally been viewed as a safe-haven asset).

Gold prices surge this year.

Will prices continue to climb?

Many analysts suggest that the record-breaking rally may be due for a correction.

In fact, the unprecedented surge has dampened retail demand in the world’s top consuming nations – China and India.

Daniel Ghali, a currency strategist at TD Securities, notes, “The origin of gold buying at this point remains elusive to us,” as ETF inflows are relatively small and Asian buyers remain largely on the sidelines, all of which are indicative of a “frothy positioning.”

China continued its gold-buying hiatus in August. The country’s central bank has refrained from purchasing gold since prices soared to record levels, and they are not the only central bank to halt or reduce gold reserves amid soaring prices. Central banks, which were a key driver of gold prices earlier this year, have slowed their purchases, as evidenced by the WGC’s Q2 report showing global central bank purchases of only 183.4 tons, a decrease of 38.85% from Q2.

Commerzbank, in a note, stated that the gold price rally “should not go on forever,” citing their prediction that the Fed will cut rates by just 25 basis points at each of the next two Fed meetings.

However, some analysts believe that gold could witness further sharp spikes due to the continued weakening of the US dollar, making gold more affordable for those holding other currencies, which has provided additional impetus for gold’s ascent.

“Geopolitical risks, such as the ongoing conflicts in the Gaza Strip, Ukraine, and elsewhere, will ensure that safe-haven demand for gold remains intact,” remarked Fawad Razaqzada, an analyst at Forex.com, in a note.

Daniel Ghali, a commodities strategist at TD Securities, added, “It’s clear that there will be more gold-buying related to the Fed’s decision to embark on a vigorous cycle of monetary easing.”

This is why traders are closely monitoring the Fed’s trajectory. For the November FOMC meeting, 50.3% of traders predict a 50-basis-point rate cut, while 49.7% foresee a 25-basis-point reduction (almost equal proportions).

Consequently, analysts believe that gold prices will continue to climb in the medium to long term.

“In our view, this rally could continue. We are targeting $2,700 per ounce by mid-2025. Along with short-term risk drivers, we predict demand for gold ETFs will accelerate in the coming months,” UBS said.

Reference: Reuters

“Sacombank Offers Interest Rate Reduction of Up to 2% p.a. to Support Customers Affected by Storms and Floods”

“Sacombank is offering a significant interest rate reduction of up to 2% per annum on loans to support individuals and businesses affected by storm and flood damage. This initiative aims to help those impacted by natural disasters to overcome their challenges, stabilize their lives, and rebuild their livelihoods and business operations.”