Services

Successful Capital Increase

On September 20, VIX Securities announced its plan to issue and offer shares to existing shareholders to raise capital.

Specifically, on August 1, 2024, VIX Securities finalized the shareholder list for the capital increase, including a 10% stock dividend for 2023, meaning that for every 10 shares owned, shareholders would receive 1 new share; and a 10% stock bonus, also at a rate of 1 new share for every 10 shares held.

At the same time, the company offered shares to its employees through an ESOP program, with a volume of 20 million shares at a price of 10,000 VND per share; and executed a 100:95 share purchase right, meaning that for every 100 shares owned, shareholders had the right to purchase 95 new shares at a price of 10,000 VND per share.

As of September 20, after completing the four rounds of issuance and share offerings, VIX Securities’ chartered capital increased from 6,694.4 billion VND to 14,585 billion VND, making it one of the largest securities companies in terms of chartered capital in the Vietnamese stock market.

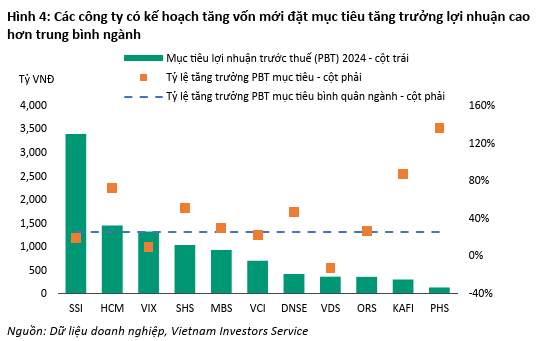

Since the beginning of the year, market participants have witnessed a race among securities companies to increase their chartered capital to seize opportunities in this market with great potential.

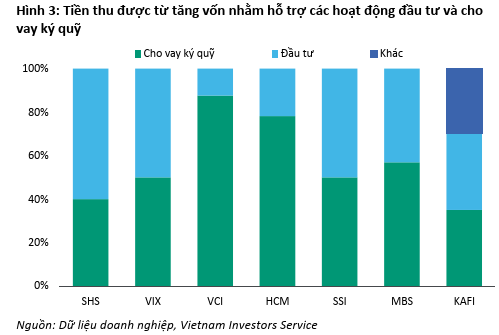

According to VIS Ratings, Vietnam’s leading credit rating agency, with the additional capital, companies can boost their core businesses of investment and margin lending in 2024. Moreover, higher profit growth from these businesses will enable companies to strengthen their risk buffers.

|

Additionally, as of the end of Q2 2024, the company’s total assets reached 10,607.6 billion VND, a 16.7% increase. Loan balances also increased by over 1,000 billion VND to 4,089 billion VND, a 35.9% surge compared to the beginning of the year. This development led to a 146.5% year-over-year increase in profit from receivables and lending activities in the first half of 2024. Likewise, brokerage activities witnessed significant growth, with a 160% year-over-year rise in brokerage fee revenue during the same period. These figures reflect positive growth in margin lending and an increase in new customers.

|

Along with investing heavily in technology and enhancing its financial capacity, VIX Securities is determined to become a strong and professional securities company, the top choice for investors, and one of the leading securities companies in the market in terms of scale and operational efficiency.

The Ultimate Guide to This Week’s Dividend Payouts: A Top Bank Prepares to Release a Generous 50% Cash Dividend

This week, a total of 25 businesses will be distributing cash dividends, with rates ranging from a substantial 50% to a more modest 1%.