Investing in the Mekong Delta: Unlocking Sustainable Growth

The Mekong Delta (ĐBSCL) is a strategically vital region for Vietnam, boasting significant economic, cultural, social, environmental, defense, and diplomatic significance. With a focus on agriculture, the region has been earmarked for significant development, targeting key produce such as rice, shrimp, catfish, and fruit.

A vibrant discussion on the Mekong Delta’s future. Photo: CK.

To realize its potential, the government has ambitious plans, as outlined in Resolution No. 78/NQ-CP, which aims to double the region’s economic size by 2030, with an average growth rate of 6.5-7% from 2021-2030. Per capita income is also targeted to reach VND 146 million per year.

The region’s infrastructure is a key focus, with Resolution No. 78/NQ-CP envisioning a multi-modal transport network connecting the region domestically and internationally. This includes approximately 830 km of new and upgraded highways, 4,000 km of national highways, 4 international airports, 13 seaports, and numerous passenger and cargo clusters for inland waterways. To achieve this vision, diverse sources of investment are essential to sustain rapid and sustainable development.

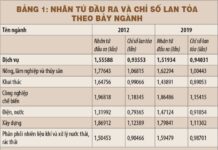

Nguyen Khanh Tung, Director of the Can Tho Socio-Economic Institute, highlighted that past annual economic reports identified insufficient and inefficient investment as a key factor hindering the region’s progress relative to others. While government and local authorities have increased infrastructure investment, disbursement rates remain low, falling short of set plans.

Nguyen Khanh Tung, Director of the Can Tho Socio-Economic Institute, shares insights at the discussion. Photo: CK.

Tung pointed out that during 2014-2023, Long An province was the most successful in attracting investment, particularly from non-state sources. This was followed by Tien Giang and Kien Giang provinces, while other localities faced significant constraints. Can Tho, for instance, remains heavily reliant on central government funding (averaging 13.8% during this period), with limited success in attracting non-state and FDI (only 7.5% and 5.2%, respectively).

“These findings underscore the challenges the Mekong Delta faces regarding investment shortfalls and limited capacity for capital mobilization,” Tung remarked.

Addressing Weaknesses to Catalyze Growth

Nguyen Phuong Lam, Director of VCCI Mekong, acknowledged the significant increase in government investment in the region but noted that it has yet to translate into positive signs beyond infrastructure development. The region has experienced the slowest investment growth in the country from 2015-2023, attributed to two key weaknesses: declining FDI and a decrease in the number of enterprises, both in quantity and registered capital.

There are also significant disparities in total social investment across provinces. The largest province boasts an average of nearly VND 35 trillion, while the smallest manages only VND 12 trillion. This uneven development, despite similar conditions and access to state capital, has hindered the region’s collective progress.

Nguyen Phuong Lam, Director of VCCI Mekong, shares his insights. Photo: CK.

Regarding FDI, Lam noted that the Mekong Delta has consistently lagged, accounting for only 7.6% of the country’s total FDI (excluding large-scale projects like wind and thermal power). On a per-capita basis, the region’s FDI attraction is significantly lower than other regions.

The region also struggles with a low rate of new enterprise establishment compared to other regions, and a high rate of business exits. In 2023, for example, the Mekong Delta saw over 15,000 new enterprises, but nearly 14,800 businesses left the market, resulting in a net gain of only 190 enterprises, a sharp decline from previous years. Private sector contribution to the region’s total social investment is also considerably lower than in other regions…

“The key to development is investment, and the Mekong Delta is currently lacking due to inadequate infrastructure,” Lam asserted. “Without improved infrastructure, investors will not come, and without investment, we cannot create jobs or stem labor migration. This vicious cycle impacts not just the economy but also society and the environment.”

The Billion-Dollar Real Estate Project: Unveiling TCM’s Latest Move

On the morning of September 20, TC Tower Co., Ltd., a wholly-owned subsidiary of Thanh Cong Textile Garment Investment and Trading Joint Stock Company (HOSE: TCM), entered into a strategic partnership with DBFS Joint Stock Company to develop the TC Tower real estate project. This project is expected to boast an investment of over VND 1,700 billion.

“Growing Business Opportunities in ASEAN: The Vietnam Advantage”

With political stability, a business-friendly government, and a clear and transparent legal framework, Vietnam presents an attractive prospect for businesses looking to expand into the ASEAN market. The country’s strong network of local partners further enhances its appeal, offering a distinct advantage to companies seeking to establish a presence in this thriving economic region.