The Fed has just announced a 50-basis point interest rate cut amid subdued inflation and clear signs of a slowing US economy. VinaCapital’s experts argue that this rate cut could be a double-edged sword for the Vietnamese economy.

This is because a weaker US dollar will ease depreciation pressure on the VND, but a slowing US economy will impact Vietnam’s GDP growth.

VinaCapital asserts that the Fed’s rate cut is initially good news. Earlier this year, the VND had depreciated by nearly 5% year-to-date, forcing the State Bank to tighten monetary policy by withdrawing liquidity from the system.

Some experts even predicted that the State Bank would raise Vietnam’s policy rate by 50 basis points by the end of this year. These developments supported the value of the VND, but depreciation pressure from ASEAN currencies only eased since late June when expectations for a Fed rate cut began to rise.

The market now expects the Fed to cut rates by over 100 basis points this year and another 100 basis points next year, which has led to a nearly 4% appreciation of the VND since late June, along with a 7-10% rise in the value of the Malaysian Ringgit, Thai Baht, and Indonesian Rupiah.

The strong appreciation of the Indonesian Rupiah has allowed the country’s central bank to cut interest rates by 25 basis points to 6%. While VinaCapital does not expect the State Bank to follow suit, there is currently no possibility of the State Bank raising interest rates as the VND’s depreciation remains below 1.5% year-to-date, still within the safe zone for the State Bank.

A slowing US economy is likely to reduce American demand for “made in Vietnam” products such as mobile phones.

According to VinaCapital’s experts, what is more concerning is the implication of the rate cut on the state of the US economy. Exports to the US increased by nearly 30% in the first eight months, which has been the most important factor driving Vietnam’s GDP growth this year.

A slowing US economy is likely to reduce American demand for “made in Vietnam” products such as laptops, mobile phones, and other goods. Therefore, Vietnam’s GDP growth in 2025 will have to rely on internal factors to compensate for the impact of the slowing US economy.

The government has many tools at its disposal to boost the economy, including increased infrastructure spending and promoting a recovery in the real estate sector.

VinaCapital forecasts that real estate transactions in Vietnam will increase by up to 35% year-on-year in the first nine months of this year. A more vibrant real estate market will certainly improve consumer sentiment and spending, which has been somewhat subdued this year.

While not surprised by the Fed’s rate cut, VinaCapital’s experts express concern about the significance of the cut’s magnitude on the US economy. “We have repeatedly emphasized the view that Vietnam’s GDP boost from export growth may diminish next year, and the Fed’s move has essentially confirmed this,” said VinaCapital’s expert.

According to VinaCapital’s experts, increased infrastructure spending and accelerating the recovery of the real estate market are two powerful tools the government can use to avert negative impacts.

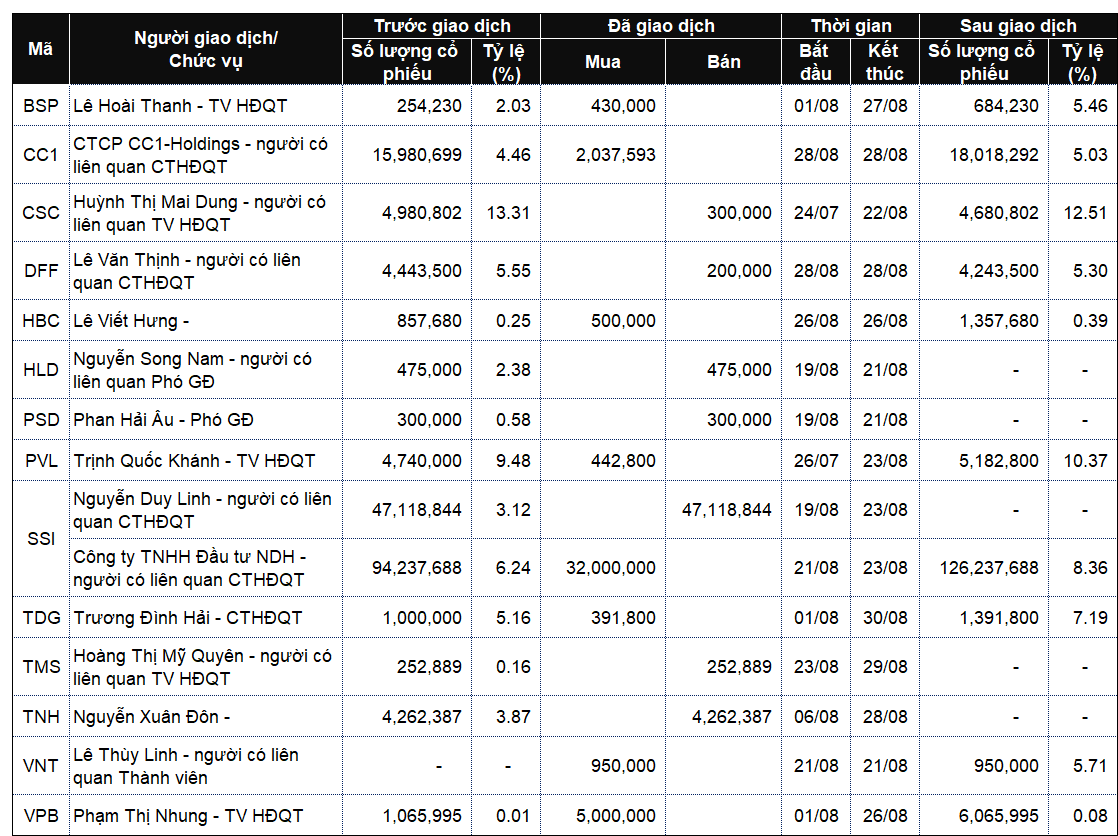

The Stock Market ‘Anticipates’ Next Week’s Key Event

The market experienced a rather dull trading week, with the last two sessions seeing the lowest liquidity since April 2023. Investor sentiment seems to be heavily impacted by the aftermath of the third storm, which disrupted the business operations of a significant number of enterprises. The market is also awaiting the response of the State Bank of Vietnam following the interest rate cut by the Federal Reserve.