Can the Fed replicate such a feat in today’s context? The Fed’s aggressive rate cut last week is deemed a good start – according to the Wall Street Journal.

In 1994, the Fed aggressively raised interest rates to combat inflationary pressures. By 1995, the job market in the world’s largest economy had cooled significantly. Similar to the present, there were no signs of an impending recession in the US economy. But in May 1995, monthly employment statistics showed that non-farm payrolls were no longer growing but had turned negative. In June, the Fed initiated the first of three consecutive rate cuts.

POLICY TIGHTNESS

That scary jobs report turned out to be a one-off. The US job market rebounded in June. But when looking at the three-month moving average to smooth out short-term fluctuations, the weakening trend was evident. In the three months leading up to June 1995, the US economy averaged 126,000 new jobs per month, down from an average of 332,000 new jobs per month in the same period a year earlier.

Fast forward to 2024, the number of new jobs in August – according to the latest data – increased from July. However, in the three months up to August, the average number of new jobs was 116,000 per month, a sharp decline from 211,000 in the same period last year.

The Fed’s three rate cuts of 0.25 percentage points each in 1995 and early 1996 proved successful: by mid-1996, the number of new jobs had rebounded to an average of about 250,000 per month, and inflation was not a significant concern for a long time afterward.

So, what prompted the Fed to initiate this rate cycle with a 0.5 percentage point cut? The Wall Street Journal argues that contrary to many people’s concerns, such a reduction does not imply that the Fed perceives the US economy as facing significant risks. In fact, at a press conference on September 18, following the Fed’s rate cut, Chairman Jerome Powell sounded relatively optimistic. “The US economy is fundamentally strong. Our intention is essentially to maintain the strength we’re seeing in the economy,” he said.

Instead, the Fed’s aggressive rate cut is related to fundamental differences between the economy and the interest rate environment in the US in the 1990s and today.

In 1995, an era of super-low interest rates, as seen in the early 21st century, was unthinkable. When the Fed, under Chairman Alan Greenspan, raised rates in 1994, the federal funds rate climbed from 3% at the beginning of that year to 6% by February 1995. In contrast, the recent tight monetary policy cycle started at a 0-0.25% interest rate at the beginning of 2022 and eventually peaked at 5.25-5.5% in July 2023. In other words, the degree of tightness of the recent cycle was far greater than three decades ago.

THE NEUTRAL RATE STORY

Moreover, the degree of tightness relative to the economy was also much higher. Economist Dario Perkins of TS Lombard research firm wrote in a recent report that around 1995, the neutral rate was only 0.75 percentage points lower than the Fed’s rate in June that year. The neutral rate is the theoretical interest rate that the Fed believes is high enough to prevent excessive inflation while still allowing for maximum employment. In this context, three rate cuts of 0.25 percentage points were just what the economy needed.

Today, the debate about the neutral rate remains lively. However, most economists believe that the neutral rate is much lower than in 1995, implying that the economy’s ability to absorb high interest rates has diminished compared to the 1990s. This stems from several factors, including demographic changes, differences in productivity growth, and shifts in the financial system.

Mr. Powell said he could not pinpoint the neutral rate at present, except that he believes it is now “significantly higher” than when it was at 0% or even negative before the Covid-19 pandemic.

Nonetheless, the Fed’s long-term federal funds rate projections in their latest update offer some clues about what the Fed currently believes to be the neutral rate. The neutral rate implied by the Fed’s “dot-plot” forecast in the September update was 2.9%, up from 2.8% in June. However, this neutral rate still has a considerable gap with the federal funds rate after the recent cut, which stands at 4.75-5%.

This implies that following the post-pandemic era of soaring inflation, the Fed has kept the federal funds rate – by its calculation – at a highly restrictive level. For this reason, the Fed has a long way to go to bring rates back to the neutral level, i.e., the rate that neither hinders nor stimulates economic growth. This could explain why the Fed opted for a substantial rate reduction to kickstart this easing cycle, and why the “dot-plot” forecast suggests two more rate cuts of 0.25 percentage points each this year and a full percentage point reduction in 2025.

The Fed of the 1990s acted proactively and successfully prevented the economy from falling into a recession. Today’s Fed aims to do the same. Considering where the Fed started this time, they will have to act faster than before – concludes the Wall Street Journal article.

“Sacombank Offers Interest Rate Reduction of Up to 2% p.a. to Support Customers Affected by Storms and Floods”

“Sacombank is offering a significant interest rate reduction of up to 2% per annum on loans to support individuals and businesses affected by storm and flood damage. This initiative aims to help those impacted by natural disasters to overcome their challenges, stabilize their lives, and rebuild their livelihoods and business operations.”

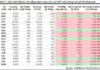

The Big 3: Banks Offering Competitive Savings Rates of 8% and Above

To earn a savings interest rate of 8% per annum and above, a minimum deposit of 500 billion VND is required.