Ms. Le Thi Thanh, an online seller residing in Thu Duc City, Ho Chi Minh City, shared that she was introduced to voluntary social insurance. She is considering it but felt that the maternity allowance of just VND 2 million from July 1, 2025, was too low.

Many workers misunderstand that voluntary social insurance only provides VND 2 million in maternity benefits.

According to Lawyer Hoang Tuan Vu (Luật Việt Nam), in reality, those who pay voluntary social insurance do not only get VND 2 million in maternity allowance but also other benefits.

First of all, it is important to clarify that the information stating that voluntary social insurance only provides a maternity allowance of VND 2 million is not entirely accurate.

In addition to the VND 2 million maternity allowance, eligible participants of voluntary social insurance are also entitled to three other benefits: retirement, survivor benefits, and occupational safety insurance, as analyzed above, instead of just the previous two benefits, which were retirement and survivor benefits.

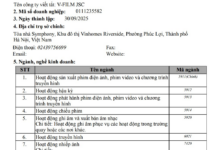

Specifically, from July 1, 2025, when the Social Insurance Law of 2024 takes effect, participants of voluntary social insurance will be eligible for the following three benefits in addition to maternity allowance:

– Retirement benefits

– Survivor benefits

– Occupational accident insurance as stipulated in the Occupational Safety and Hygiene Law of 2015.

Breakdown of the benefits:

Maternity allowance: The benefit is VND 2 million per child born or for each fetus of at least 22 weeks of gestation that dies in the uterus or during labor.

Female workers from ethnic minorities or Kinh women with ethnic minority husbands from poor households are also entitled to additional support policies from the government when giving birth.

(Based on Article 95 of the 2024 Social Insurance Law)

Retirement benefits:

– Female workers who have paid social insurance for 15 years: Eligible for a retirement pension of 45% of the average income used as the basis for social insurance contribution, plus 2% for each additional year, up to a maximum of 75%.

– Male workers who have paid social insurance for 20 years: Eligible for a retirement pension of 45% of the average income used as the basis for social insurance contribution, plus 2% for each additional year, up to a maximum of 75%.

– For those who are both eligible for monthly social assistance and fall under the provisions of Article 21 of the 2024 Social Insurance Law, the higher social assistance benefit will be granted.

In addition to the VND 2 million maternity benefit, eligible participants of voluntary social insurance are also entitled to three other benefits.

(Based on Article 99, Clause 2, Article 22 of the 2024 Social Insurance Law)

Survivor benefits: According to Articles 109 and 110 of the 2024 Social Insurance Law, participants of voluntary social insurance will be entitled to funeral allowances and one-time survivor benefits from July 1, 2025, as follows:

– Funeral allowance: Equal to 10 times the reference amount in the month of the person’s death.

– Survivor benefit for the dependents of a participant of voluntary social insurance or someone preserving their social insurance period shall be calculated based on the number of years of social insurance contribution, as follows:

For those who contributed before 2014: 1.5 times the average income used as the basis for social insurance contribution for each year.

For those who contributed after 2014: Twice the average income used as the basis for social insurance contribution for each year.

For those with less than 60 months of contribution: The total amount contributed.

For those who contributed to both compulsory and voluntary social insurance: The minimum survivor benefit = 3 times the average of the salary and income used as the basis for social insurance contribution.

– One-time survivor benefit for the dependents of a retired person or a person who temporarily stopped receiving a pension and then died is calculated based on the number of years the pension was received as follows:

If the person died within the first two months: The one-time survivor benefit = 48 months’ pension of the month the person was receiving.

If the person died from the third month onwards: The one-time survivor benefit will decrease by 0.5 months’ pension for each month compared to the 48-month pension of the month the person was receiving (however, it must be higher than three months’ pension of the month the person was receiving).

– When a person receiving monthly social assistance dies, the organization or individual arranging the funeral will receive funeral expense support.

What is the Monthly Pension Amount for Employees Who Have Paid Social Insurance Premiums for 15 Years Starting July 2025?

The new Social Insurance Law for 2024 has been officially passed. A key change is highlighted in Article 98, which states that employees who have paid social insurance contributions for at least 15 years are now eligible for monthly retirement pensions when they reach retirement age. This is a significant shift from the previous requirement of 20 years of contributions.

Case of Workers Still Getting Social Insurance Payout Once Even After Contributing Enough for 20 Years

According to Article 1, Article 8 of Decree No. 115/2015/ND-CP, if an employee has reached the retirement age and has contributed to social insurance for 20 years, they will not receive a lump sum social insurance payment. Instead, they will be entitled to a pension as regulated. However, there are still some cases where individuals can withdraw their social insurance in a lump sum even if they have contributed for 20 years.

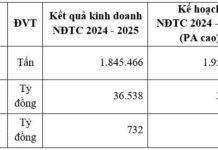

Resolutely implementing solutions to reduce late insurance payments from the beginning of the year

As the number of participants in social insurance, health insurance, and unemployment insurance grows, the Social Insurance Agency is also intensifying efforts to collect contributions and reduce the amount of late payments by 2024…