The event offered a comprehensive overview of the market, with a particular focus on the banking sector. It provided investors with insights into Nam A Bank’s business operations and strategic orientation for the upcoming period.

Nam A Bank’s Online Investor Meeting

|

On this occasion, Nam A Bank representatives addressed several key areas of interest to investors. These included financial performance, growth prospects, and credit growth orientation; risk management strategy; the “Green and Digital Bank” strategy; the development of the 365+ ONEBANK by Nam A Bank self-service transaction network; the bank’s positioning and 3-5-year development orientation, and more.

Stable Growth Across Various Metrics

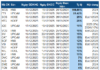

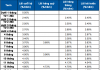

NAB has achieved stable growth in its core business operations in 2024. As of August 2024, the bank’s cumulative pre-tax profit reached over 75% of the plan approved by the Board of Directors for the year. The ROE ratio stood at an impressive 21.46%, while the ROA ratio was 1.65%, indicating that the bank has not only grown in scale but also achieved high profitability.

NAB’s NIM ratio has improved to 3.8% (compared to 3.6% at the end of the second quarter). The bank expects the NIM to remain in the range of 3.5–3.8% until the end of 2024, as interest rates are maintained at a low level to support individuals and businesses amid economic challenges.

In terms of operating expenses (CIR), NAB is currently at an optimal level of approximately 38%. According to NAB representatives, the bank aims to be among the top 7-10 banks in Vietnam in terms of salary and welfare to attract top talent. They also plan to expand their network of branches and ONEBANK transaction offices nationwide. NAB continues to invest significantly in technology to enhance its products and services. Therefore, the CIR target is set at 40-45% to lay the foundation for the bank’s continued growth in the coming years.

Regarding risk management, NAB’s NPL ratio has remained stable since the second quarter of 2024. The bank’s leadership has stated their goal of reducing this ratio to 2% and increasing provisions by an additional VND 300-500 billion to improve the LLCR ratio to 55-60%.

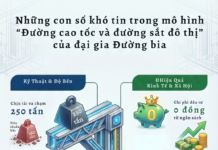

NAB’s loan portfolio has undergone a strategic shift, focusing on priority sectors such as agriculture, forestry, and fisheries (accounting for nearly 6% of the total portfolio as of Q2 2024) and smart transportation lending.

In the long term, the bank follows an industry value chain model and aims to expand this model to strategic sectors, including agriculture, forestry, fisheries, education, healthcare, and resorts. For example, in the tea industry, the bank will be involved in every stage, from seedlings and farmers to purchasing enterprises, processing, sales, and exports.

Customers transacting at Nam A Bank

|

Leading the Way as a “Green and Digital” Bank

NAB has been at the forefront of digital and green banking, as evidenced by the introduction and development of the ONEBANK ecosystem, a comprehensive and automated digital financial ecosystem.

Since its launch, ONEBANK has experienced remarkable growth, with a quarterly growth rate of over 40%, attracting more than 143,000 new customers as of September 2024. With nearly 1.7 million transactions, ONEBANK has significantly contributed to NAB’s success in the digital banking arena.

ONEBANK has enabled NAB to expand its customer base and effectively mobilize capital. Capital mobilization through ONEBANK accounts for nearly VND 10,000 billion (6% of total mobilization). With plans to aggressively expand its network, NAB aims to increase the number of ONEBANK transaction points to 130 by the end of 2024, offering convenient and modern digital financial services to individual and corporate customers nationwide.

Moreover, NAB continues to lead in green credit. The bank has implemented a green credit value chain focusing on agriculture, fisheries, and renewable energy. NAB aims to increase the proportion of green credit to 20-25% (twice or thrice the current proportion).

The value chain in the fisheries sector is a prime example of this strategy’s success. All activities, from breeding, farming, and processing to exports, are carried out according to international green standards. This not only contributes to environmental protection but also creates long-term economic value for NAB and its customers.

Enhancing Market Position and Attracting Strategic Investors

NAB is committed to expanding and enhancing its position in the financial market, with a focus on attracting more international strategic investors. Notably, NAB still has a significant room for foreign investment, creating opportunities for strategic capital sales transactions. This will not only strengthen NAB’s financial position but also expand its international cooperation network, thereby enhancing its competitiveness in the global market.

Regular investor meetings are an essential activity for providing transparent and comprehensive information to customers. In the future, NAB plans to implement various initiatives to promote connectivity and ensure the quick and transparent provision of information, safeguarding the interests of domestic and foreign investors.

“Financial Sector Steps Up to Support Individuals and Businesses Affected by Storm and Flooding”

The banking industry has always been at the forefront of policy response, swiftly adapting and providing accurate and relevant support to businesses and individuals alike.