Although the breadth of the VN-Index this morning showed a dominant number of declining stocks, the adjustment range was very narrow. On the other hand, liquidity plummeted on the two exchanges, indicating that selling pressure was not significant. The market is still in the phase of absorbing short-term profit-taking demand.

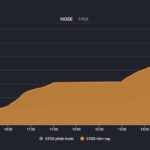

The VN-Index opened with a decent gain of approximately 5 points but closed the morning session slightly down by 0.68 points (-0.05%). The downward slide actually only occurred within the first hour, and from around 10 am onwards, it transitioned to a sideways state below the reference level. Although the index remained in the red for most of this period, the decline was very stable and did not worsen. The HoSE breadth at 10 am recorded 119 gainers and 213 losers, and at the session’s close, it stood at 136 gainers and 235 losers.

Trading also proceeded at a very slow pace, with the total matched order value on the two listed exchanges for the entire morning reaching only VND 5,598 billion, a 50% decrease compared to the previous Friday’s morning session and the lowest in the last four sessions. Liquidity plummeted as the sideways movement in a narrow range below the reference level indicated weak buying power in the green zone, but the selling pressure was also insufficient to push prices deeper.

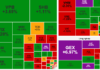

According to HoSE statistics, out of the 235 declining stocks, only 61 fell by more than 1%, with their liquidity accounting for 11.1% of the total matched order value on this exchange. MWG was the only stock that exceeded VND 100 billion in trading, reaching VND 168.1 billion with a drop of 1.03%. The remaining 12 stocks in this group had liquidity ranging from VND 10 billion and above. This clearly illustrates the minimal selling pressure, which could only affect a small number of stocks.

Conversely, on the upside, 40 out of 136 stocks rose by more than 1%, accounting for 20.7% of the exchange’s value. Notable gainers included MBB, up 1.01% with a matched volume of VND 299.8 billion; TPB, up 1.32% with VND 135.5 billion; DCM, up 1.19% with VND 129 billion; and VCG, up 1.07% with VND 120.5 billion. About a dozen other stocks had sporadic liquidity of a few dozen billion VND.

Thus, the vast majority of stocks and market liquidity this morning were concentrated in the group with narrow fluctuations. Given the solid gains last week and a weakening market in the last session, the demand for short-term profit-taking is understandable. What matters is how investors choose to exit the market: whether they opt for aggressive selling, offloading large volumes to clear their portfolios, or seek the best selling prices while gradually restructuring their portfolios. The narrow range of fluctuations indicates that investors are trading in a balanced and calm manner.

One factor contributing to the stable trading session today was the lack of distinct pressure in the large-cap stock group. The minimal loss in points acted as a psychological catalyst. The VN30-Index also witnessed a negligible decline of 0.06% with a not-so-disparate breadth: 12 gainers and 17 losers. Among the largest-cap stocks, VCB rose 0.88%, GAS increased by 0.14%, HPG climbed 0.58%, VIC gained 1.18%, and VNM inched up by 0.14%, effectively counterbalancing the declines in BID (-0.2%), FPT (-0.37%), CTG (-0.42%), VHM (-0.69%), and TCB (-0.42%). As long as these large-caps maintain their ability to offset points, the VN-Index will continue to trade sideways.