According to the latest report on the Vietnamese corporate bond market for August 2024 by VIS Rating, the three key highlights of the market in recent times are the declining cumulative bond default rate across the market, the recovery in the circulation scale thanks to new issuances, and improved liquidity in the secondary market. The most evident signal comes from new bond issuances.

Primary corporate bond issuances, including private and public offerings, as of September 10, 2024, have reached more than VND 280 trillion, equivalent to 80% of new issuances in 2023, while only 2/3 of 2024 has passed.

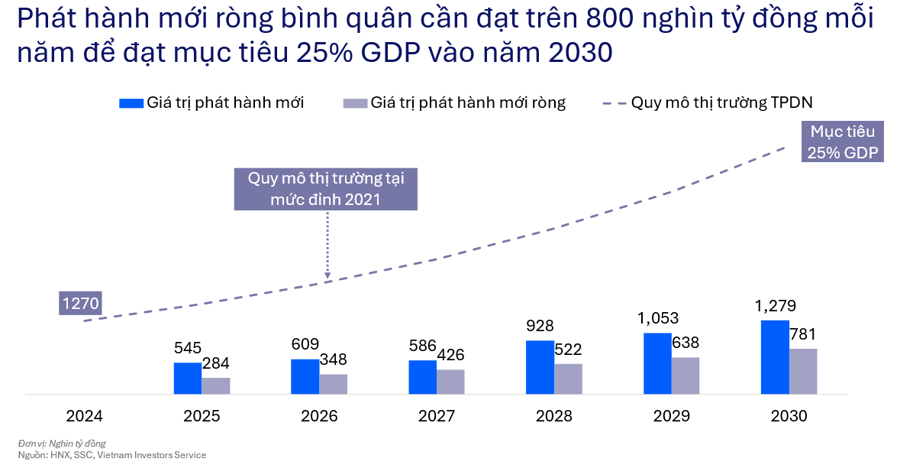

However, when compared to the government’s targets for the market’s size, the gap remains significant. According to VIS Rating’s estimates, to achieve the target of a market size of 25% of GDP by 2030, the average annual primary issuance must exceed VND 800 trillion.

In addition, after the lessons learned from the crisis in the previous period, the goal of developing a safe and stable market is given higher priority than achieving growth in scale at all costs.

THREE CONDITIONS TO ACHIEVE THE DESIRED BOND MARKET SCALE

Mr. Tran Le Minh, CEO of VIS Rating, stated that there are three conditions for the Vietnamese bond market to develop and achieve its set goals, with the target of the corporate bond market size reaching a minimum of 25% of GDP by 2030.

“Currently, individual investors in the Vietnamese market hold a significant proportion of corporate bonds. According to VIS Rating’s estimates, as of the end of June 2024, this ratio was 33% of the total value of circulating corporate bonds. In other international markets, bonds are typically held by institutional investors.”

First, continue to enhance market transparency.

In the new development cycle of the corporate bond market, investors will not only focus on the financial health of the issuing organization but also pay attention to the credit quality of each bond. This is because each issuance has unique features, terms, and conditions that affect the bondholders’ ability to recover their capital.

This requires all market participants, including issuers, service providers, regulatory authorities, and investors, to work together to create a transparent information environment.

Second, provide a simple and widely-accepted reference for investors to determine whether the trading price of a bond is commensurate with the risk involved in investing in that bond.

Third, encourage greater participation from long-term institutional investors in the corporate bond investor structure.

Currently, individual investors in the Vietnamese market hold a significant proportion of corporate bonds. According to VIS Rating’s estimates, as of the end of June 2024, this ratio was 33% of the total value of circulating corporate bonds. In other international markets, bonds are typically held by institutional investors.

The necessary condition to attract long-term institutional investors is to strengthen the first and second factors. From the perspective of domestic credit rating organizations, the credit rating process will have more room to contribute to the corporate bond market in the next phase.

ENHANCING MARKET DISCIPLINE

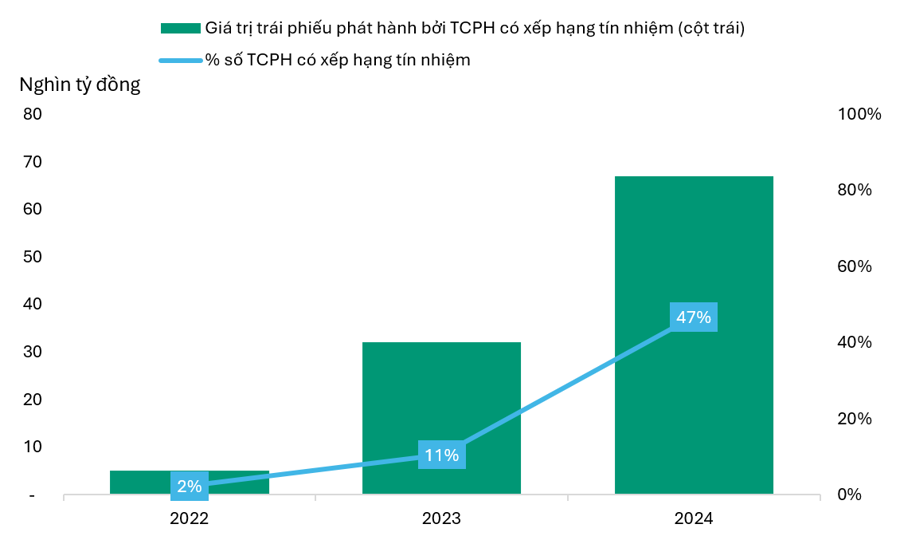

Credit rating activities improve market transparency and encourage market participants to practice transparency. By publicly disclosing credit rating results on the websites of rating agencies, the market can be aware of the credit quality of issuing entities or even individual bond issues.

Moreover, credit rating agencies continuously update information on the business performance and financial health of companies and provide independent and objective opinions on changes in credit ratings and outlooks. This gives the market a channel to monitor the situation of issuing organizations.

Another important contribution of credit rating agencies is to make the corporate bond market more accessible to both issuers and investors. Credit ratings provide a scoring system to determine a fair price for bonds based on their risk level.

Currently, there is no universal measure for bonds, leading to time and resource consumption for buyers and sellers to agree on a price, which sometimes disadvantages the weaker party in negotiations. This issue can be resolved when credit rating results become prevalent, providing a “common language” among participants in the corporate bond market.

For issuers, credit ratings help convey their credit story to the market without disclosing confidential business information. Additionally, the ratings serve as a relative comparison of debt repayment capability among companies operating in Vietnam, helping issuers position themselves in the eyes of lenders and determine reasonable borrowing costs. This will encourage more companies to proactively seek bond issuance opportunities instead of solely relying on negotiations with a few banks or creditors.

Credit rating agencies not only provide rating results but also actively engage in market research, offering assessment reports on credit outlooks and the impact of new macroeconomic developments on the creditworthiness of industries and businesses.

EXPECTATIONS FOR THE EVOLUTION OF CREDIT RATING ACTIVITIES

Despite the significant role of credit rating activities in the corporate bond market, most bond issuers in Vietnam only seek ratings when required by regulations and do not consider it a necessary voluntary practice. This could be due to concerns about the cost, time consumption, or confidentiality of the process.

Additionally, Vietnam’s regulations focus on credit ratings for issuing entities rather than specific types of bonds. These are practices that more developed markets have already gone through.

Alongside improving market awareness and fostering a culture of voluntary credit ratings, some neighboring countries have accelerated this process by mandating credit ratings during an initial development phase, such as Indonesia, Malaysia, and Thailand. Currently, the proportion of rated bonds in these markets is much higher than in Vietnam, even though some, like Malaysia, have relaxed their mandatory rating requirements.

In the latter part of 2024, regulatory authorities are expediting the completion of the legal framework, with the amended Securities Law serving as the foundation. The writer anticipates that the legal amendments will pay closer attention to the role of credit rating activities to foster a more sustainable corporate bond market in this new cycle.

Unveiling the Flaws in the New Proposal for Corporate Bond Investments

The proposed criteria of a minimum of 10 transactions per quarter with professional investors in the last four quarters could potentially deter investors from participating in the bond market. This may further complicate capital raising for enterprises, as the market liquidity is already low following the collapses in 2022.

Enterprise Private Bonds: A Playing Field for Professionals Only, Inadvisable for Retail Investors

The proposed amendments to the current Securities Law aim to foster a stable development phase, paving the way for a more transparent market recovery and preventing past risks from reoccurring. This is according to experts in the field, who emphasize the importance of creating a robust foundation for the market’s rebound.