For years, the outdated state of Vietnam’s personal income tax has been a topic of discussion. Many believe that the tax brackets are long overdue for an update to match the current economic landscape. In addition to revising the tax brackets, there are calls to increase the dependent deduction. The current monthly deduction of 4.4 million VND per dependent is relatively low compared to the actual cost of living.

Nguyen Quynh Van, a resident of Hoang Mai district in Hanoi, shared that her family, consisting of her, her husband, and their two children, has a monthly income of 30 million VND. After covering all their living expenses in the capital city, they are left with only 6 to 8 million VND for other expenditures.

“My children are both in school. The younger one couldn’t get into a public kindergarten, so we had to send him to a private school. The older one is in secondary school and needs additional English and tutoring classes, which cost about 6 million VND per month, excluding other expenses,” she said. “The 4.4 million VND deduction per dependent is simply not enough to cover the cost of living in Hanoi.”

Another resident of Hanoi, Pham Ngoc Linh from Dong Da district, shared that her combined household income with her husband is 25 million VND per month. After accounting for the tax deductions for both of them, which total 22 million VND per month, they are left with a personal income tax bill of 3 million VND per month.

“I have numerous daily expenses, from groceries to fuel, utilities, and more, all of which are increasing in price, while my personal income tax remains the same,” she said. “It’s a challenging equation for those with incomes close to the tax threshold. With our current income, I don’t know when we’ll be able to save enough to buy a house, especially with the monthly personal income tax payment.”

Many citizens have expressed their opinion that the current dependent deduction is outdated and far removed from reality. This fixed amount has remained unchanged for the past four years, despite the country’s economic and social development and the rising consumption needs of the population. The majority of people have voiced their desire for an increase in the dependent deduction to better align with today’s living standards.

In an interview with the press, Dr. Nguyen Duc Do, Deputy Director of the Institute of Finance and Economics (Academy of Finance), agreed that it is time to raise the dependent deduction.

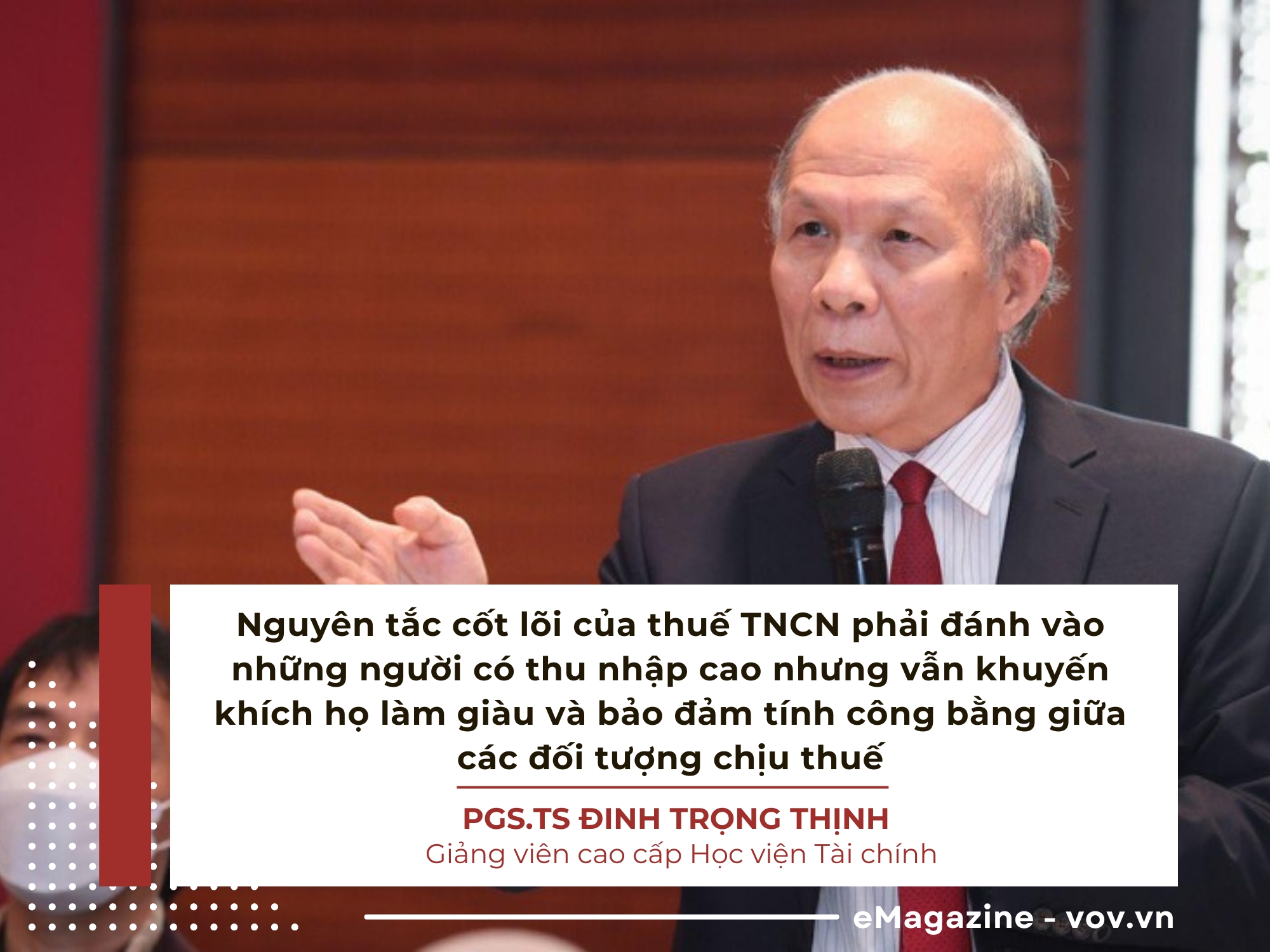

According to Dr. Do, while the economic situation has evolved, the personal income tax policy has remained unchanged for almost a decade, leading to its obsolescence. However, any adjustments to the dependent deduction must be carefully studied and evaluated for their potential impact on the people and the economy.

“The reality is that the standard of living for the people has increased, and the number of people paying personal income tax is growing,” Dr. Do said. “Therefore, policies must adapt to reality; maintaining a policy for almost ten years is inappropriate. To ensure the people’s standard of living, taxable income levels and dependent deductions need to increase.”

Dr. Do pointed out that inflation has been relatively low in the past seven to eight years, averaging around 3% annually. Over the last decade, the average increase in the price of goods has been approximately 1.5 times. Personal income tax revenue has also increased significantly due to the fixed tax rates while GDP, inflation, and the number of taxpayers have all risen.

He believes that the 11 million VND monthly income tax threshold was set when the average income of workers was around 8 million VND. After almost ten years, the average income has increased to 13 million VND per month, and the income tax calculation should be adjusted accordingly.

Sharing a similar view, Associate Professor Dr. Dinh Trong Thinh, a senior lecturer at the Academy of Finance, also emphasized the inadequacy of the current dependent deduction compared to the average spending of families in Hanoi, Ho Chi Minh City, and other major cities in Vietnam. The outdated deduction has burdened taxpayers.

Highlighting the core principle of personal income tax, which is to tax high-income earners while encouraging wealth creation and ensuring fairness among taxpayers, Dr. Thinh noted that Vietnam’s personal income tax rate is currently high compared to the global trend. He cited Singapore, which has reduced its personal income tax rate to 20%, and Indonesia, which has a rate of 25%, while Vietnam’s rate stands at 35%.

“Those who earn hundreds of millions of dong per month are often highly skilled individuals who create jobs and contribute to society beyond their tax payments,” Dr. Thinh said. “Additionally, in Vietnam, personal income tax is mainly borne by salaried employees. Therefore, increasing the dependent deduction is necessary to keep up with the rising cost of living and inflation.” He also recommended amending the Personal Income Tax Law to include adjustments to the dependent deduction.

“In the past, when it came to adjusting the dependent deduction, we only considered one criterion: inflation. When the CPI exceeded 20%, the competent authorities would propose to the National Assembly’s Standing Committee to adjust the tax. This approach only considers the erosion of inflation on income without taking into account the need to improve the quality of life. This is not a sustainable solution,” said Associate Professor Dr. Dinh Trong Thinh.

Dr. Thinh also pointed out that it is unreasonable to add up the inflation rates of this year and next year to gradually accumulate a 20% change. This is because the inflation rate for this year is based on this year’s price level, and next year’s inflation rate will be based on next year’s price level. Therefore, adding up the inflation rates is like comparing apples to oranges—it’s not scientific.

“When determining the dependent deduction, we must consider factors such as per capita income, average spending, social welfare issues, and other relevant aspects. In reality, many countries allow deductions for actual expenses incurred by individuals. For example, if someone suddenly falls ill or has to care for a sick family member, their medical expenses should be deductible. The same goes for education expenses, self-improvement, and even investments in business ventures,” Associate Professor Dr. Dinh Trong Thinh explained.

Therefore, Associate Professor Dr. Dinh Trong Thinh suggested that it is necessary to promptly study and adjust the dependent deduction and that there is no need to wait for the CPI to fluctuate above 20% before making changes. Instead, a review and adjustment could be conducted every two years.

In a recent document sent to the National Assembly’s Committee for Civil Affairs, voters from six provinces (Binh Dinh, Ha Giang, Thai Nguyen, Tra Vinh, Tuyen Quang, and Tay Ninh) requested adjustments to the dependent deduction for taxpayers and dependents and a revision of the progressive tax rate to ensure alignment with reality.

In response to this proposal, the Ministry of Finance stated that the dependent deduction for taxpayers and their dependents is a specific amount based on the general social context, regardless of whether the taxpayer has a high or low income or varying consumption needs.

“The specific amount of the dependent deduction needs to be carefully studied and calculated, ensuring that it is higher than the country’s per capita GDP, the regional minimum wage, and the average per capita consumption level over a certain period,” the Ministry of Finance said.

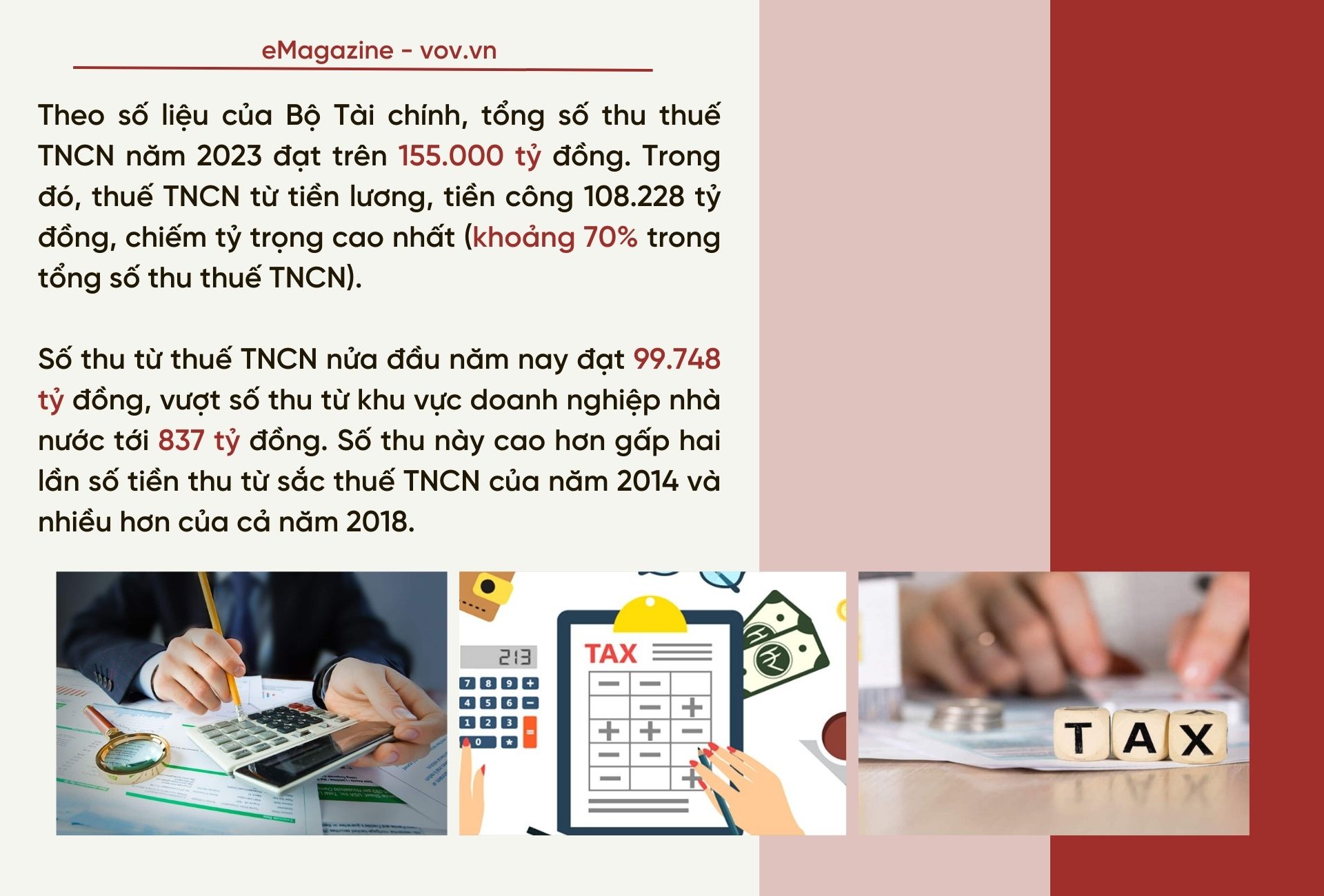

Citing a 2023 survey on living standards conducted by the General Statistics Office, the Ministry of Finance noted that Vietnam’s average monthly per capita income was 4.96 million VND. The highest-income group, comprising the richest 20% of the population, had an average monthly income of 10.86 million VND per person.

The current dependent deduction of 11 million VND per month is more than 2.2 times the average per capita income (significantly higher than the range of 0.5-1 times commonly applied by other countries). The dependent deduction of 4.4 million VND per person per month is also close to the country’s current average per capita income.

Regarding the fluctuation of the consumer price index, the Ministry of Finance argued that, according to data from the General Statistics Office, the consumer price index increased by 3.23% in 2020, 1.84% in 2021, 3.15% in 2022, and 3.25% in 2023. Therefore, since the last adjustment of the dependent deduction in 2020, the consumer price index has increased by only 11.47%, which does not meet the requirement for adjusting the dependent deduction.

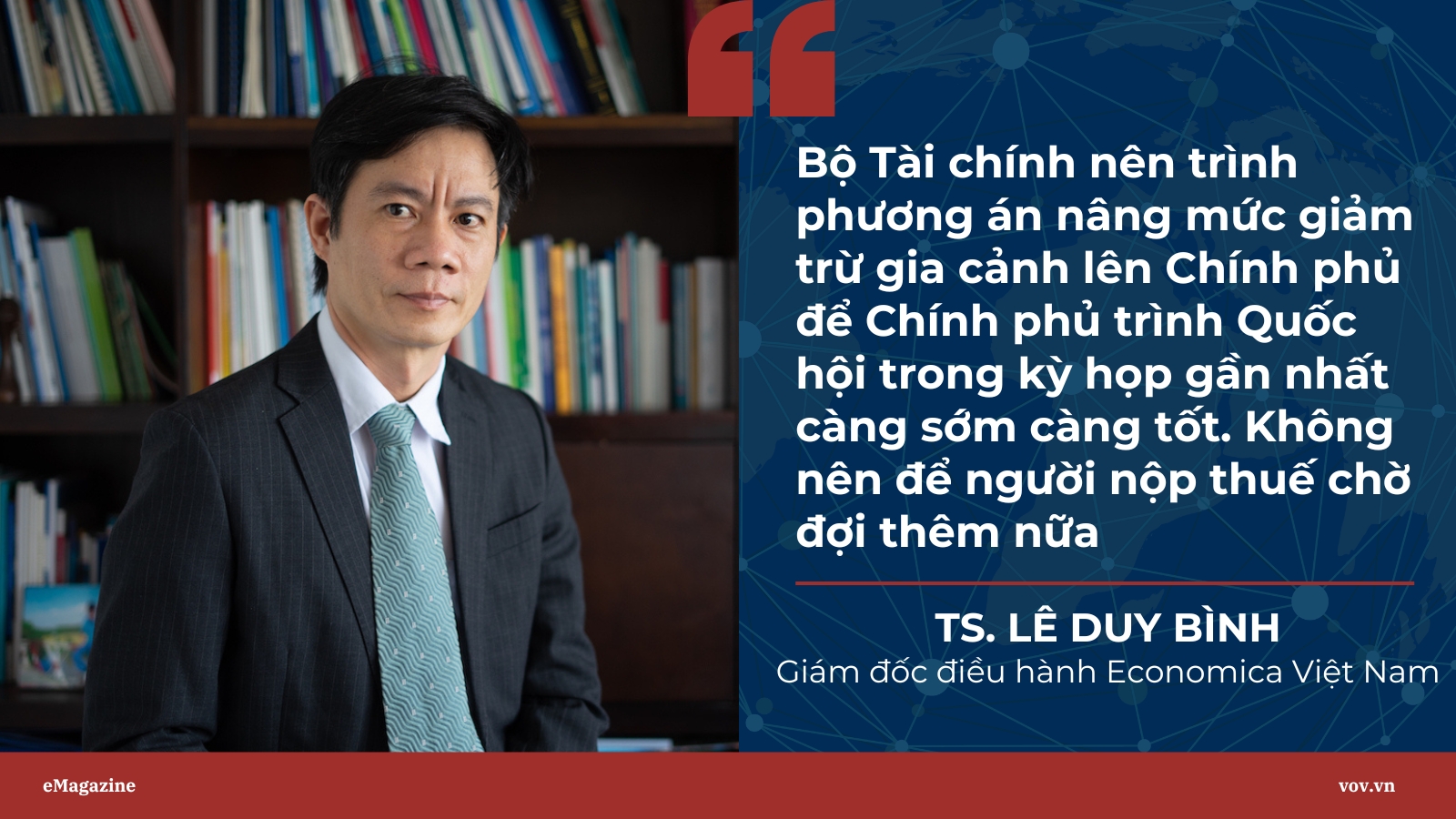

Dr. Le Duy Binh, Executive Director of Economica Vietnam and an economic expert, believes that since the last adjustment of the dependent deduction in 2020, the cost of living for many essential goods has increased significantly, with some items even doubling or tripling in price, far outpacing the average annual inflation rate. This directly impacts the basic needs of the people.

Dr. Binh also noted that relying solely on a 20% inflation threshold is insufficient; the evolution of consumption patterns among the population should also be considered. Many tax policies are outdated and inadequate but are slow to be reviewed and adjusted. For example, the current Personal Income Tax Law, with its provisions on taxable income thresholds, progressive tax brackets, and dependent deductions, has not kept pace with changes in minimum wages, prices, and inflation. Some aspects are decades old, and these gaps are significant.

Dr. Le Duy Binh believes that if the approval process takes another two years, the Personal Income Tax Law will leave many taxpayers struggling to make ends meet while still being subject to personal income tax.

In the long run, Dr. Le Duy Binh proposed that the dependent deduction should be based on the annual consumer price index (CPI) and adjusted annually, rather than waiting for the CPI to fluctuate above 20% as per the current regulation. Additionally, when raising the dependent deduction, it is essential to consider regional differences.

“We cannot apply the same dependent deduction for civil servants and employees in Hanoi, Ho Chi Minh City, or other major cities as we do for residents of smaller provinces with significantly lower living costs,” he said.

Furthermore, Dr. Binh emphasized that there are many necessary expenses incurred by taxpayers that the Ministry of Finance should include as deductible items. For example, expenses for medical treatment, education, home construction, and repairs should be considered.

“All citizens incur expenses for education, healthcare, and the treatment of critical illnesses, as well as education expenses for their children when the public school system cannot accommodate them,” Dr. Le Duy Binh said. “These are significant costs that should be included in the dependent deduction calculation.”

Paying taxes is a civic duty, but reasonable tax policies should also “ease the burden on the people.” Only then can tax revenues be sustainable, ensuring social welfare and motivating people to work hard, rather than driving them to evade taxes or fall into poverty because of them.

“Post-Flood: Curbing Price Hikes, Combating Inflation”

Inflation has eased and market prices have stabilized. However, according to experts, the unpredictable nature of floods and their potential impact need to be considered in the coming months. If the production and business activities in the areas affected by the third storm can be quickly restored, and supply-demand connections are re-established, leading to stable prices, inflation can be kept under control and this year’s GDP growth target can be achieved, or even exceeded.

The Power of Words: Unlocking the Art of Persuasion

“PNJ Unveils its Premier Status in Retail’s Contribution to the National Coffers”

PNJ has solidified its leadership in the retail industry, not only through impressive business figures but also by spearheading the journey towards sustainable development. The company has made a significant impact, contributing 4,500 billion VND to the state budget in the last three years, clearly demonstrating its commitment to the nation’s progress and solidifying its position as a powerhouse in the jewelry industry.

Proposed Resolution to Address Nearly 9,000 Backlogged Cases in Ho Chi Minh City Awaiting Land Pricing Tables

The HoREA has requested that the tax authorities immediately process 2,737 dossiers which do not entail any financial obligations to the state. All of these dossiers are legally compliant and should, therefore, be expedited without delay.