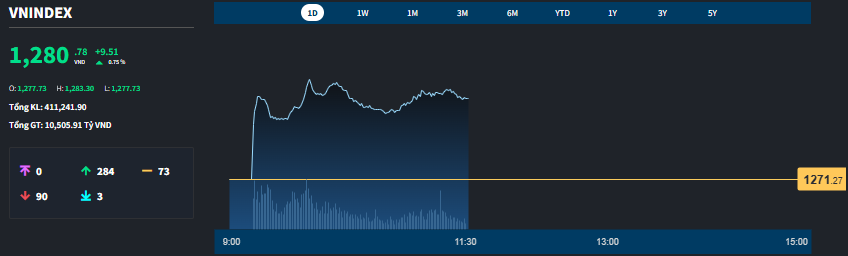

A surge of capital inflow into blue-chip stocks this morning has boosted the liquidity of the VN30 group by 2.3 times compared to yesterday morning, reaching a six-month record of nearly VND 6,615 billion. Out of the 25 highly liquid stocks on the HoSE, 16 belong to this blue-chip basket. The VN30-Index is currently outperforming the market with a 1.26% gain and is poised to surpass its 27-month peak.

In fact, if we consider the closing prices, today’s intraday high of 1,334.97 for the VN30-Index has already surpassed the previous peak in June 2024. However, if we look at the intraday fluctuations, the peak of 1,339.17 on June 13 still stands as the highest point, albeit by a small margin. The blue-chip group is witnessing exceptional price appreciation and is leading the charge for the VN-Index.

Foreign capital did not play a significant role in the VN30 group’s liquidity, with net buying this morning accounting for only 7.73% while selling made up 5.48%. This indicates a strong presence of domestic investors, which is a positive sign. Small retail investors typically have minimal involvement in these highly liquid, large-cap blue-chip stocks. The influx of capital into this group often signifies the participation of large institutional investors.

The strength of the blue-chips has, of course, benefited the VN-Index. The top 10 stocks contributing the most to the index’s gain are all from the VN30 basket, led by HPG with a 2.77% increase, followed by ACB at 3.63%, MBB at 2.05%, TCB at 1.51%, CTG at 1.25%, and VPB at 1.6%. The prominent role of the banking sector is evident here. Out of the basket, 27 stocks recorded gains while only one declined, with 12 stocks rising by more than 1%. The sole loser was BCM, which fell by 0.42%.

The significant increase in liquidity for the blue-chip group has also lifted the overall trading value on the HoSE by 84% compared to yesterday morning, reaching VND 10,545 billion. This is the first morning session to surpass the VND 10,000 billion mark in trading value in the past five weeks. Moreover, the VN30 basket’s trading value accounted for 62.7% of the total trading value on the exchange, an exceptionally high proportion considering that, so far this year, there have only been three trading sessions where this basket’s trading value exceeded 60%.

The VN-Index closed the morning session up 0.75% (+9.51 points), with 284 gainers and 90 losers, underperforming the VN30-Index due to differences in capitalization weights. VCB, BID, and FPT, the three largest stocks by market capitalization on the VN-Index, posted modest gains, while GAS remained unchanged. Nonetheless, the breadth of the market showed positive trading sentiment, with 79 stocks out of the 284 gainers rising by more than 1%. While the blue-chips from the VN30 basket dominated this group, notable performances were also seen from DGC, HSG, VND, CSV, PVD, and DCM, all of which recorded impressive liquidity with trading values exceeding VND 100 billion.

In contrast to the VN30 group, the mid-cap and small-cap stocks underperformed. The Midcap index rose a modest 0.61%, while the Smallcap index inched up by just 0.4%. Historically, the Midcap group has had a strong tradition of liquidity in speculative stocks, but today, they only accounted for 28.5% of the trading value on the HoSE. Nonetheless, there was an overall improvement in liquidity for these two groups. Specifically, out of the approximate VND 4,816 billion increase in the HoSE’s trading value, the VN30 group contributed VND 3,789 billion, indicating that the remaining groups also experienced a liquidity boost of over VND 1,000 billion.

The losers on the VN-Index were negligible, and most of them lacked significant trading volume. A few stocks that stood out with more noticeable declines were AGM, falling 3.52% with a trading value of VND 5.9 billion; TCD, dropping 3.3% with a trading value of VND 20.7 billion; FIR, declining 2.02% with a trading value of VND 3.1 billion; and SHI, slipping 1.68% with a trading value of VND 6.1 billion. The total trading value of these 90 losing stocks accounted for only 7.2% of the exchange’s overall trading value.

The strong price gains and exceptional liquidity witnessed this morning indicate the presence of substantial capital inflows. The market has overcome critical information events and left adverse factors behind. The probability of the market plunging back to the lows witnessed earlier this week is extremely low. As a result, capital is becoming more decisive and confident.