The dip in the VNI today was mainly due to the impact of restructuring trades rather than a sell-off. Therefore, it is not advisable to focus on the index or stocks affected by these trades. More importantly, a large amount of money has entered the market.

If we exclude the ATC trades from the overall picture, the market did see some short-term profit-taking. Foreign investors did not participate significantly until the last session, and the afternoon trading liquidity (excluding ATC) was considerably lower than the morning session, with stock gains narrowing gradually. Given the high T+ profits, it is normal for speculators to take profits.

The low liquidity during the price dip continued to be very low, indicating that this was only due to typical short-term selling volume. The decline in prices was due to a slowdown in money flow and waiting for the ATC rather than a lack of funds. Stocks outside the restructured group became polarized but basically maintained their green color, with most decliners having only a small margin. After today’s session, the market will return to normal, and supply and demand will be more realistic and observable.

What’s important is that liquidity for this session rose to a high of around 21,300 billion matched orders on the two exchanges. Those who wanted to take profits today were very favorable, and buyers could also get better prices as selling increased towards the end. Overall, this was an open trading session, and both sides placed orders comfortably.

Even without the restructuring trades, the market would have seen a profit-taking session as prices had risen quickly to T+4,5. In the upward trend, there are always short-term selling periods, but what matters is how the money flows in. The market has now stabilized, with more supportive factors, so money will sooner or later be convinced. Today was just the first signal. Once the money is in, it will move within the market and replace the expectations of short-term investors. Sellers cannot withdraw their money and then sit idly by; they will look for new opportunities. The key is that the money flow has been activated.

The view remains that the market is improving and optimism is growing. Short-term fluctuations due to speculative buying and selling effects are not important; agile traders can trade a portion, and if not, they can hold. Intraday adjustments with narrow margins and low liquidity are a strong signal, and even strong stocks may only fluctuate on the uptrend rather than falling into multiple sessions.

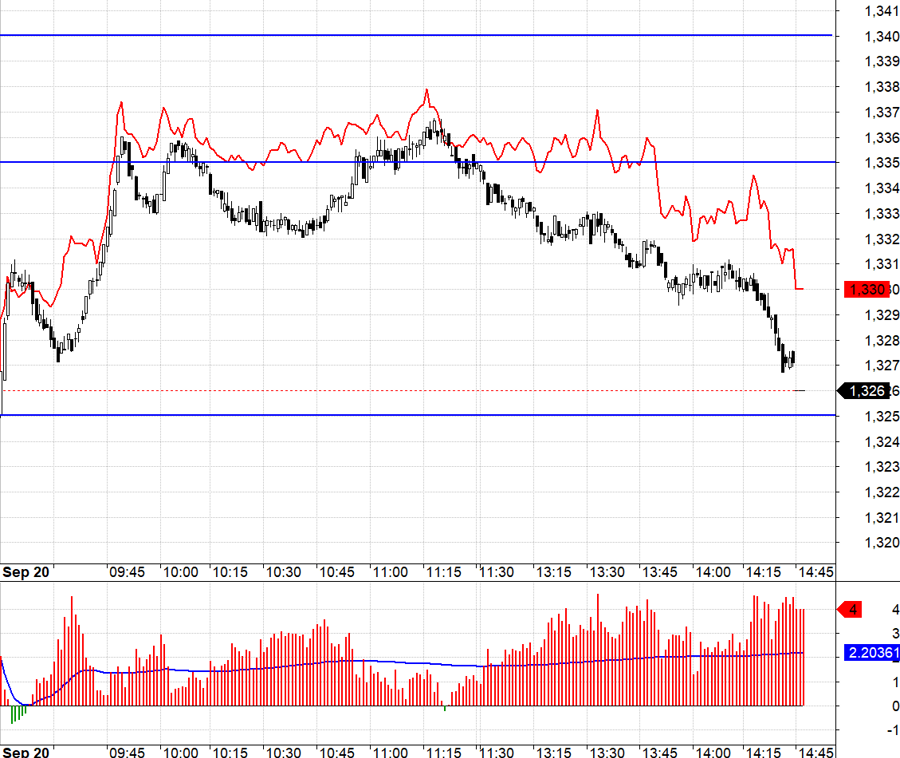

The derivatives market slowed down today, waiting for VN30, but the positive sentiment was evident in the basis remaining positive during the index’s downward slide. VN30 formed two peaks around 1335.xx and slid down, setting up a Short was standard, but the basis expanded. Even though the index eventually slid down to near 1325.xx, a fairly wide range, F1 only decreased partially, limiting profits. Nevertheless, in an uptrend, Shorts are always affected by the ability to maintain such a basis.

Today’s dip was not due to a clear supply and demand dominance, and the market is likely to stabilize in the next session. Increased or sustained above-average liquidity is expected. The strategy remains to look for Long derivative opportunities.

VN30 closed today at 1326. The nearest resistance for the next session is 1335; 1340; 1349; 1355; 1360. Supports are 1318; 1310; 1305; 1300.

“Stock Market Blog” is a personal blog and does not represent the views of VnEconomy. The opinions and analyses are those of the individual investor, and VnEconomy respects the author’s views and writing style. VnEconomy and the author are not responsible for any issues arising from the investment opinions and analyses posted.