Maximizing profits is the primary goal for many investors. However, high profits do not necessarily equate to a strong investment portfolio if risks are not carefully managed. Striking a balance between profits and risks is crucial to ensuring the stability and longevity of an investment portfolio.

The Sharpe Ratio is a risk-adjusted performance measure. Although it was not a well-known indicator in the past, it has gained prominence recently due to its proven effectiveness in investing.

The Sharpe Ratio is an essential metric that helps investors evaluate the performance of an investment portfolio relative to the risk it undertakes. It encourages investors to consider not only the profits but also the level of risk associated with those profits. The Sharpe Ratio provides insight into whether an investor’s portfolio is generating returns commensurate with the risk undertaken. This ratio is calculated by subtracting the risk-free interest rate from the expected return of the portfolio and then dividing it by the standard deviation of the returns (representing volatility and risk).

The primary application of the Sharpe Ratio is to compare the performance of different investments or a portfolio to the overall market. A positive Sharpe Ratio (>0) is considered favorable, especially if it is higher and greater than 1. A negative ratio may indicate that the level of risk has diminished the investment’s efficiency.

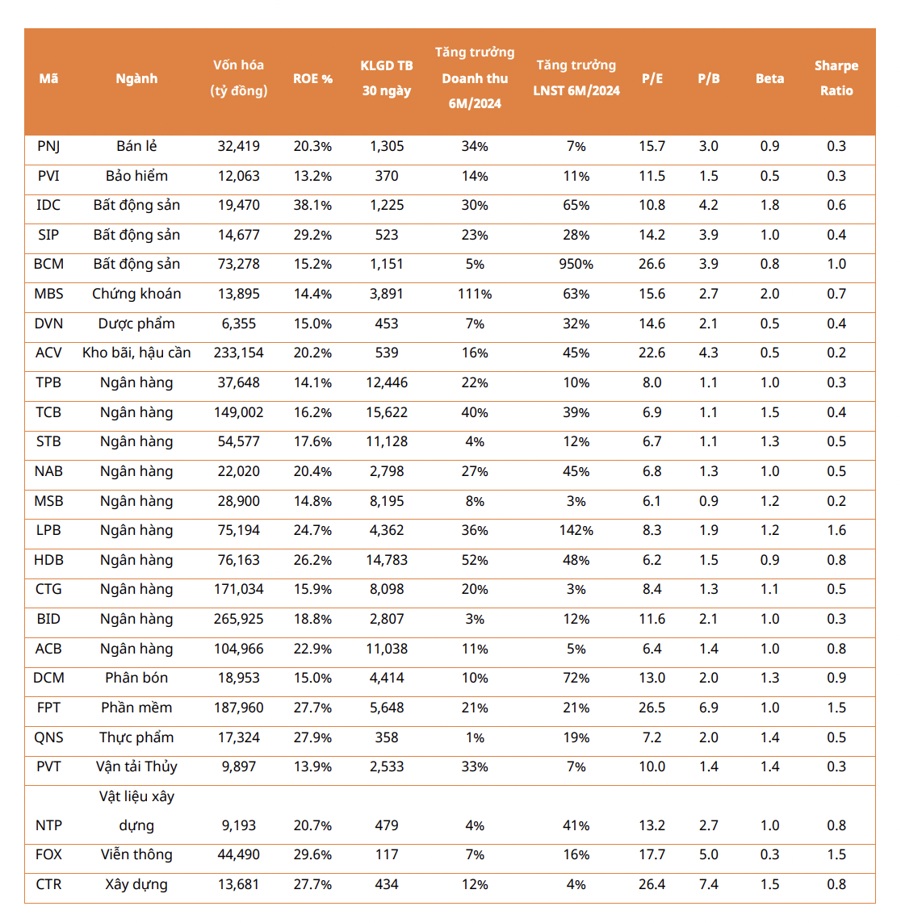

Mirae Asset Securities has recently screened a range of stocks using the Sharpe Ratio. The initial portfolio of stocks was constructed based on the financial performance of these companies in the first half of 2024, focusing on those with solid financial foundations and sustainable growth potential.

Stocks in the portfolio were selected based on the following criteria: companies with a market capitalization of over VND 5,000 billion, and an average trading volume of more than 100,000 shares to ensure liquidity.

The selected stocks demonstrated a higher Return on Equity (ROE) compared to the VN-Index, indicating superior profitability and efficient business operations.

The companies’ revenue and profits for the first half of 2024 showed positive growth, ensuring financial stability and health. Risk management was also a key consideration, with the portfolio’s Sharpe Ratio being positive, reflecting a favorable risk-return profile.

The screening results revealed that the banking, real estate, retail, and telecommunications sectors hold significant long-term growth potential. The banking sector constituted a large portion of the portfolio due to its stable profit-generating ability, high ROE, and the anticipated credit growth story for the second half of the year, aligned with the initial 15% target set by the State Bank of Vietnam. Additionally, the narrative around the Fed’s interest rate cuts and market upgrades is expected to be the primary growth driver for the overall market in the medium to long term.

Notable banking stocks include TCB, TPB, HDB, BID, ACB, and CTG. In the real estate sector, BCM, SIP, and ICD stood out, while MBS represented the securities group.

Prior to this, the VN-Index showed a positive reaction in August, rebounding from a significant decline in July. This recovery was influenced by several positive factors: indications of interest rate cuts from the Fed, easing pressure on exchange rates, improved second-quarter financial results, and a decrease in net selling by foreign investors.

In August alone, the VN-Index rose 4.6% to 1,283 points, representing a 13.4% increase since the beginning of the year. The average trading volume for the month was 654 million shares, a slight increase of 2% from July. Meanwhile, the average trading value for August exceeded VND 16,600 billion, a minor decrease of over 2% from the previous month. Foreign investors recorded net selling of over VND 3.6 billion in August, but the selling pressure had significantly eased, reaching the lowest level since March 2024.

During August, the group of stocks that positively influenced the market underwent significant changes, with the Finance, Retail, and Chemicals sectors leading the way with growth rates ranging from 8.8% to 10.2%.

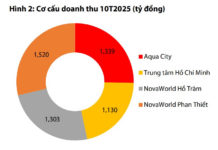

The Largest Container Ship Company in Vietnam Increases Profit Plans by 50% to 4.5 Trillion VND

In the first half of the year, this company achieved 58% of its annual revenue target and 38% of its profit goal.