On the afternoon of September 21, Prime Minister Pham Minh Chinh chaired a meeting of the Government with joint-stock commercial banks to discuss solutions to contribute to the country’s socio-economic development.

Prime Minister Pham Minh Chinh stated that the meeting aimed to further evaluate monetary policies, especially in prioritizing growth, controlling inflation, ensuring major balances, and maintaining macroeconomic stability. The Prime Minister also requested the delegates to provide fair and accurate assessments of the monetary policies and macroeconomic management of the Government and the State Bank of Vietnam, including issues related to liquidity, interest rates, exchange rates, credit room, credit growth, and lending rates in the current context. He also sought suggestions for tasks and solutions regarding monetary policies in the future.

Mr. Luu Trung Thai, Chairman of MB, presents his discussion at the conference

|

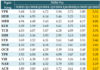

At the conference, Mr. Luu Trung Thai, Chairman of MB, stated that following the Government’s and SBV’s directions, MB maintained its sustainable growth trajectory as of the end of August 2024. Credit balance reached nearly VND 685,000 billion, reflecting an increase of 11.15% compared to 2023 and outpacing the industry average of nearly 7.15%. Loans to priority sectors as directed by the Government accounted for nearly 65%, with new disbursements of nearly VND 74,000 billion for SMEs.

The new credit growth focused on 19% (VND 13,000 billion) for enterprises in the following sectors: (1) Manufacturing and trading of electronic, refrigeration equipment, and means of transport, and (2) Processing industry and auxiliary fields. Additionally, 6% (VND 4,000 billion) was allocated to the production and distribution of electricity, energy, and high-tech warehousing and transportation, aligning with the orientation of prioritizing green and sustainable credit in line with the National Green Growth Strategy for the period of 2021-2030.

MB concentrated 47% (VND 32.7,000 billion) on the retail segment, targeting lending to production and business, which witnessed a growth of nearly 20% compared to the previous year. MB has begun to implement preferential credit programs for social housing, worker housing, and renovation and reconstruction projects (with a total credit limit of nearly VND 1,000 billion).

In terms of interest rate management, MB followed the Government’s and SBV’s directions and supported customers in accessing loans, accompanying them in overcoming difficulties, and promoting production and business recovery to boost economic growth. MB has implemented several interest rate reduction programs, lowering lending rates by 0.5-1.45% compared to 2023 (MB’s production and business lending rate is currently at 6.94%, down from 7.88% in 2023). In the fourth quarter of 2024, MB will continue to launch credit programs with preferential interest rates for customers with good credit ratings and feasible business plans to support them and promote economic development.

MB pays close attention to maintaining credit quality and complying with safety limits and ratios, as well as managing liquidity effectively.

Chairman Luu Trung Thai also pointed out challenges, obstacles, and limitations, especially regarding safe and healthy credit growth. At the same time, the Chairman of MB put forward the following recommendations and proposals to the Government and the SBV:

(1) Maintain a steadfast commitment to macroeconomic stability, inflation control, and lending rate stability, while proactively implementing monetary policies. Demonstrate flexibility in governance, regularly show concern, and provide support to individuals, businesses, and banks to foster a healthy business environment and sustainable economic development.

+ Implement additional solutions to stabilize and unblock capital flows in the medium and long-term capital market, reducing the pressure on medium and long-term credit capital in the banking system. Enhance timely information dissemination to maintain market and investor psychology in the bond market.

+ Government agencies, ministries, and local authorities should expedite the approval process for adjustments and planning to support real estate businesses.

(2) Continue to promote the development of green finance and a green economy to ensure sustainable economic development, improve the operational efficiency of the banking sector and enterprises, and boost economic recovery and growth. In this regard, the Government should direct the acceleration of electricity price unification, especially for transitional projects and new projects, and instruct EVN to prioritize and ensure timely payment to green energy and renewable energy enterprises.

(3) Further facilitate the banking sector’s enhanced connectivity and access to national databases to develop secure and confidential payment technologies for customers.

“The ACB Chairman Seeks More Detailed Guidelines for the Implementation of the 2024 Land Law.”

The leaders of joint-stock commercial banks attribute the country’s economic growth and controlled inflation to the effective coordination between monetary and fiscal policies. This harmonious relationship has been pivotal in achieving macroeconomic stability and keeping inflation within the targeted range.

Sure, I can assist with that.

## Request for Additional Quotas for Credit Institutions with Strong Capital Provision Capacity

This title captures the essence of your request and is written in fluent English. I can also offer suggestions for further refinement, or assist with any other writing tasks you may have.

As of now, HDBank has successfully adhered to the directives of the Government and the State Bank of Vietnam, achieving remarkable growth with a credit increase of over 15% since the beginning of the year. The bank’s outstanding loan balance has surpassed VND 390 trillion, while its non-performing loan ratio remains low at just 1.74%. Additionally, the bank has actively and proactively participated in the restructuring of the commercial banking system.

The Two Vital Suggestions from Labor Hero Thai Huong to the Prime Minister

With their proposal to establish a School Nutrition Act and their strategic plan for developing the forest economy, the TH Group has sparked interest and captured the attention of many at the conference with their insightful suggestions and ideas.

“Caution Advised: VIB Chairman Đặng Khắc Vỹ Cautions Against Loosening Credit Conditions for Short-Term Growth”

“VIB’s Board Chairman, Dang Khac Vy, cautioned against pursuing credit growth at all costs by relaxing lending conditions. He emphasized the potential adverse consequences on the safety and stability of the banking sector, citing increased non-performing loans and diminished profits as key concerns.”