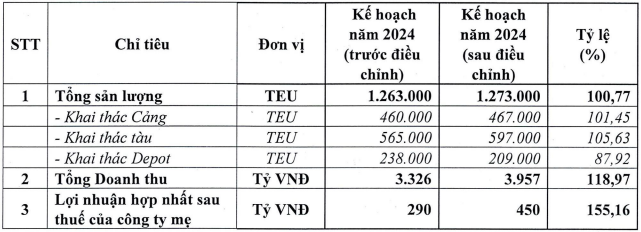

Specifically, HAH has adjusted its 2024 business plan with a 19% increase in total revenue compared to the initial plan, reaching VND 3,957 billion. The net profit target has been adjusted with a significant increase of 55%, to VND 450 billion, up from the VND 290 billion approved by shareholders.

In terms of volume, HAH slightly increased its plan from 1.26 million TEU to 1.27 million TEU, including a more than 1% increase in port operations and nearly a 6% rise in vessel operations, while depot operations decreased by 12%.

The new plan does not mention dividend payments; therefore, the approved cash dividend of 10% and stock dividend of 10% at the 2024 Annual General Meeting of Shareholders will remain unchanged.

|

HAH raises its 2024 business plan

Source: HAH

|

The Board of Directors also approved the policy to invest in the purchase of used container ships of the Panamax type (3,500 – 5,000 TEU) to prepare for the expansion of production and business activities. At the same time, the Board of Directors authorized the Chairman of the Board of Directors and the General Director of the Company to organize research, seek partners, negotiate contracts for the purchase and sale of ships, and perform related tasks.

In the initial plan approved by the 2024 Annual General Meeting of Shareholders in April 2024, HAH also announced its fleet development plan, which includes continuing to look for suitable used ships when opportunities arise to meet the needs of the fleet. In addition, the company will continue to implement the project to invest in and receive two newly built 1,800 TEU vessels (Bangkok Mark IV) in 2024.

Regarding ports and logistics, HAH continues to implement the project to invest in ports and depots in the Cai Mep area, with an estimated value of VND 300 billion, and continues to seek opportunities to invest in infrastructure for logistics services in other areas such as the Central region and the Mekong Delta.

In fact, since the Annual General Meeting of Shareholders, HAH has received two 1,800 TEU vessels (Bangkok Mark IV), Anbien Sky in May 2024, and Haian Opus in July 2024. Previously, HAH also received two similar vessels, Haian Alfa in December 2023 and Haian Beta in March 2024. Of these, HAH operates two vessels and leases out the other two.

The four new vessels have a total investment of nearly VND 3,000 billion, helping HAH increase its total cargo capacity by nearly 44%, corresponding to an increase of more than 7,000 TEU from 16,000 TEU at the end of 2022.

Four 1,800 TEU vessels received by HAH since the end of 2023

|

| HAH’s business results for the first half of 2024 |

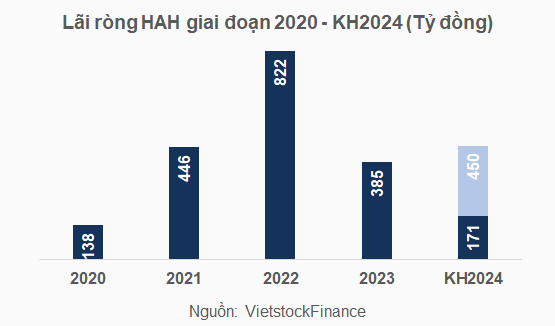

The newly built vessels quickly contributed to HAH’s volume in the first half of 2024, driving a 31% increase in net revenue compared to the previous year, to nearly VND 1,653 billion. However, the average freight rate decreased compared to the same period, and the cost of the fleet also increased due to the addition of two vessels, Haian Alfa and Haian Beta, during the period, resulting in a 21% decline in net income to over VND 171 billion.

With the net income achieved in the first six months of this year, HAH has only achieved 38% of the adjusted net income plan (VND 450 billion) instead of the 69% execution rate of the initial plan (VND 290 billion).