The Special Consumption Tax Law has undergone four revisions, positively impacting various economic and social aspects. However, according to the Ministry of Finance, the current special consumption tax policy still has some limitations.

Facing this situation, in implementing the National Assembly’s law and ordinance-building program, the Ministry of Finance has developed and collected opinions to perfect the draft amended Law on Special Consumption Tax. Accordingly, on September 23, the National Assembly’s Standing Committee will provide comments on the draft amended Law on Special Consumption Tax at its 37th meeting. Following that, the Government will incorporate the Standing Committee’s comments, finalize the draft Law, and submit it to the upcoming National Assembly session.

Notably, according to the draft Law on Special Consumption Tax, the special consumption tax rate for alcohol and beer will start applying a continuously increasing tax rate from 2026, reaching up to 100% by 2030.

At the workshop on contributing opinions to the draft Law on Special Consumption Tax (amended) held by the Foreign Investment Enterprise Association (implemented by the Investor Magazine) in collaboration with the People’s Representative Newspaper on September 20, experts and enterprise representatives made recommendations to ensure a balance between the interests of the Government and businesses.

ALCOHOLIC BEVERAGES FACE A SURGE IN SPECIAL CONSUMPTION TAX

At the workshop, Ms. Phan Minh Thuỷ, representing the VCCI Legal Department, stated that enterprises agree with the Party and State’s viewpoint on using the special consumption tax policy to protect people’s health and limit the consumption of harmful products such as alcohol, beer, and cigarettes. However, the current draft proposes a significant tax increase and a rapid tax hike for these items.

“This rapid and substantial tax increase will prevent enterprises from adjusting their production capacity to match the decline in consumption due to tax policies. This will lead to many investment projects incurring losses and being unable to recoup their capital,” Ms. Thuỷ emphasized. “Additionally, the rapid decline in output will negatively impact the employment of workers, making it challenging to transition to new occupations for the redundant labor force from alcohol and cigarette factories.”

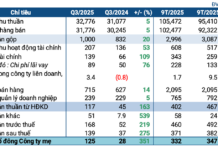

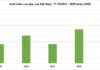

Dr. Can Van Luc, BIDV’s Chief Economist, shared that alcoholic beverage businesses have faced difficulties in the past two years, with most experiencing a 20-30% drop in revenue. “Imposing a special consumption tax will create more challenges for enterprises in this industry,” he affirmed.

Agreeing with this opinion, Prof. Dr. Nguyen Mai, Chairman of the Foreign Investment Enterprise Association, stated that the alcohol industry is facing significant difficulties due to the pandemic and the impact of Decree 100/2019/ND-CP on administrative sanctions in the field of traffic. Alcohol production and consumption have significantly declined compared to the pre-pandemic period.

“Additionally, as the price of alcohol increases, consumers will shift their behavior to unofficial products such as homemade alcohol, counterfeit alcohol, smuggled alcohol, or products without labels and unknown origins, which can harm consumers’ health,” Prof. Dr. Nguyen Mai added.

Representing Heineken Vietnam, Mr. Nguyen Thanh Phúc, Director of External Relations, shared that with the Ministry of Finance’s current proposed tax increase, the entire beer industry believes this is an unprecedented shock that will negatively impact the industry’s stability and sustainable development and affect local budget revenues. It may also fail to achieve the set goals. Specifically:

Regarding production, business, socio-economic, and tax collection, according to the Vietnam Beer – Alcohol – Beverage Association’s estimates, with the Ministry of Finance’s option 2, increasing the special consumption tax to 15% in 2026 could lead to a 20% rise in product prices. Such a tax hike would hinder production and undermine the goal of increasing state budget revenue.

Moreover, the output decline will result in a more severe tax shortfall due to the negative impact on distributors, retailers, the food service industry, tourism, the night-time economy, etc. Consequently, it will affect value-added tax and corporate income tax contributions. It is essential to note that these taxes always account for a substantial proportion of the tax structure. Therefore, an in-depth study is necessary before implementing the tax increase to ensure that it achieves its goals without disrupting production, other industries, or eroding total budget revenues.

International experiences on optimal special consumption tax rates indicate that when the tax rate surpasses the optimal point, the goal of increasing state budget revenue will be significantly impacted as sales volume declines, creating pressure on other macroeconomic factors. A specific example is Belgium. In November 2015, the Belgian government increased the special consumption tax on spirits by over 40%, expecting to collect an additional 128 million EUR in the first six months of 2016. However, this drastic move backfired as sales volume dropped by 33% when alcohol prices rose by more than 20%, causing the government to fall short of its tax revenue target.

Regarding reducing the consumption of alcoholic beverages and protecting community health, Mr. Phúc pointed out that the relationship between increasing the special consumption tax and decreasing the consumption of alcoholic beverages is complex and not a simple direct correlation. An excessive tax hike may push consumers toward illegal, untaxed, and lower-quality products with higher alcohol content, posing significant risks to community health and reducing state budget revenue.

In addition, the current special consumption tax rates are unreasonable, as beer with an average alcohol content of only 5.5% is subject to a 65% special consumption tax, the same rate as liquor over 20 degrees. This discrepancy not only diminishes the motivation for beer companies to promote community health but also reflects a lack of fairness in tax policies.

RECOMMENDATIONS FOR BALANCING THE INTERESTS OF THE GOVERNMENT, BUSINESSES, AND CITIZENS

Given the aforementioned shortcomings, the workshop’s experts and enterprise representatives agreed on the necessity of a concrete roadmap for applying the special consumption tax to alcoholic beverages to avoid a significant shock to enterprises in this industry.

“We propose studying and developing a roadmap for increasing taxes on alcohol and cigarettes that aligns with enterprises’ production and business situation,” VCCI’s representative stated.

According to Prof. Dr. Nguyen Mai, a 2-3 year preparation period is necessary, along with synchronous solutions to prevent the mentioned negative behaviors. The tax increase should not be implemented in 2024-2025.

Similarly, Dr. Can Van Luc made three key recommendations:

First, consider the timing, tax rate, and appropriate roadmap, as enterprises subject to this tax have faced multiple challenges in the past.

Second, it is suggested to categorize taxable items and not equate alcohol and beer. They are distinct alcoholic beverages with different alcohol content and cultural implications. Accordingly, the tax calculation method should be based on alcohol content, meaning that higher alcohol content should be subject to a higher tax rate to regulate consumption behavior.

Specifically, for alcoholic beverages, separate tax rates should be applied to beer and liquor (with the tax rate for beer at a maximum of 50% of the tax rate for liquor above 20% because they have very different alcohol content and health and cultural impacts).

Additionally, since the special consumption tax is a consumption tax, but the taxpayers are organizations and individuals producing, importing goods, and providing services, it will not affect those who produce and consume harmful products themselves, which are subject to the tax. It is recommended that the drafting agency consider including organizations and individuals who produce and consume goods subject to the special consumption tax, such as alcoholic beverages, as taxpayers.

Third, increase budget spending on communication programs to raise awareness and educate people while synchronizing them with other solutions, such as combating tax evasion and fraud.

“Along with domestic industry associations and foreign business associations, including the Vietnam Beer – Alcohol – Beverage Association and the European Business Association in Vietnam, we fully support the government’s goal of using the special consumption tax to protect people’s health and increase sustainable budget revenues. However, we believe that tax increases should adhere to the principles of maintaining stability, harmony, nurturing revenue sources, and aligning with economic scenarios. Simultaneously, it should foster a predictable investment and policy environment to reinforce foreign investors’ confidence.”

From the enterprise perspective, according to Heineken Vietnam’s representative, adjusting the special consumption tax will impact various industries, businesses, and citizens. Therefore, it must be based on balancing the interests of enterprises, the state, and citizens, promoting production and business development, socio-economic advancement, and tax collection while mitigating the negative aspects of goods that can harm people’s health. “Tax increases should follow a suitable roadmap to allow related entities to prepare and avoid abrupt changes,” Mr. Phúc stated.

Mr. Phúc made specific proposals considering the particular impacts of the special consumption tax.

First, regarding the goal of promoting production, business, socio-economic development, and combating tax evasion, Heineken Vietnam, along with other beer companies and the Vietnam Beer – Alcohol – Beverage Association, proposed the following: To create a stable environment for industrial recovery, the special consumption tax rate should remain unchanged for one year from 2026 when the amended Law takes effect. The first tax increase should occur in 2027. Subsequently, to allow consumers to gradually adapt to the new prices due to the special consumption tax increase, the tax should be raised every two years by 5% each time, reaching a maximum of 80% by 2031 and maintaining stability.

Thailand’s experience can be referenced. In 2024, Thailand reduced the special consumption tax on alcoholic beverages, specifically cutting the tax on wine from 10% to 5% and eliminating the special consumption tax on domestic alcoholic beverages. This policy revived the tourism, restaurant, and hotel industries, supported domestic producers, and boosted the economy.

Second, regarding the goal of reducing the consumption of alcoholic beverages and protecting community health, to encourage technological innovation and focus on low-alcohol products, it is necessary to establish specific tax rates corresponding to the different alcohol content in beer. This ensures alignment with current laws and regulations, such as the Law on Prevention of Harmful Effects of Alcohol and Beer and advertising regulations. Specifically, beer with an alcohol content of 5.5% or less should be subject to a 65% tax rate; beer with an alcohol content of over 5.5% and less than 15% should be taxed at 70%; and beer with an alcohol content of over 15% should be taxed at 75%.

Instead of focusing on tax increases, it is essential to vigorously implement a comprehensive solution by changing consumers’ behavior toward the positive through communication and awareness-raising programs about the safe and responsible consumption of alcoholic beverages.

Unlocking Public Investment Law: Overcoming the Challenge of ‘Having Money but Unable to Spend’

For the proposal to build the Public Investment Law (amended), Prime Minister Pham Minh Chinh emphasized the need to remove obstacles and red tape, preventing situations where “there is money but it cannot be spent”, and avoiding prolonged projects. He stressed the importance of decisively cutting unnecessary and cumbersome procedures.

The Digital Technology Industry Act: Defining Digital Assets

With a growing number of individuals accumulating substantial wealth and assets through digital transactions, the challenge of taxing these transactions has become increasingly prominent. According to Mr. Dau Anh Tuan, Vice Secretary-General and Head of the VCCI’s Legal Department, the draft Law on Digital Technology Industry with its notable features in management and legal framework, particularly its first-ever definition of digital assets, is poised to address this issue.