On September 23, the State Securities Commission of Vietnam (SSC) and the Japan International Cooperation Agency (JICA) jointly organized a workshop to launch the project “Enhancing Capacity for Promoting the Efficiency of the Vietnamese Securities Market.”

The overall objective of the project is to enhance the efficiency, fairness, and transparency of Vietnam’s stock market to international standards within three years of the project’s completion.

Specifically, the project aims to strengthen the supervision and inspection of the market, enhance the quality of market intermediary institutions such as securities companies and fund management companies, improve public offerings, and strengthen listing and information disclosure in line with international standards.

Each expected output will have its own set of policies. For instance, for the first output on market supervision and unfair trading surveillance, the policy entails a three-tier detection system involving the collaboration of the SSC, the stock exchanges, and the participation of securities companies. In Japan and the United States, self-regulatory organizations (SROs) are involved in detection and inspection under the supervision of the authorities.

Additionally, the program suggests considering the development of a transaction and account information-sharing system among the SSC, the stock exchanges, and securities companies for market surveillance.

The second output focuses on the supervision and training of market intermediaries, with policies including supporting the amendment of the circular related to the qualification certificates of securities practitioners (Circular 197/2015), discussing the possibility of using SROs for other business regulations, and backing the SSC’s investor education initiatives. In many countries, investor education is implemented as part of “financial literacy enhancement.” In Japan, the “Organization for the Promotion of Economic and Financial Education” was recently established in 2024.

The third output aims to enhance and internationalize public offerings, listings, and information disclosure. This involves considering an IPO process that aligns with both Vietnamese securities laws and international standards, integrating the IPO process with listings, and enabling foreign and individual investors to participate. It also entails considering the business aspects of securities companies, such as underwriting fees, and amending Decree 155/2020 if necessary.

Mr. Kawasaki Satoru, Deputy Commissioner for International Affairs at the Japan Financial Services Agency, emphasized that ensuring fairness among investors is crucial for a vibrant stock market. To combat insider trading, Japan established a Surveillance Commission in 1992, tasked with inspecting securities companies and reporting suspicious transactions to the prosecution.

“We also amended the law in 2024 to strengthen administrative penalties and implement surveillance by collecting market information, analyzing and inspecting securities companies, imposing heavy fines, and initiating criminal proceedings if there are grounds. These actions aim to prevent misconduct in the market,” he emphasized.

Regarding IPOs, Mr. Kojima Kazunobu, Chief Advisor of JICA, highlighted that foreign investors, including Japanese investors, are highly interested in Vietnam’s stock market.

The best opportunity for foreign investors to invest in Vietnam’s securities is through IPOs, but the current auction process makes it challenging for them to participate. Moreover, the number of companies conducting IPOs and listing on the Vietnamese stock market in recent years has been quite limited.

To address this, Mr. Kojima suggested that Vietnam needs to adopt a new IPO method compatible with international standards, such as underwriting and book-building. “If large and emerging companies with investment appeal conduct IPOs and listings, a large amount of foreign capital will flow into Vietnam,” he added.

At the workshop, Mr. Bui Hoang Hai, Vice Chairman of the SSC, emphasized the timeliness of the project. Following the Prime Minister’s directives, the SSC and the Ministry of Finance are reviewing and evaluating the Securities Law and Decree 155.

The draft Securities Law includes proposed improvements such as strengthening the capabilities of securities companies, increasing their responsibility for market surveillance, and combining IPOs and listings.

“I hope that the project experts will immediately start reviewing the Securities Law to implement the necessary reforms in the Securities Law and Decree 155,” Mr. Hai added.

According to the Vice Chairman of the SSC, compared to other countries in the region, Vietnam’s stock market has developed to a similar scale as other ASEAN markets. The SSC recognizes that the current focus should be on enhancing the quality of the market.

“This project is timely and aligns with the SSC’s needs to improve the efficiency of the primary market, strengthen intermediary capabilities, and enhance the function of associations in supporting the SSC’s market surveillance. To achieve these goals, the SSC will implement the project plans and ensure the quality and timely execution of the project,” concluded Mr. Bui Hoang Hai.

Unlocking Vietnam’s Stock Market Potential: A Significant Step Forward with the Adoption of Non Pre-funding

The new circular contains notable provisions pertaining to foreign institutional investors’ ability to engage in stock purchases without a cash requirement. Additionally, it outlines a roadmap for disclosures in the English language, marking a significant development in Vietnam’s capital market evolution.

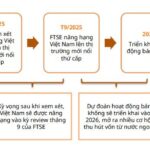

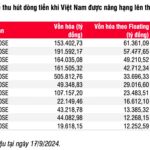

The Vietnam Stock Market Nears Upgrade Milestone: Which Stocks Will Attract Major Capital Inflows?

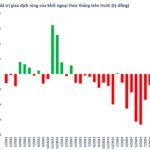

With the market’s emerging-market upgrade, SSI Research estimates that a staggering $1.7 billion in ETF funds could flow into the market, excluding active funds.