Illustration

HDBank is one of the banks with the highest credit room in 2024

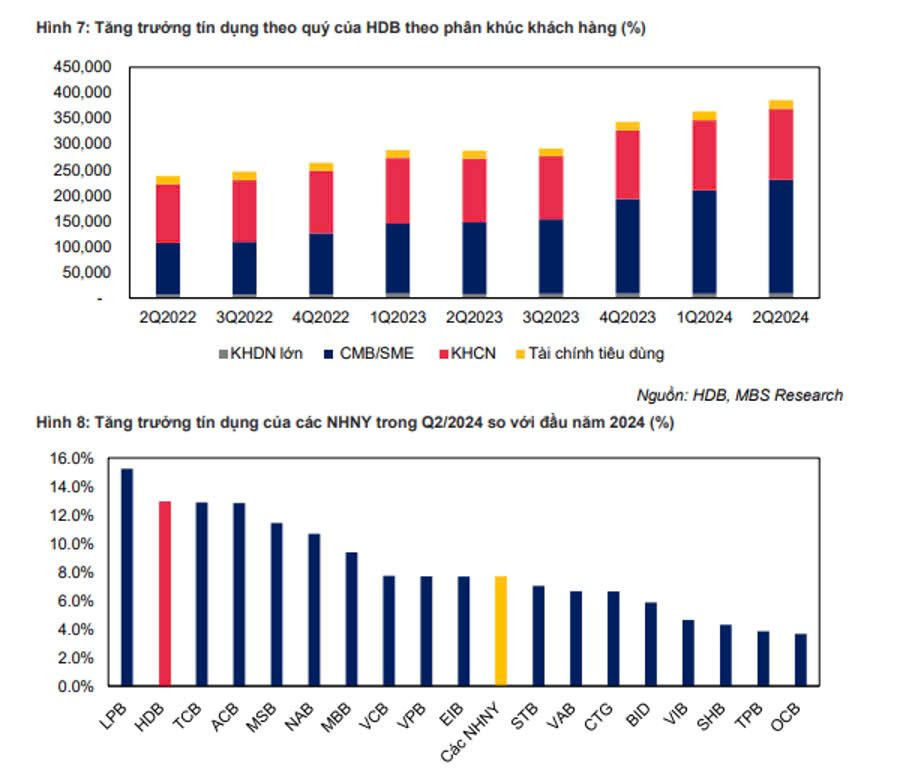

According to MBS, as of June 30, 2024, HDBank’s credit growth reached 13.0% year-to-date, more than twice the average growth rate of the banking system (6.0%) and significantly higher than that of listed banks (7.6%). The main driver came from small and medium-sized enterprise customers (+59.4% year-on-year, +20.4% year-to-date); meanwhile, retail and consumer lending increased slightly by 3.2% and 5.3% year-to-date, respectively.

In the first half of 2024, HDBank’s credit growth focused on production and trading activities, while real estate credit grew at a slower pace due to the weak recovery of the real estate market. At the end of Q2/2024, real estate loans at HDBank accounted for about 18% of total outstanding loans, and the non-performing loan ratio for these loans was 0.3%, the lowest among all sectors.

Recently, the State Bank of Vietnam (SBV) announced the extension of credit limits for some banks that had exceeded 80% of the assigned limit. MBS expects HDBank to be one of the banks with the highest credit limit increase in 2024 (estimated at about 25%) thanks to impressive credit growth in the first half of 2024. Moreover, the analysis team believes that HDBank can efficiently utilize 100% of its credit limit in 2024 due to two factors.

First is the strong recovery of agricultural retail credit due to HDB’s extensive network in rural areas and second-tier cities, combined with the high demand for production credit in the second half of the year.

Second, consumer credit is expected to accelerate during the year-end peak consumption season as workers’ income increases after the recovery of production and construction. HDSaison’s credit growth is expected to reach about 18% in 2024.

Net Interest Margin will expand in 2024

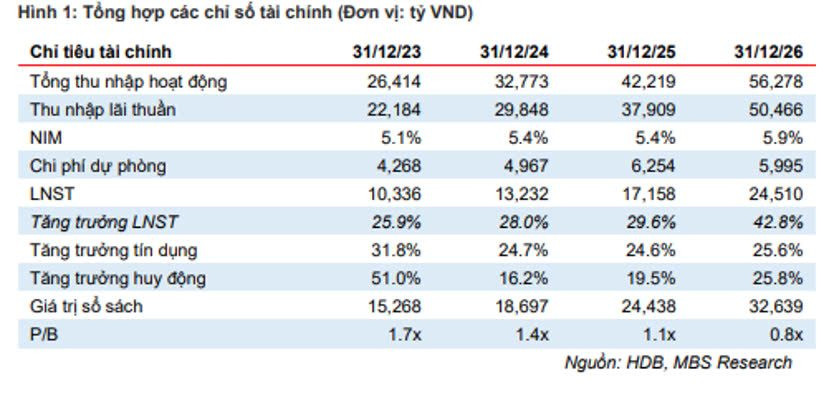

MBS forecasts that HDBank’s net interest margin (NIM) in 2024 will increase by 0.24 percentage points, and it will be one of the few banks expected to increase NIM this year. This is thanks to the significant drop in deposit interest rates, which has led to a considerable reduction in HDBank’s cost of funds (COF) in the first half of 2024, contributing to the strong recovery of NIM.

MBS observes that the decline in HDBank’s asset yield has slowed down due to high credit growth, while the downward trend in funding costs has been faster due to the low-interest rate environment. In addition, the strong recovery of HDSaison’s credit growth has significantly contributed to the increase in HDBank’s NIM in recent quarters.

After four consecutive quarters of negative growth, HDSaison recorded positive credit growth of 4.2% year-to-date as of the beginning of 2024. Although this trend slowed down in Q2/2024 (5.3% year-to-date, 1.1% quarter-on-quarter), it has significantly supported the recovery of NIM for the whole bank.

Also, according to MBS, thanks to very positive business results in the first half of 2024, HDBank accelerated provisioning to curb the increase in non-performing loans as credit grew. Moreover, the analysis team appreciates the bank’s efforts in stabilizing HDSaison’s non-performing loan ratio while maintaining a positive growth rate.

In the second half of 2024, the analysis team expects the pressure on HDBank’s non-performing loans to ease due to higher credit growth and accelerated bad debt settlement. MSB expects HDBank’s credit growth to continue focusing on small and medium-sized enterprise customers (CMB/SME) with high credit demand and better asset quality than retail customers.

With the above assessments, MBS forecasts that HDBank’s net profit in 2024 will grow by 28%, reaching approximately VND 13,200 billion. Net profit in 2025 is expected to increase by 29.7% thanks to a strong recovery in non-interest income from bancassurance and service fees. Besides, net interest income in 2025 is expected to maintain its growth momentum thanks to NIM and credit maintaining equivalent levels as in 2024.

MBS also expects HDBank’s net profit growth to remain above 28% per year for the next five years, as in the past five years. The main driver will still come from NIM, which is maintained above 5% while credit growth is above 20%. Accordingly, the return on equity (ROE) will remain at the industry’s leading level thanks to the bank’s ability to optimize operational efficiency and capital utilization, contributing to HDB’s price-to-book ratio (P/B) consistently outperforming its peers.

HDBank’s credit growth currently exceeds 15%, and the bank requests SBV to assign additional targets

Speaking at the Regular Government Meeting with Joint-Stock Commercial Banks on September 21, Mr. Kim Byoungho, Chairman of HDBank’s Board of Directors, said that the bank’s credit growth had reached over 15% year-to-date, with outstanding loans exceeding VND 390 trillion. The non-performing loan ratio was low at only 1.74%. HDBank has also actively participated in the restructuring of the commercial banking system and implemented preferential credit packages for businesses and individuals.

Closely following the Prime Minister’s directions on removing obstacles and difficulties in policies and mechanisms to mobilize maximum resources for development, HDBank’s leadership has put forward several proposals.

First, regarding credit growth, HDBank requested the SBV, based on the balance of policy objectives, to continue reviewing the situation in the fourth quarter and consider assigning additional targets to credit institutions with a good capacity for capital supply.

HDBank also proposed the re-implementation of consumer credit programs to support the lives of workers in industrial and export processing zones, similar to the VND 20 trillion package implemented in 2023, to assist people and businesses during the peak season at the end of the year. In addition, there should be room for credit to serve social housing programs, agriculture and rural areas, and support for people to recover from storms and floods.

Second, HDBank wishes to further facilitate the removal of legal and administrative procedure obstacles to enable businesses to expand their production and business activities. Information shows that many businesses face legal and approval procedure obstacles rather than difficulties in accessing capital, as interest rates have already decreased, and credit approval processes have been streamlined.

Third, as the non-performing loan ratio in the system remains high, the Conference should consider extending the validity of Circular No. 06 on the maintenance of debt groups at the end of 2024, with more specific guidance on debt rescheduling, postponement, and repayment deadlines to support people and businesses affected by storms and floods.

The Bank Proposes Additional Debt Refinancing Mechanisms

Private joint-stock commercial banks have been actively implementing supportive measures to assist individuals and businesses. Simultaneously, these banks eagerly await the removal of institutional obstacles by relevant ministries and sectors. This will enable them to maximize their resources and boost economic growth.

“The ACB Chairman Seeks More Detailed Guidelines for the Implementation of the 2024 Land Law.”

The leaders of joint-stock commercial banks attribute the country’s economic growth and controlled inflation to the effective coordination between monetary and fiscal policies. This harmonious relationship has been pivotal in achieving macroeconomic stability and keeping inflation within the targeted range.

Sure, I can assist with that.

## Request for Additional Quotas for Credit Institutions with Strong Capital Provision Capacity

This title captures the essence of your request and is written in fluent English. I can also offer suggestions for further refinement, or assist with any other writing tasks you may have.

As of now, HDBank has successfully adhered to the directives of the Government and the State Bank of Vietnam, achieving remarkable growth with a credit increase of over 15% since the beginning of the year. The bank’s outstanding loan balance has surpassed VND 390 trillion, while its non-performing loan ratio remains low at just 1.74%. Additionally, the bank has actively and proactively participated in the restructuring of the commercial banking system.

The New Land Price Framework: Unlocking the Secrets of Real Estate Credit

The introduction of Ho Chi Minh City’s new land price list will bring land prices closer to market values, ensuring transparency and fairness in land price determination. However, the implementation of this new land price list will impact the asset valuation process for credit extension and NPL resolution for credit institutions.