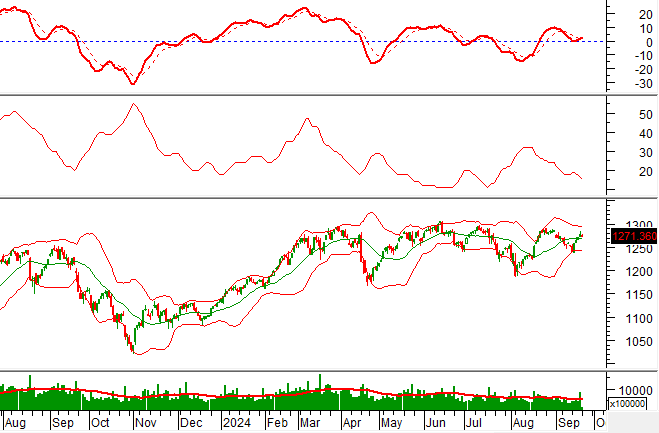

Technical Signals for VN-Index

In the trading session on the morning of September 23, 2024, the VN-Index declined, accompanied by a slight drop in volume, indicating investors’ hesitation.

Currently, the VN-Index is testing the Middle Bollinger Band, while the ADX indicator continues to weaken and stays below 20, suggesting the potential for volatile sessions with alternating gains and losses in the upcoming sessions.

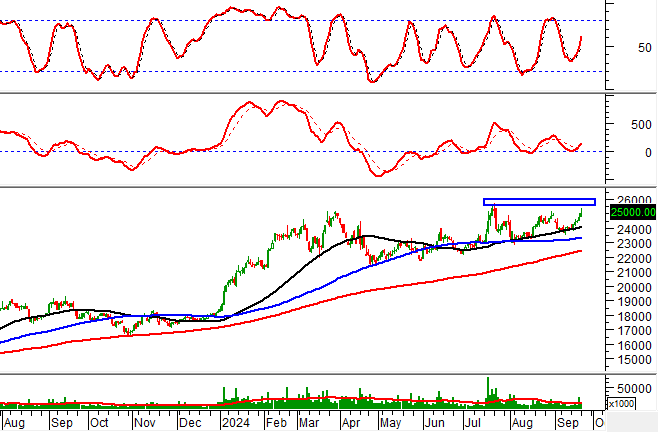

Technical Signals for HNX-Index

On September 23, 2024, the HNX-Index witnessed a decline, along with a significant drop in trading volume during the morning session, reflecting investors’ cautious sentiment.

Additionally, the HNX-Index is retesting the 50-day SMA and 200-day SMA while the Stochastic Oscillator indicates a buy signal. If the index successfully surpasses this resistance zone, the mid-term optimistic outlook may return in the following sessions.

MBB – Military Commercial Joint Stock Bank

On the morning of September 23, 2024, MBB witnessed a price increase, accompanied by a trading volume surpassing the 20-session average, indicating investors’ growing optimism.

Moreover, the stock price is advancing towards retesting the 52-week high (equivalent to the 25,500-26,000 range) while the MACD indicator continues to widen the gap with the Signal line after previously generating a buy signal. If it successfully surpasses this resistance level, the long-term upward scenario will resume in the upcoming sessions.

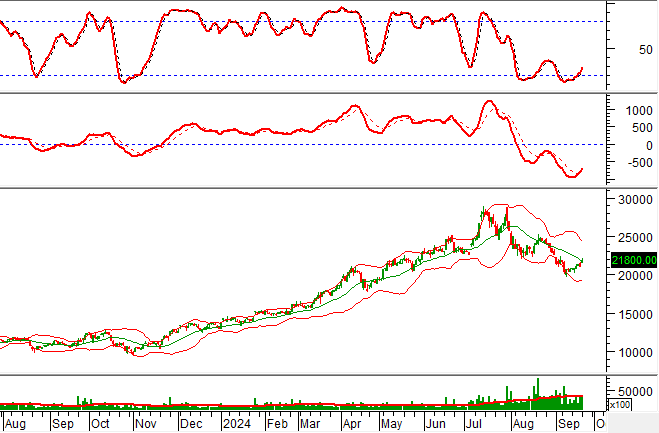

NTL – Urban Development and Construction Corporation

During the morning session on September 23, 2024, NTL witnessed a strong price increase, along with a trading volume exceeding the 20-session average, indicating improving investor sentiment.

Additionally, the stock price is testing the Middle Bollinger Band, while the Stochastic Oscillator continues its upward trajectory after previously generating a buy signal. If it successfully surpasses the Middle Band, a short-term recovery scenario will unfold in the upcoming sessions.

Technical Analysis Department, Vietstock Consulting

“Japan Supports Enhancing the Efficiency of Vietnam’s Stock Market”

On September 23, the State Securities Commission of Vietnam (SSC) and the Japan International Cooperation Agency (JICA) hosted a workshop in Hanoi titled “Promoting the Efficiency of Vietnam’s Stock Market.” This event marked the launch of a project aimed at “Enhancing Capacities for Promoting the Efficiency of Vietnam’s Securities Market.”

The Flow of Funds: Market Confirms Bottom, Shaking Hands to “Seal the Deal”

A week brimming with news and significant events propelled the market to surge beyond many investors’ expectations. The rapid ascent left some feeling like they missed the boat. However, experts believe that latecomers still have opportunities as the market is due for more volatility, shaking off short-term speculative positions while welcoming new investors.