ACB’s ESG Journey Begins With a Contemplation: “What Do We Leave for Posterity?”

Mr. Tran Vu Hien, Director of Finance Division at Asia Commercial Joint Stock Bank (HOSE: ACB), commenced the workshop by referring to the bank’s “greening” journey over the past decade.

According to Mr. Hien, this journey stemmed from Chairman Tran Hung Huy’s contemplation, “What do we leave for posterity?” As a result, ACB, in its role as a financial institution, prioritized not just money but also the imperative to leave a pristine planet for future generations.

Mr. Tran Vu Hien, Director of Finance Division at ACB, speaking at the IR View Workshop

|

Mr. Hien shared that when Mr. Tran Hung Huy assumed the role of Chairman, ACB conducted a survey on employees’ environmental concerns, with 90% responding that they were not interested. However, over the past decade, ACB has successfully shifted this mindset.

“During trips and teambuilding activities, ACB employees always engage in environmental protection initiatives such as beach cleanups and tree planting. In their daily routines, ACB is gradually going green by eliminating the use of plastic water bottles and single-use plastic items. The office carpets are made from recycled fishing nets, and energy-efficient glass is used for windows,” Mr. Hien explained.

The past ten years have been the first step in ACB’s journey towards a greener future. The bank aspires to collaborate with all shareholders, partners, and fellow banks in embracing ESG practices.

“ACB does not aim to be the leader in ESG, but we hope to inspire others to join us in this endeavor,” shared Mr. Hien. ACB introduced a green credit package worth over VND 2,000 billion earlier this year, which has been fully disbursed, and the bank plans to extend it further to assist its clients in their green transition.

This credit package is not only for green businesses but also for companies and sectors aiming to improve their environmental performance. For example, they can invest in better wastewater and air pollution management systems and adopt more energy-efficient production processes. Enterprises that meet ACB’s green criteria can enjoy very favorable loan terms.

VietinBank Allocates 42.3 Trillion VND for Green Projects and Encourages Partners and Clients to Embrace Green Supply Chains

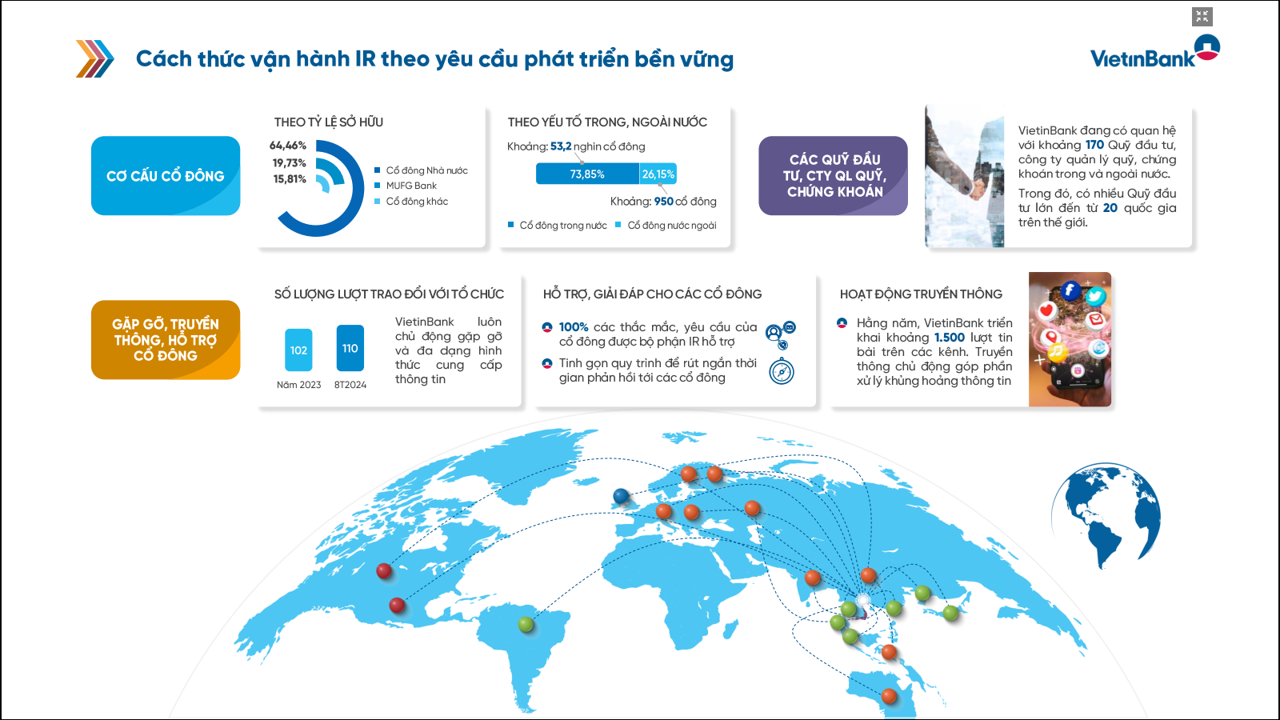

Mr. Vuong Huy Dong, Vice Secretary of the Board of Directors and Head of Investor Relations at Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank, HOSE: CTG), then shared the bank’s approach to IR in the era of digitalization and greening.

According to Mr. Dong, VietinBank established its IR department in 2009, and since 2014, it has been directly under the Board of Directors’ Secretariat in the Board of Directors’ Office. The IR department directly advises the Board of Directors and conveys information from shareholders, receiving direct instructions from the Board. As a result, the bank can continuously update and convey information to investors promptly.

Mr. Vuong Huy Dong, Vice Secretary of the Board of Directors and Head of Investor Relations at VietinBank

|

VietinBank’s IR activities comply with legal regulations, ensure shareholders’ interests, and integrate communication into financial activities. The bank does not discriminate between large and small shareholders, and all shareholders can access information in both Vietnamese and English.

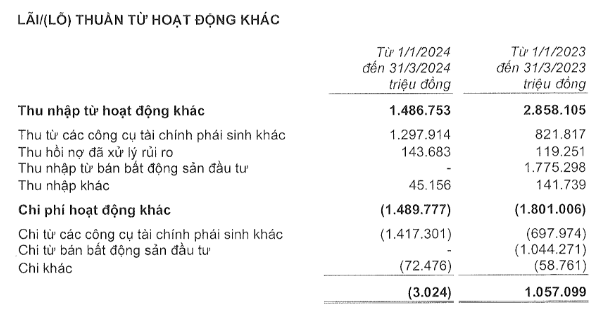

The bank continuously analyzes its shareholder structure to formulate appropriate strategies. Currently, it has two major shareholders: the State (64.46%) and MUFG Bank (19.73%).

In terms of domestic and foreign ownership, domestic shareholders hold nearly 74% of the shares, with approximately 53,000 shareholders. Foreign shareholders account for 26.15%, with nearly 1,000 shareholders. On average, each domestic shareholder owns about 9,500 CTG shares, while each foreign shareholder owns 400,000 CTG shares. This indicates a significant disparity in investment value, underscoring the bank’s need to understand the information and guidance sought by institutional investors. VietinBank’s IR department maintains relationships with 170 securities companies and investment funds, both domestic and foreign, including prominent funds from 20 countries worldwide.

These investment funds serve as a bridge to connect with shareholder groups. VietinBank attaches great importance to these funds and actively participates in 100 investor conferences and meetings annually. In 2024, this figure has already surpassed the 2023 level, and by the end of the year, it is expected to reach 120-130 conferences. On average, the bank interacts with investment fund shareholders ten times per month.

VietinBank does not discriminate between investors, and 100% of shareholder requests and inquiries are addressed. The bank has also streamlined its processes to reduce response times for shareholders.

Additionally, the bank prioritizes communication in its investor relations activities, publishing approximately 1,500 articles in the mass media annually. This helps keep investors informed about VietinBank, address communication bottlenecks, clarify questions related to CTG stock, and mitigate communication risks.

Regarding digital transformation, VietinBank is a pioneer in the government’s and the banking industry’s digitalization efforts. The bank has implemented 108 innovation initiatives. IR activities play a pivotal role in showcasing the bank’s progress in digitalization to investors.

Specifically, the bank employs online workshops, event livestreams, and website development and improvement to facilitate investors’ access to information. Investors can aggregate reports on the VietinBank IR website to obtain the latest data. Alternatively, they can subscribe to receive proactive updates on the banking industry and CTG stock, along with weekly analytical reports on CTG stock to address any concerns promptly.

The bank also leverages social media channels like Facebook and YouTube, using concise titles to attract investors’ attention. VietinBank actively pursues sustainable development, signing a cooperation agreement with the Ministry of Natural Resources and Environment and participating in the World Economic Forum.

At COP28, VietinBank signed an MoU with MUFG to arrange USD 1 billion for sustainable development projects. The bank has committed to a green deposit and financing package worth VND 5,000 billion, offering preferential interest rates for sustainable development projects.

VietinBank’s total green credit balance stands at VND 42.3 trillion, accounting for 2.7% of its total credit balance, with nearly 1,000 customers. The bank not only provides financial support for green projects but also encourages its partners, suppliers, and clients to embrace green supply chains.

IR activities are closely involved in sustainable development initiatives to enhance shareholders’ understanding of VietinBank’s commitment to sustainability. The bank recognizes that a company with a strong sense of responsibility towards the community and the environment is more attractive to investment funds, especially those prioritizing ESG factors. VietinBank integrates its sustainability report into its annual report, providing investors with the most up-to-date information.

Additionally, VietinBank regularly participates in conferences and forums, and its communication activities disseminate information about its sustainable development efforts to domestic and foreign investors.

PAN Group’s Journey Towards a “Greener” Supply Chain

Another enterprise strongly committed to green criteria is PAN Group (HOSE: PAN). At the IR View workshop, Mr. Nguyen Hong Hiep, Director of External Relations at PAN Group, shared the company’s journey towards a “greener” supply chain, which began over a decade ago.

Mr. Nguyen Hong Hiep, Director of External Relations at PAN Group, speaking at the IR View Workshop

|

“Our journey towards ‘greening’ began in 2012 when the company shifted its focus to agriculture and food,” Mr. Hiep stated. This vision goes beyond business development, aiming to elevate the position of Vietnamese agricultural products in the global market.

Mr. Hiep pointed out a paradox: “Although Vietnam ranks high in agricultural exports, it lags in terms of position within the value chain, quality, and value addition, particularly in branded goods.” Recognizing this, the PAN Group’s leadership set a goal to invest in like-minded enterprises and engage more deeply in the value chain.

Currently, PAN Group derives most of its revenue from exports, with a 50% contribution, primarily to European, American, and smaller markets like Canada, Australia, and South Korea.

“To achieve this, we had to establish stringent production processes that meet international standards, especially sustainability criteria,” emphasized Mr. Hiep.

With the growing emphasis on ESG (Environmental, Social, and Governance), particularly after the government’s net-zero emission commitment by 2050 at COP26, PAN Group has been proactive. In 2015, when the United Nations announced the 17 Sustainable Development Goals for 2030, PAN Group promptly set nine goals, focusing on sustainable consumption, production, and supply chains.

“To achieve these goals, PAN Group had to establish a robust sustainability governance system from the outset,” said Mr. Hiep.

“We began publishing separate sustainability reports in 2015, making us one of the few pioneering companies in this regard. This has helped us gain significant traction with international investors,” Mr. Hiep shared proudly.

PAN Group not only applies these principles to itself but also encourages its member companies to embrace sustainable development. Depending on their level of development and listing status, member companies are required to publish sustainability reports or maintain transparent internal reports.

PAN Group’s sustainability governance model is well-structured, with three levels: the Sustainability Subcommittee under the Board of Directors, the Steering Committee for Sustainable Development, and the dedicated Sustainable Development Department. This structure ensures the consistent implementation of the sustainable development strategy from the highest level down to each member company.

“It can be said that PAN Group has been relatively successful in ‘greening’ its supply chain. We have undergone a systematic process, overcoming numerous challenges and receiving increasing recognition,” said Mr. Hiep.

VNM’s IR Activities Are Built on Four Main Pillars

The next presentation, “Managing IR Activities in Enterprises,” was delivered by Mr. Dong Quang Trung, Head of Investor Relations at Vietnam Dairy Products Joint Stock Company (Vinamilk, HOSE: VNM). Vinamilk is a listed company that has been honored with the IR Awards for eight consecutive years from 2011 to 2023.

According to Vinamilk’s IR Head, the company’s IR model is built on four main pillars: transparency, accessibility, engagement, and crisis management.

Mr. Dong Quang Trung, Head of Investor Relations at VNM, speaking at the IR View Workshop

|

Regarding the first pillar, VNM understands that transparency is the foundation of trust. The company provides information through various channels, including financial reports, annual reports, press releases, and bilingual disclosures to ensure the rights of domestic and foreign shareholders. VNM’s annual reports consistently rank among the top in the competitions organized by the Ho Chi Minh City Stock Exchange.

VNM always complies with information disclosure regulations. In addition to keeping investors informed, internal departments within the company also benefit from understanding these disclosures. Many pieces of information are handled by specialized departments, and if they are not aware of the disclosure requirements, they may fail to comply.

The second pillar is accessibility. VNM recognizes the value of time, so the company has established a system that allows investors to easily access and download information about VNM. Going beyond information disclosure, the company also publishes diverse documents for investors. These documents are updated quarterly to ensure that investors have the most current information about the company.

Recognizing that IR is a two-way process, VNM attaches great importance to the third pillar, engagement. VNM utilizes online meetings to enable investors to participate in the company’s meetings. Before the pandemic, the company’s annual general meetings attracted 400-500 investors. This number increased to 1,300 participants due to the shift to online events. Online meetings make it easier for shareholders to attend. While 1,300 participants represent progress, VNM strives to improve further.

VNM conducts surveys among shareholders through the email list it manages. The company also invites investors to participate in quarterly meetings with the Management Board.

The fourth pillar, crisis management, aims to protect shareholders’ interests. VNM utilizes crisis communication management systems. Daily, the system sends emails to monitor information on social media and the internet. If there are discrepancies, the company works with the communications and public relations departments to rectify the information through various communication channels.

Mr. Trung also shared VNM’s approach to engaging with institutional investors. Specifically, foreign investors show significant interest in VNM, with 500 foreign shareholders, including 300 investment funds, on the company’s shareholder list. Each year, VNM allocates resources to participate in ten investment events in key markets such as Singapore, the United Kingdom, the United States, and Hong Kong to attract capital.

Currently, international investors are highly focused on ESG. A critical practice is VNM’s participation in ESG rankings. This participation facilitates investors’ evaluation of the company. VNM has joined the CDP ranking and received positive feedback. In the future, VNM aims to participate in more rankings.

Additionally, VNM provides specialized information on macroeconomics and the industry to institutional investors. These investors are keenly interested in such information and often seek VNM’s insights.

Mrs. Bui Thi Thao Ly (SSV): ESG Disclosure Enhances Access to Foreign Capital

At the IR View workshop on ‘greening’, held as part of the IR Awards 2024 ceremony on the morning of September 24, Ms. Bui Thi Thao Ly, Director of the Analysis Center of Shinhan Securities Vietnam Co., Ltd. (SSV), represented the seller and shared her insights on attracting foreign capital through ESG disclosure.

“SABECO and the Communist Youth Union Join Forces to Aid Northern Provinces in Post-Storm Recovery Efforts”

SABECO, or The Saigon Beer, Alcohol and Beverage Joint Stock Company, has extended its support to six northern provinces affected by Typhoon Yagi. In collaboration with the Ho Chi Minh Communist Youth Union (Central Committee), local authorities, and business and media partners, SABECO provided post-disaster relief to those in need.

Unlocking Billions: The Power of Adaptation for Vietnamese Businesses

By focusing on and strengthening these two key factors, Vietnamese businesses can attract a wider range of foreign investors and elevate their presence in the global market.