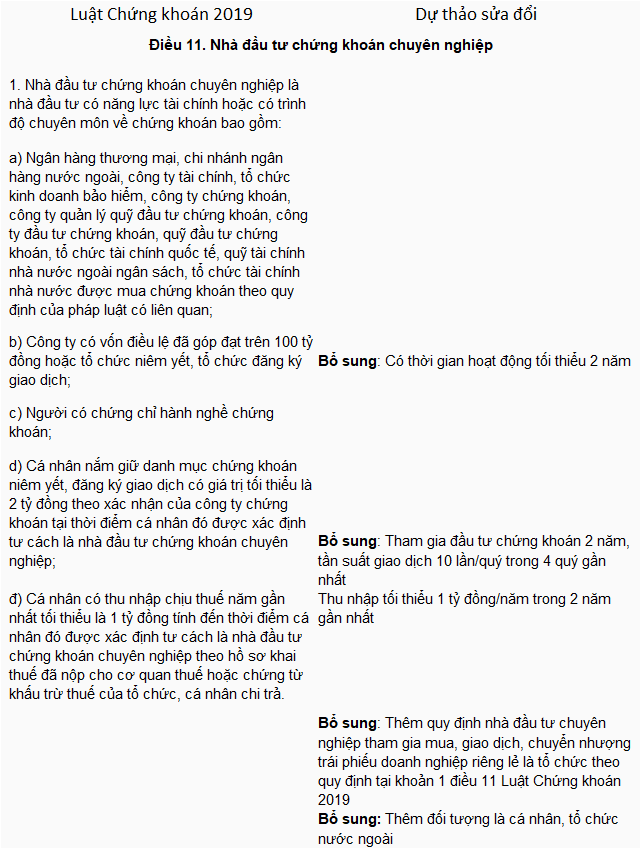

The Law on Securities 2019 (Article 11) defines professional securities investors as those with financial capacity or professional knowledge of securities, including both institutional and individual investors, with certain quantifiable metrics.

In the draft amendment to the Law on Securities, the Ministry of Finance has added criteria for professional investors.

|

Amendment details regarding professional investors in the Law on Securities

|

For institutional investors, the amended regulation aims to prevent the creation of shell companies to participate in private placements. For individual investors, the regulations aim to ensure that investors have the requisite expertise, financial capacity, and continuous activity in the market.

Additionally, expanding the scope of professional securities investors facilitates foreign capital inflows into Vietnam.

From a legislative perspective, the definition of professional securities investors restricts participation in private securities offerings and the establishment of member funds (investment funds with 2-99 members) – investment forms with high risks.

There are two notable points in the legal framework proposed by the Ministry of Finance for professional investors.

According to the new draft, individual investors will not be allowed to participate in private placements and transactions of corporate bonds, with this opportunity being reserved for professional organizations.

Separating individual retail investors from the private bond market does not mean excluding them from the corporate bond ecosystem. Individual investors can redirect their investments towards publicly offered corporate bonds or entrust their investments to professional organizations such as bond investment funds.

The public bond market, with its higher transparency and stricter regulation, is a more suitable playing field for individual retail investors. Simultaneously, organizations like investment funds have the requisite expertise to manage the risks associated with private corporate bonds. Consequently, individual investors are less likely to suffer losses, and the potential for systemic risk is mitigated.

The collapse of the corporate bond market in 2022 serves as an expensive lesson. Individual investors, who are typically more vulnerable, often fail to assess the risks involved and may unknowingly be steered towards products with higher risk profiles than they can handle.

The second point addressed in the regulation is ensuring that investors have continuous activity in the securities market. This idea is quantified by transaction frequency and investor income requirements. Specifically, individual investors are mandated to have more than 10 transactions per quarter in the last four quarters.

This quantification may pose challenges for investors regarding transaction frequency, as not everyone trades frequently, especially long-term investors who tend to have lower transaction volumes.

In the common understanding of the financial world, professional investors are organizations or individuals with a profound understanding of investment activities. Beyond financial capacity and investment expertise, true professional investors should also possess risk management capabilities and the wherewithal to absorb potential losses.

In reality, transaction frequency does not reflect the two primary criteria of professional investors: financial capacity and expertise.

In the US securities market, the Securities and Exchange Commission (SEC) defines accredited investors as those eligible to participate in certain types of exclusive offerings. These investors are financially sophisticated and capable of bearing the risks and losses associated with such investments.

The SEC’s criteria include an annual income exceeding $200,000 (or a combined income with a spouse of $300,000, equivalent to VND 5-7.5 billion) for the last two years or a net worth exceeding $1 million (approximately VND 25 billion), without any transaction frequency requirements.

Markets in the ASEAN region also refrain from imposing transaction frequency mandates. In Malaysia, the Securities Commission Malaysia (SC) defines professional investors according to the Capital Markets and Services Act 2007 (CMSA). For individual investors, they must have total personal assets exceeding 3 million MYR (approximately VND 17.4 billion) or an annual income of no less than 300,000 MYR (approximately VND 1.7 billion).

A transaction frequency requirement similar to the Ministry of Finance’s proposal can be found in the definition of Professional Clients by the European Union, as outlined in the Markets in Financial Instruments Directive (MiFID).

According to MiFID, entities meeting two out of three conditions regarding financial portfolio value (over €500,000, equivalent to VND 13.5 billion), professional experience (working in the financial sector for over a year), and transaction frequency (10 transactions per quarter in the last four quarters) may request to be recognized as Professional Clients. Subsequently, these investors are deemed Professional Investors under the amended directive for Alternative Investment Fund Managers (AIFMD).

Overall, the Ministry of Finance’s new regulations aim to channel individual investors towards investing through professional institutions to mitigate risks while ensuring that professional investors maintain continuous and close engagement with the market.

However, further consideration is necessary regarding the evaluation based on transaction frequency. This criterion could potentially hinder professional investors who do not frequently trade.

Chí Kiên

Enterprise Private Bonds: A Playing Field for Professionals Only, Inadvisable for Retail Investors

The proposed amendments to the current Securities Law aim to foster a stable development phase, paving the way for a more transparent market recovery and preventing past risks from reoccurring. This is according to experts in the field, who emphasize the importance of creating a robust foundation for the market’s rebound.

“Individual Investors Speak Out on Corporate Bond Trading Restrictions”

“There is a growing concern among individual investors that they will be left behind in the corporate bond market if and when new regulations are implemented. This fear is understandable, as regulatory changes can significantly impact investment strategies and opportunities.”