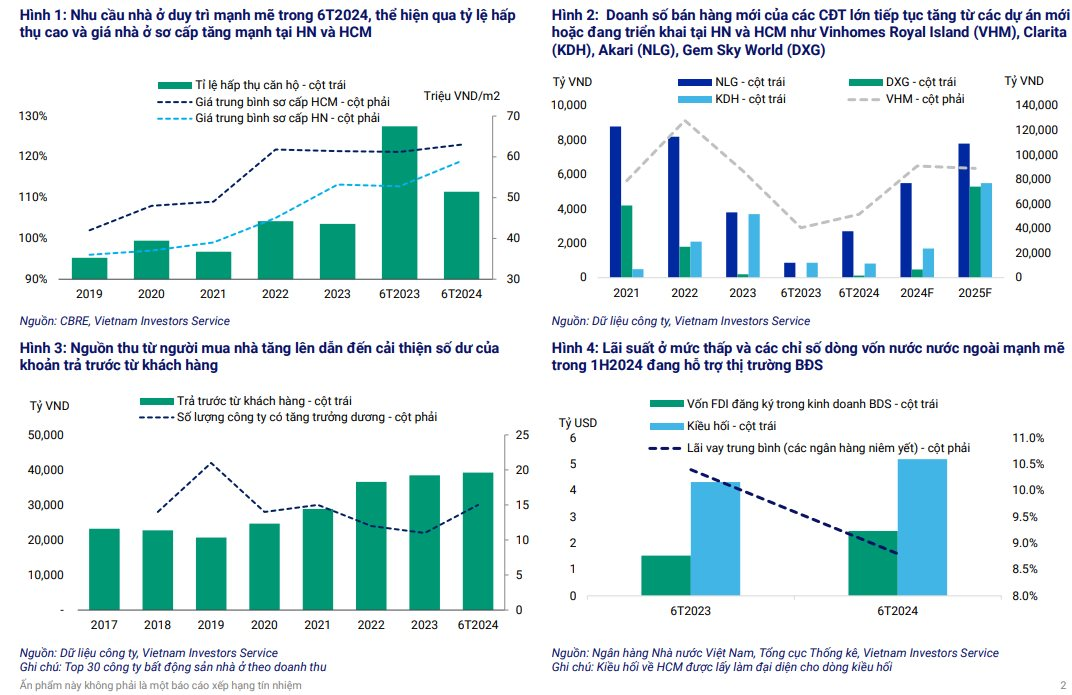

In its analysis report released on September 23, credit rating agency VIS Rating stated that real estate transactions nationwide in Q2/2024 reached the highest level since Q4/2022, along with continuously rising property prices in Hanoi and Ho Chi Minh City.

Over the next 12-18 months, VIS Rating forecasts that buyer sentiment will remain robust due to the low-interest-rate environment. Large developers such as Vinhomes (VHM), Khang Dien (KDH), Nam Long (NLG), and Dat Xanh (DXG) will lead the industry in sales from new housing projects launched in Hanoi and Ho Chi Minh City. In the first half of 2024, new sales of these developers increased by an average of 31% year-on-year.

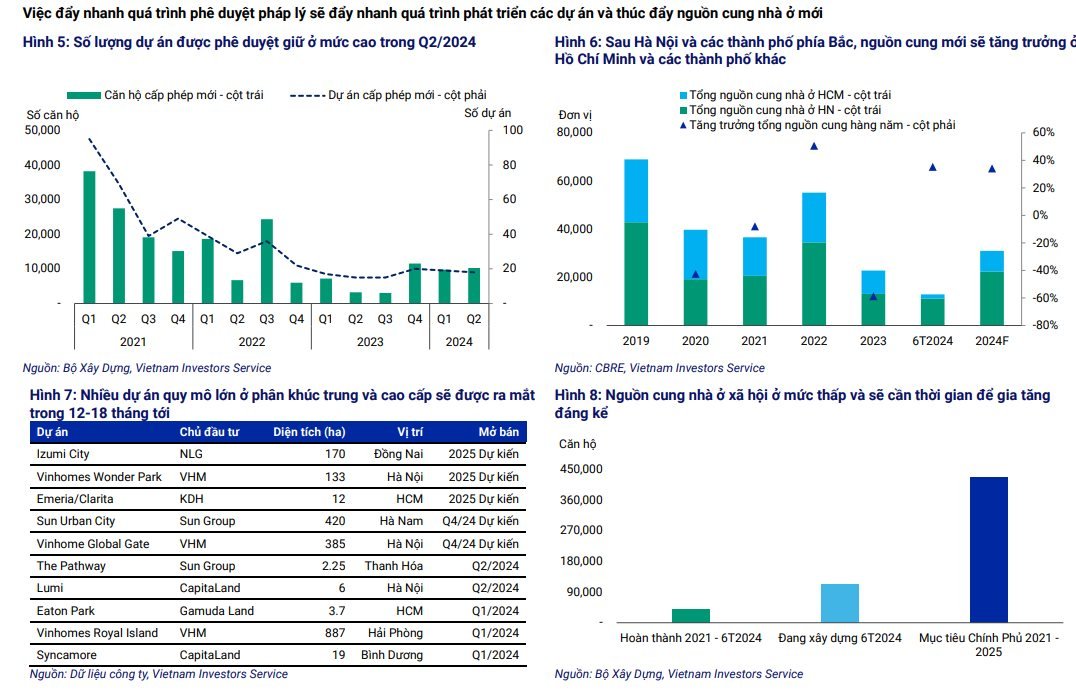

In addition, VIS Rating believes that expediting the legal approval process will accelerate project development and boost the supply of new housing.

In the first half of 2024, the supply of new housing increased mainly in major northern cities such as Hanoi and Haiphong. As the legal approval process for new projects speeds up, we expect more products in the mid- to high-end segments to be released in Ho Chi Minh City and other major cities in the next 12-18 months.

The recently issued regulations will restrict highly leveraged investors from developing new projects. However, VIS Rating expects large developers like VHM, KDH, and NLG to remain unaffected and complete their large-scale projects as planned.

The current supply of social housing only meets about 10% of the government’s 2025 target of 428,000 units, and it will take time to increase significantly.

VIS Rating’s data for the first six months of 2024 shows that the total debt of listed investors increased by 19% year-on-year, mainly due to new project developments by VHM (total debt increased by 63% year-on-year), VPI (54%), DIG (59%), and KDH (33%).

Leverage will continue to increase as investors raise more debt to finance new project developments. The industry’s debt-to-EBITDA ratio rose to 3.7x in the first half of 2024, up from 2.7x in 2023; cash reserves increased by 5%; operating cash flow slightly recovered but remained negative in the first half of 2024. More than two-thirds of listed investors have weak to extremely weak cash flow to repay debt, specifically operating cash flow below 5% of total debt, particularly those affected by project legal issues such as LDG, QCG, and NVL. High reliance on short-term loans poses significant refinancing risks.

The ratio of short-term debt to total debt for listed investors remained high at 44% in Q2/2024, with companies with limited cash reserves (e.g., CKG, NBB, QCG, KOS) having the highest refinancing needs.

Additionally, approximately VND 105 trillion worth of real estate bonds will mature in 2025. VIS Rating estimates that about 50% of the bonds maturing in the next 12 months are at risk of delayed principal and interest payments, mostly related to investors who have recently delayed payments, such as NVL and Van Thinh Phat.

Overall, investors’ access to new capital has improved in 2024 due to the growth of bank credit for real estate businesses and the doubling of equity issuance compared to the previous year. The issuance of new real estate bonds in the first eight months of 2024 decreased by 5% year-on-year and is expected to remain low due to tighter issuance requirements and upcoming changes in securities laws.

According to the current draft law, the proposed changes include mandatory collateral requirements for publicly issued bonds and privately placed bonds restricted to institutional investors only.

The New Real Estate Boom: Are Ho Chi Minh City Residents Ready to Spend Their Savings and Take Out Loans for Property?

The property market is booming, and potential buyers know that hesitation will only result in missed opportunities. With an increasing number of people willing to take out loans to secure their dream homes, the competition is fierce. The pressure to act fast is on, as buyers recognize that property prices and availability show no signs of decreasing.

“The Regret of Having Money but Not Investing in Real Estate”

“I was compensated for my land in the Thu Duc area over a decade ago,” shared Ms. H, reflecting on her experience.