The southern land market in Vietnam witnessed a notable decrease in cut-loss selling compared to mid-2023. However, some investors are still struggling to offload their properties at a loss with no buyers in sight.

Mr. H, a land investor from District 7 in Ho Chi Minh City, shared his story. He started investing in peripheral land in mid-2021, profiting from a few successful flips with his friends. However, when he purchased a plot of land measuring 60 square meters for 2.1 billion VND in late 2021, things took a turn. Not only has the value of his investment failed to appreciate, but he has also been unable to find a buyer even after lowering his asking price.

Mr. H took out a bank loan of 800 million VND to finance the purchase, resulting in monthly interest and principal payments of over 10 million VND for years. Despite his efforts to sell the plot for 2.2-2.4 billion VND, he had to further reduce the asking price to 2 billion VND in December 2023, but to no avail.

Many investors are unsure when prices will recover to their purchase levels, leaving them holding onto their assets indefinitely. Photo: Tieu Bao

Mr. Tr and his investment group are facing a similar predicament in the neighboring province of Ho Chi Minh City. They are holding onto plots of garden land measuring 2,000-3,000 square meters, and if they were to sell now, they would incur losses of 30-50% compared to their purchase price. In mid-2023, the group tried to offload one or two of their assets, accepting a nearly 40% loss, but even after a long waiting period, they couldn’t find any buyers.

Recent market reports indicate a recovery in demand for land plots, with increased interest compared to previous periods. However, this growth seems concentrated in select areas of the northern market, while the southern market lags in terms of recovery, with data suggesting only a slight increase in interest rather than actual purchases.

According to a Ho Chi Minh City-based real estate broker, land and house prices have not rebounded to their early-2022 levels, with a price gap of 10-20% depending on the area. Selling land at 2021-2022 prices remains challenging.

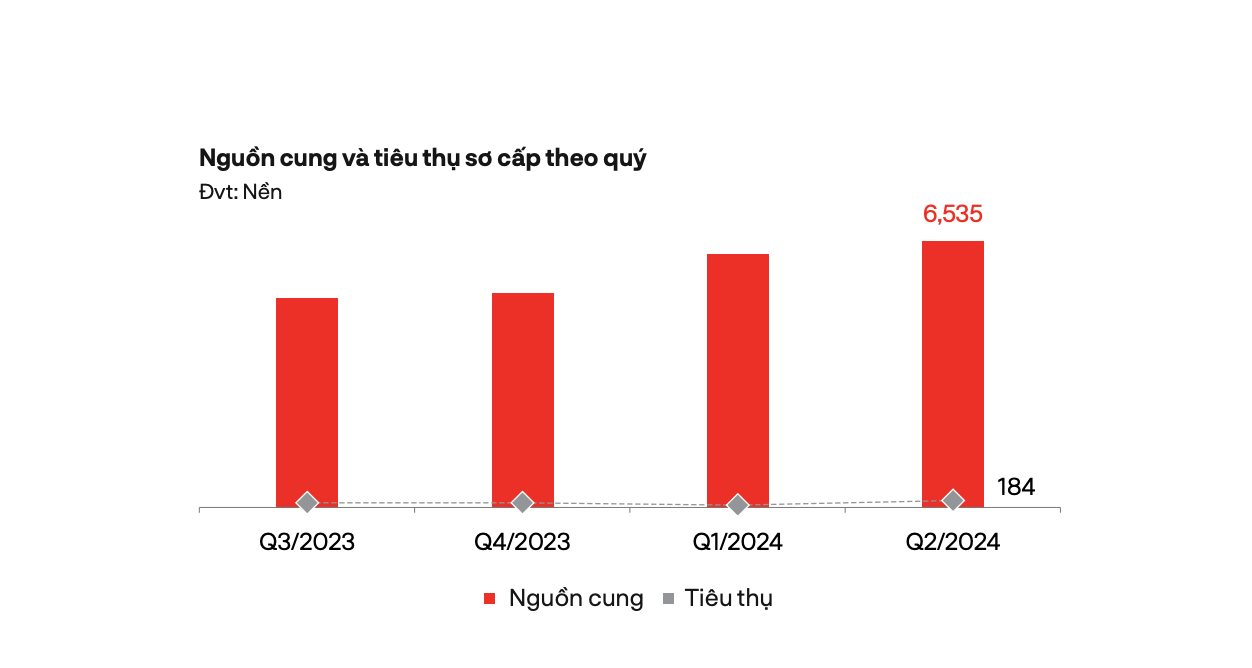

The consumption index for southern land remains low across quarters. Source: DKRA Group

The broker also noted that the new laws have not significantly impacted market liquidity. There is still a large inventory of old properties listed by investors. Unless sellers adjust their asking prices, demand is likely to remain subdued. The market has seen the emergence of investment groups looking to acquire multiple properties simultaneously, but they often try to drive down prices during negotiations. As a result, most sellers refuse to sell at a significant loss, and buyers are unable to acquire properties at their desired prices, leading to a stalemate in transactions despite positive market sentiments.

The New Real Estate Boom: Are Ho Chi Minh City Residents Ready to Spend Their Savings and Take Out Loans for Property?

The property market is booming, and potential buyers know that hesitation will only result in missed opportunities. With an increasing number of people willing to take out loans to secure their dream homes, the competition is fierce. The pressure to act fast is on, as buyers recognize that property prices and availability show no signs of decreasing.

“The Regret of Having Money but Not Investing in Real Estate”

“I was compensated for my land in the Thu Duc area over a decade ago,” shared Ms. H, reflecting on her experience.