“More than a decade ago, in 2011-2012, I vividly recall a Vietstock report indicating that less than 10% of listed companies met the standards for IR practices,” Mr. Long began his story at the discussion session. “By 2018-2019, this number had risen to 40%. And now, in 2024, we’ve reached the 60% mark.”

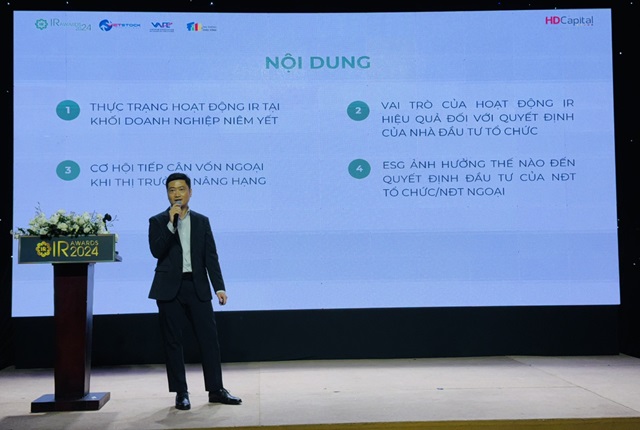

Mr. Nguyen Thanh Long, CEO of HD Capital Joint Stock Company, during the discussion session on the topic “Investment Preferences of Institutional/Foreign Investors” at the IR Awards 2024 ceremony, held on the morning of September 24th.

|

Mr. Long pointed out the distinct disparity in IR implementation between large and small businesses. “Resources have undoubtedly influenced the way IR activities are carried out in Vietnamese enterprises,” he said.

“In smaller companies, the IR function is often assigned to the accounting and finance department as an additional responsibility. While they may work diligently, they cannot match the professionalism of a team formally trained in IR,” Mr. Long shared.

According to him, different industries also vary in their adherence to IR practices. “Companies in the financial, banking, and insurance sectors tend to have better IR practices compared to some other sectors like real estate or construction,” he added.

Looking ahead, the CEO believes there are still many challenges to overcome. He highlighted a notable weakness in the current IR landscape: “Only 10% of listed companies provide bilingual reports. This poses a significant barrier in attracting international investors.”

However, he also emphasized the emerging opportunities. “Post-COVID-19, virtual meetings and webinars have become more common. This enables companies to reach a wider range of investors at a lower cost,” Mr. Long explained.

When elaborating on the significance of effective IR, he outlined three key factors: transparency and accuracy of information, fairness in treating shareholders, and the ability to build long-term trust.

“We must not underestimate the importance of treating retail shareholders fairly,” Mr. Long stressed. “I’ve witnessed shareholder meetings where the management tended to favor large shareholders. This is an area that needs improvement because even a relatively minor negative comment on social media can significantly impact a company’s business operations.”

Opportunities from Market Upgrade and ESG Trends

Looking to the future, Mr. Long particularly hopes that effective IR practices will drive the upgrade of Vietnam’s market status and attract ESG investment trends.

Upgrading the market has been a persistent concern for both the government and the investment community. Vietnam has recently made strides toward this goal, such as the Ministry of Finance’s new circular related to pre-funding operations for foreign investors.

Mr. Long informed that Vietnam has already met 7 out of 9 FTSE criteria and 10 out of 18 MSCI criteria for emerging market status. “When this happens, we can attract billions of USD in foreign investment. Qatar and the UAE, after being upgraded, attracted $2 billion each, while Pakistan attracted $500 million,” he said.

Regarding the ESG trend, Mr. Long presented impressive figures: “Out of the approximately $140 trillion in assets under management (AUM) in the global investment fund industry, $35 trillion is flowing into ESG funds. This massive amount of capital can significantly alter the landscape of an industry.”

Mr. Long concluded, “IR is not just a bridge between a company and its investors; it is the key to optimizing shareholder value and fostering the sustainable development of the enterprise.”

“The Role of Private Sector Participation in Vietnam’s Infrastructure Projects on its Path to Becoming a Dragon by 2045”

“At a time when ambitious development goals demand extensive resources, attracting private investment is key to alleviating the burden on the state sector. This strategy is crucial for addressing the pressing need for infrastructure investment, particularly in transportation. By doing so, we can enhance the country’s economic competitiveness and improve the quality of life for its citizens.”