In September, VPBank, or the Vietnam Prosperity Joint Stock Commercial Bank, is offering interest rates on deposits ranging from 0.4% to 6.0% per annum.

The bank has introduced a range of interest rates corresponding to five tiers of deposit amounts: below VND 1 billion, from VND 1 billion to below VND 3 billion, from VND 3 billion to below VND 10 billion, from VND 10 billion to below VND 50 billion, and VND 50 billion and above.

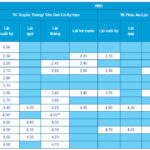

VPBank’s September Counter Deposit Interest Rates

For over-the-counter deposits, the interest rates offered range from 0.4% to 5.8% per annum.

Specifically, the interest rate for 1- to 3-week terms is set at

0.4%/year

, while the 1-month term offers a range of

3.5% to 3.7%

depending on the deposit amount. The interest rate for 2- to 5-month terms is

3.7% to 3.9%

, and for 6- to 11-month terms, it is currently

4.9% to 5.1%

. The 12- to 18-month term offers an interest rate of

5.4% to 5.5%

, while the 24- to 36-month term falls within the range of

5.7% to 5.8%

.

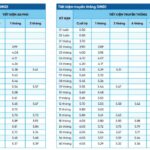

VPBank’s September 2024 Counter and Online Deposit Interest Rates

Source: VPBank

VPBank’s September Online Deposit Interest Rates

For online deposits, the interest rates offered are 0.1% per annum higher than counter deposits for terms of 1 month and above.

The 1- to 3-week term has a fixed interest rate of

0.4%/year

, while the 1-month term offers a range of

3.6% to 3.9%

. The 2- to 5-month term has an interest rate range of

3.8% to 4.0%

, the 6- to 11-month term is at

5.0% to 5.2%

, and the 12- to 18-month term is offered at

5.5% to 5.6%

. For the 24- to 36-month term, the interest rate is

5.8% to 5.9%

.

Additionally, VPBank offers a priority customer policy, where customers with a minimum deposit balance of VND 100 million and a minimum term of 1 month will receive an additional 0.1% interest rate on top of the current listed rates.

Thus, the highest interest rate offered by VPBank can reach 6.0% for priority customers who opt for online deposits of VND 10 billion and above for the 24- to 36-month term. For smaller deposit amounts, the maximum savings interest rate applied at VPBank is 5.9% per annum.

VPBank’s Latest Interest Rates for September: Which Term Deposit Offers the Best Returns?

In September, VPBank offered an attractive interest rate for online savings accounts with a term of 24 months or more.

A Bank Increases Savings Rates Across All Terms Starting Today, September 12th.

With the recent rate adjustment, NCB now offers a maximum savings interest rate of 6.15% per annum. This is currently the highest interest rate in the market for regular deposits.