Recognizing Listed Companies with Outstanding IR Activities in 2024

Ms. Bui Thi Thao Ly, Director of SSV Analytics Center, shares at the IR View Workshop

|

Ms. Ly stated that with the remarkable progress in information disclosure by listed companies in recent years, analysts have had increasing access to comprehensive and easily accessible information from these businesses, including financial data, business plans, and messages about core values from their leadership. This has enabled SSV to better understand these companies, contributing to enhanced analysis and forecasting accuracy.

In the past few years, SSV has received new inquiries and analysis requests from investors, research groups, and rating organizations regarding the level of commitment and practices related to sustainable development among listed companies. In particular, international institutional investors face challenges in evaluating and screening potential stocks in Vietnam for ESG investment themes, given the growing trend of “green” and responsible investing globally.

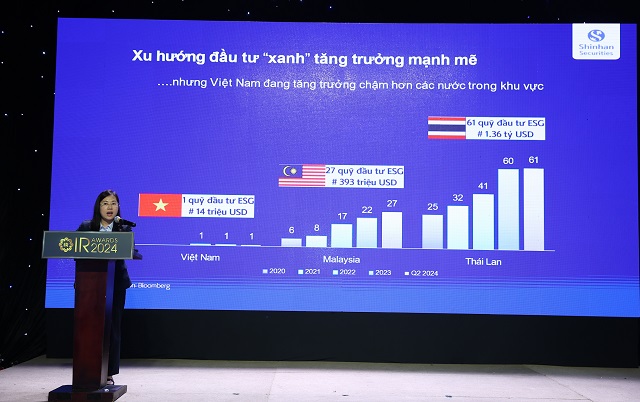

Statistics from Asia (excluding Japan, Australia, and New Zealand) show a significant increase in the number of ESG investment funds since 2020, concentrated in countries like China, South Korea, and Thailand. The total assets under management in these funds reached USD 58 billion as of Q2 2024, more than ten times higher than a decade ago.

However, it is unfortunate that Vietnam lags behind its regional peers, with only one ESG investment fund, fewer than neighboring countries like Malaysia and Thailand, which have witnessed a boom in recent years.

The positive outcomes in neighboring countries can be attributed to (1) mandatory requirements for sustainability reporting, (2) guidance on ESG information disclosure with quantitative metrics such as greenhouse gas emissions and reduction targets, and (3) the introduction of new policies, including tax incentives for ESG funds and investors to encourage participation.

While there are multiple reasons for Vietnam’s lag in the “green investment” space, according to SSV, the primary obstacle is the lack of comprehensive ESG data, which impacts the ability to screen investment opportunities effectively. Inadequate disclosure of information by companies committed to sustainable practices can lead to erroneous analyses and evaluations, negatively affecting their reputation.

According to Bloomberg’s statistics, only about 3% of listed companies on the HOSE have data available for evaluation, which is surprising given that a PwC survey found that 44% of listed companies in Vietnam have made ESG commitments and plans.

The level of ESG information disclosure currently meets just over 23% of the evaluation criteria, with many quantitative indicators still lacking. Specifically, environmental information disclosure stands at less than 10%, social information at 14%, and governance-related information is significantly higher at nearly 47%, indicating that governance ranking is a top priority for these businesses.

Even though the number of ESG investment funds in Vietnam is still limited, there are listed companies that have taken the lead in sustainability reporting and have successfully attracted global ESG funds. A notable example is VNM, which has attracted 300 foreign investment funds, including 126 ESG funds. This demonstrates how proactive ESG reporting can help listed companies access global ESG funds with substantial assets under management.

Ms. Bui Thi Thao Ly sharing at the IR View Workshop

|

According to Bloomberg Intelligence, the total assets of global ESG funds are estimated to be far greater than those in Asia, reaching USD 30 trillion in 2022 and projected to exceed USD 40 trillion by 2030.

Therefore, SSV believes that practicing sustainability reporting and comprehensive information disclosure, with attention to filling in the data gaps for analysis and ranking by domestic and foreign organizations, will significantly enhance the ability of Vietnamese listed companies to access global ESG investment funds.

In addition to attracting investment, other incentives for companies to embrace sustainability reporting include enhancing their image and reputation, improving competitiveness in the market, and attracting and retaining talented employees.

As a securities analyst at SSV, we look forward to seeing more listed companies embrace sustainability reporting with enhanced standards and are proud to play a role in conveying this information to investors through our analytical reports. We stand committed to supporting Vietnam’s journey toward the national Net Zero 2050 goal.

IR in the Green Era: Vietnam Enterprises’ “Greening” Strategy and Capital Attraction

Mr. Nguyen Thanh Long (HD Capital): IR Could Be the Key to Unlocking Billion-Dollar Investments in Vietnam

Huy Khai

Unlocking the Billion-Dollar Investment: Nguyen Thanh Long of HDCapital on the Power of IR for Vietnam’s Economy

After years of navigating the stock market, Mr. Nguyen Thanh Long, CEO of HD Capital Fund Management JSC, has witnessed a remarkable transformation in investor relations (IR).

Mrs. Bui Thi Thao Ly (SSV): ESG Disclosure Enhances Access to Foreign Capital

At the IR View workshop on ‘greening’, held as part of the IR Awards 2024 ceremony on the morning of September 24, Ms. Bui Thi Thao Ly, Director of the Analysis Center of Shinhan Securities Vietnam Co., Ltd. (SSV), represented the seller and shared her insights on attracting foreign capital through ESG disclosure.

Vietnamese businesses accelerating ESG implementation

ESG (Environmental – Social – Governance) practices have become increasingly prominent in Vietnamese businesses, as they navigate through the initial learning phase. The implementation of ESG principles is steadily gaining traction and proving to be more effective than ever before.