SLS currently has approximately 9.8 million shares outstanding and will need to pay out nearly VND 196 billion in dividends. The payment date is set for November 4, 2024.

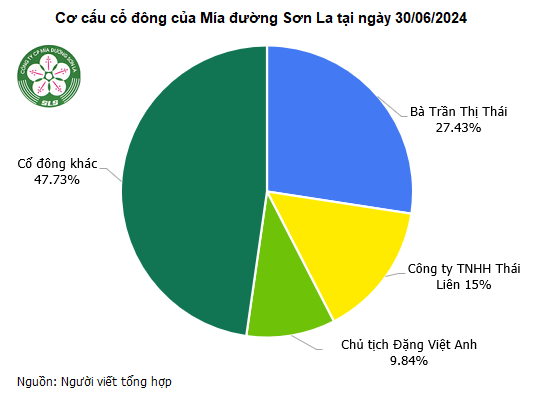

As of June 30, 2024, the group of shareholders related to Chairman of the Board of Directors Đặng Việt Anh held 52.27% of SLS shares, expecting to receive over VND 102 billion in dividends for this period. Among them, Trần Thị Thái (Việt Anh’s mother) owns 27.43% of the capital; Thai Lien Company owns 15% and Viet Anh owns 9.84%.

Thai Lien Company is a legal entity represented by Trần Thị Liên, Thai’s sister.

Since its listing on the HNX in 2012, Mia Duong Son La has never missed a year of dividend payments to its shareholders, with rates typically above VND 5,000/share. In the last three fiscal years, the company has paid out dividends above VND 10,000/share, reaching a record high of VND 20,000/share for the 2023-2024 fiscal year.

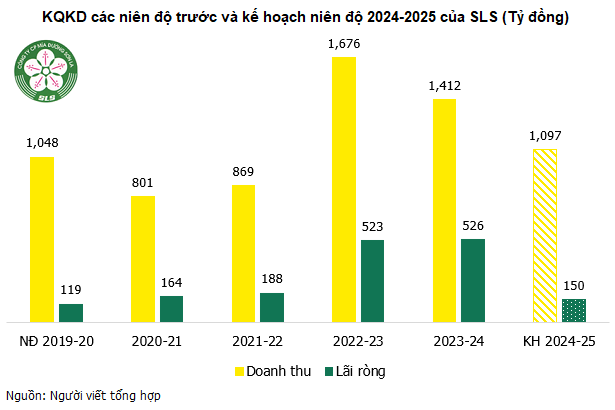

The company’s ability to pay out such high dividends is a result of its record profit of over VND 526 billion, surpassing its target by 284%, with an EPS of VND 53,754.

For the 2024-2025 fiscal year (July 1, 2024 – June 30, 2025), SLS aims for a revenue of VND 1,097 billion and a net profit of VND 150 billion, a decrease of 22% and 71%, respectively, compared to the previous year.

In the stock market, during the morning session of September 26, SLS share price traded around VND 200,400/share, an increase of over 39% compared to the beginning of the year.

|

SLS Share Price Movement since the Beginning of 2024 |

The Top 10 Universities with Revenue in the Thousands of Millions

As per the recent enrollment proposal and the ‘public transparency’ reports submitted by universities to the Ministry of Education and Training, 10 higher education institutions boasted impressive annual revenues exceeding 1,000 billion VND in 2023. Among these top-performing institutions, 6 were public universities, while 4 were private.