The soft drink industry report, launched by Coc Coc on September 19th, provides an insightful analysis of consumer trends, dynamics, and shopping habits across Northern, Central, and Southern Vietnam. Additionally, the data reveals factors influencing Vietnamese consumers’ choices when it comes to beverage brands.

Figure 1: Brand preferences across different regions in Vietnam

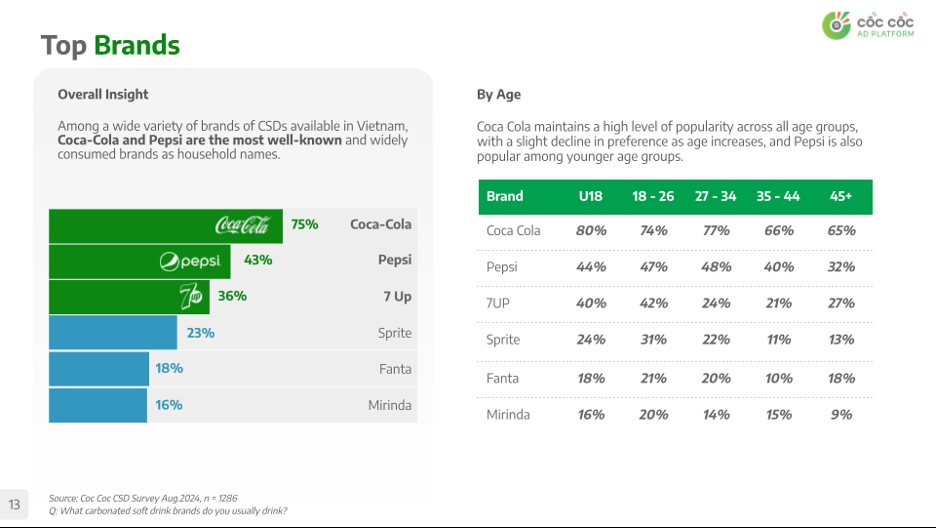

According to the survey data, the most popular brands among Vietnamese consumers include Coca-Cola, chosen by 75% of respondents, followed by Pepsi at 43%, and 7Up at 36%. The survey data also highlights the market share competition between the two arch-rivals, Coca-Cola and Pepsi, and other prominent brands in Vietnam:

When it comes to age groups, Coca-Cola maintains its popularity across all ages, while Pepsi captures a larger market share among younger consumers.

In terms of regional preferences, Coca-Cola is more popular in the North, whereas Pepsi is favored in Central and Southern Vietnam. 7Up and Mirinda are preferred in the South, whereas Sprite is more popular in the North.

Considering rural and urban areas, rural consumers opt for Coca-Cola, while Fanta and Sprite are more popular in urban areas. Pepsi, 7Up, and Mirinda show similar popularity across both regions.

Figure 2: Brand loyalty across different age groups in Vietnam

Brand loyalty varies significantly across age groups.

Notably, 44% of survey participants indicated a preference for familiar brands but are still open to trying new ones. However, 25% of consumers stated that they would only purchase their favorite brands. Older individuals tend to exhibit higher brand loyalty, sticking to one or a few select brands.

With an ever-expanding array of purchasing channels, consumers now have more diverse options than ever. Nonetheless, for carbonated soft drinks, offline channels remain dominant.

Specifically, 69% of participants opt for grocery stores, 53% choose supermarkets, and 49% favor convenience stores. While online channels are not yet widespread, 5% of consumers still purchase through e-commerce platforms or social media.

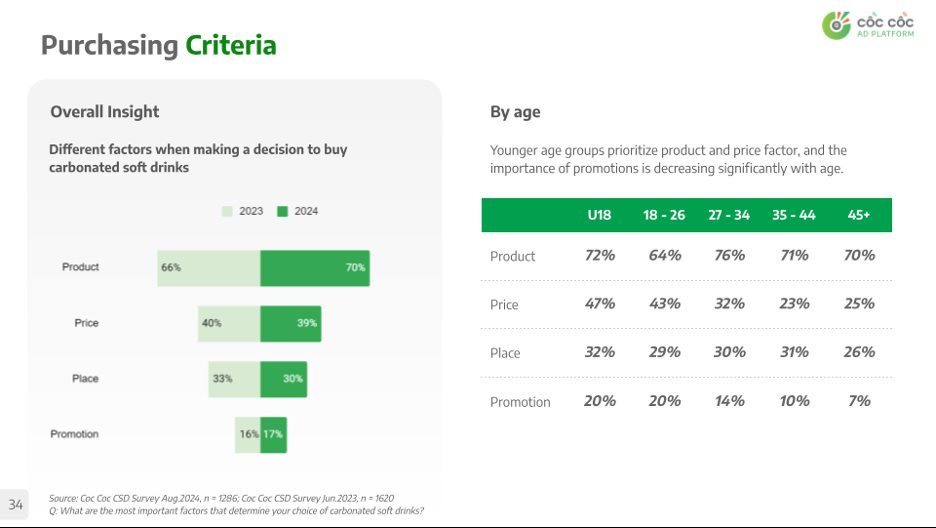

Analyzing consumer evaluations through the lens of the 4Ps (Product, Price, Place, Promotion), product-related factors (such as brand, packaging, and flavor) are deemed influential in purchasing decisions by 70% of consumers. Price ranks second, with 39% considering it a key factor, especially among those under 26 years old. Convenience and channel diversity are important to 30% of consumers, and 17% are attracted by promotions and discounts.

According to Vietnam’s Ministry of Industry and Trade, Vietnamese consumers, on average, only consume 23 liters of beverages per year, compared to the global average of 40 liters. This indicates a significant potential for growth in Vietnam’s beverage market. In 2023 alone, the industry generated a revenue of 8.25 billion USD and is projected to reach the 10 billion USD mark by 2027.

Only 30% of ‘Made in China’ EV users would buy another Chinese car, same fate could follow Vietnam if there’s nothing more than cheap prices

A survey by Differential Asia revealed that ‘customer retention’ is a subject that Chinese EV makers still have a lot to learn from.

Retail market recovery in 2024: How far will it go?

There is a need for collaboration among various levels and sectors to boost retail demand and contribute to economic development.