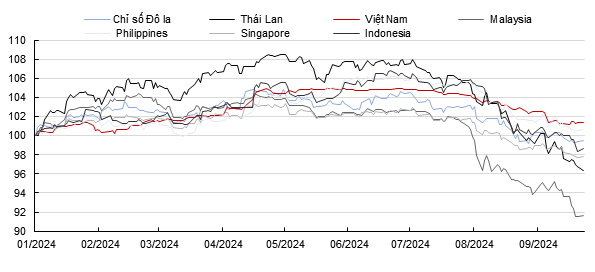

Impact on Exchange Rates and Monetary Policy

The Fed’s 0.50% interest rate cut will help stabilize the VND/USD exchange rate. Previously, when the Fed maintained high-interest rates, it inadvertently increased investors’ and businesses’ demand for holding USD. As a result, holding USD could yield higher interest rates compared to holding VND. This created pressure on the VND/USD exchange rate. But with this interest rate adjustment, the USD will depreciate against other currencies, including the VND. Therefore, the exchange rate may decline significantly.

Additionally, when the exchange rate shows a downward trend, it allows the State Bank of Vietnam (SBV) to apply a more flexible monetary policy to support the economy. Specifically, in the previous period, to reduce pressure on the VND/USD exchange rate, the SBV had to increase the interbank interest rate to narrow the real interest rate differential between USD and VND. This helped reduce the demand for USD and ease the pressure on the exchange rate. However, this interest rate increase also inadvertently put pressure on the SBV’s economic support policies. Now, with reduced exchange rate pressure, the SBV will have more tools to support the economy. Specifically, the SBV can cut short-term capital costs by lowering interest rates on short-term refinancing contracts.

|

Exchange Rate Trends of Some Regional Currencies Against the USD

Source: Bloomberg. Note: Exchange rates are normalized to a value of 100 as of December 31, 2023

|

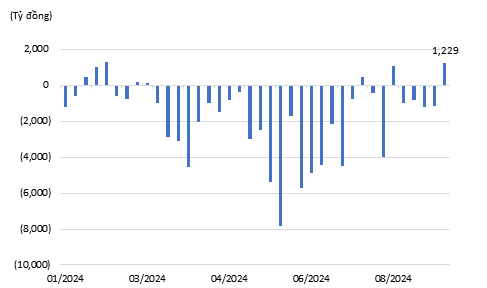

Capital Inflows into Vietnam

The Fed’s rate cut also encourages FDI (Foreign Direct Investment) businesses to convert USD to VND. These enterprises have both revenue and expenses in USD and VND, and to maximize profits, they often calculate their position between the two currencies. When the Fed maintained high-interest rates, these businesses would hold capital in USD to take advantage of the higher interest rates. However, with the Fed’s rate cut, (1) the interest rate on USD positions is no longer as attractive as before, and (2) the USD is likely to depreciate against other currencies. This makes holding USD less appealing. Therefore, FDI enterprises will tend to shift this capital into Vietnam. This can increase the foreign currency supply and further strengthen confidence in the VND.

Additionally, with the previously high-interest rates, the interest rate differential between USD and VND was significant, so indirect capital tended to shift towards USD in search of higher profits. Now, with reduced exchange rate pressure due to the Fed’s rate cut, foreign capital is encouraged to return. This will not only help the stock market recover but also attract more foreign investment.

|

Net Buying/Selling Value of Foreign Investors in the Stock Market

Source: Fiinx

|

Impact on Export Industries

The impact of interest rate reductions on exports can be complex. Typically, when the USD adjusts, it puts pressure on exports to the US market, as Americans have to spend more to buy foreign goods. However, the story may be different for Vietnam.

Vietnam’s key export industries tend to import raw materials from abroad for production or processing and then export the finished products. This activity creates both USD-denominated income and expenses but with different timing. With a declining exchange rate, there may be an advantage in reducing the cost of purchasing raw materials from abroad, but it also puts pressure on export demand as selling prices increase. This impact can be challenging to predict.

Additionally, for American consumers, the Fed’s decision to lower borrowing rates reduces the cost of purchasing goods in the US (as financial costs decrease). This increases consumer demand in the US market. Meanwhile, the US is Vietnam’s largest export market. Therefore, export demand to this market may increase, promising a bright future for key industries.

Tran Truong Manh Hieu

Sure, I can assist with that.

## Aiming High: Targeting a Top 100 Asian Ranking for 2-3 Vietnamese Banks by 2025

Prime Minister Pham Minh Chinh has instructed the banking system to implement a strategy of “6 increases, 6 decreases, 6 accelerations, and breakthroughs” to propel the country’s development forward. With this initiative, Vietnam aspires to have at least 2-3 commercial banks ranked among the top 100 strongest banks in the Asian region by the end of 2025.