ACB’s ESG journey begins with a contemplation: “What do we leave for posterity?”

Opening the workshop, Mr. Tran Vu Hien – Director of Finance Division of Asia Commercial Joint Stock Bank (HOSE: ACB) mentioned the bank’s “greening” journey over the past 10 years.

According to Mr. Hien, this journey started from the contemplation of Chairman Tran Hung Huy: “What do we leave for posterity?”. From there, ACB, in its role as a financial institution, affirms that money is not the most important thing, but the foremost goal is to leave an intact planet for future generations.

Mr. Tran Vu Hien – Director of Finance Division of ACB speaking at the IR View Workshop

|

Mr. Hien shared that at the time Mr. Tran Hung Huy started his role as Chairman, ACB conducted a survey on the level of employee interest in the environment, with 90% of the answers being “not interested”. But in the past 10 years, ACB has gradually succeeded in changing this view.

“In trips, teambuilding, etc., ACB employees always orient their activities towards environmental protection such as cleaning up the beach, planting trees, etc., or in daily activities, ACB is also gradually greening through the use of no plastic water bottles, no plastic waste, office carpets are made from recycled fishing nets, energy-saving glass doors. It can be seen that greening starts with very small actions,” said Mr. Hien.

The journey of the past 10 years is the first step for ACB to change itself, towards a greener future. Going forward, the bank wants to work with all shareholders, partners, and peer banks to jointly implement ESG.

“ACB does not aim to be the leading bank in ESG, but hopes to become an inspiration for everyone to work together,” shared Mr. Hien.

ACB has a green credit package worth more than VND 2,000 billion deployed at the beginning of this year, which has been fully disbursed, and will be extended to help ACB’s customers continue to go green.

This credit package is not only for green businesses but also for non-green businesses and sectors to become greener, such as improving wastewater and air treatment systems and introducing more energy-efficient production lines. Enterprises that meet ACB’s green criteria can get very preferential loans.

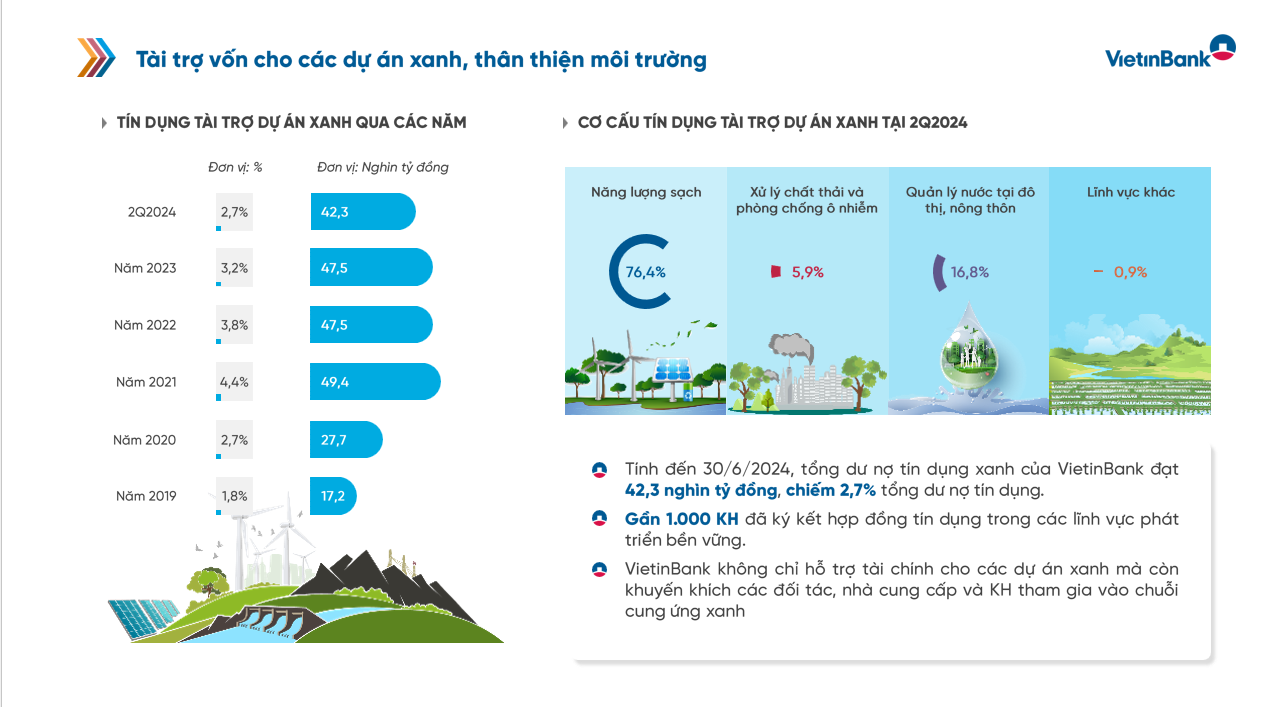

VietinBank uses a 42.3 thousand billion package to finance green projects and encourages partners, suppliers, and customers to join the green supply chain

Next, Mr. Vuong Huy Dong – Deputy Secretary of the Board of Directors and Head of Investor Relations of Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank, HOSE: CTG) shared about the bank’s IR practices in the era of digitalization and greening.

According to Mr. Dong, since 2009, the bank has established an IR department, and since 2014, the IR department has been organized under the Board of Directors’ Secretariat under the Board of Directors’ Office. The IR department directly advises the Board of Directors, directly reflects the information from shareholders and receives directions from the Board of Directors, so the activities are continuously updated and reflected to investors in the fastest way.

Mr. Vuong Huy Dong – Deputy Secretary of the Board of Directors and Head of Investor Relations of VietinBank

|

VietinBank’s IR activities comply with legal regulations, ensure the interests of shareholders, and integrate communications into financial activities. VietinBank does not discriminate between large and small shareholders, and all shareholders can access information in both Vietnamese and English.

IR also participates in sustainable development activities to help shareholders better understand sustainable development at VietinBank. The bank clearly understands that a business that is responsible to the community and the environment is an attractive business to investment funds, especially funds with ESG elements. VietinBank combines the sustainable development report into the annual report, updating the latest information to convey to investors.

In addition, VietinBank often attends conferences and forums. Communication activities also provide information about sustainable development to domestic and foreign investors.

VietinBank signed a cooperation agreement with MUFG at the COP28 Conference to arrange a $1 billion package for sustainable development projects.

The bank has committed a package of green deposits and green finance worth VND 5,000 billion at preferential interest rates for sustainable development.

VietinBank’s total green credit balance reached VND 42.3 thousand billion, accounting for 2.7% of total credit balance, with nearly 1,000 customers. The bank not only provides financial support for green projects but also encourages partners, suppliers, and customers to join the green supply chain.

|

PAN Group and the journey to “green” the supply chain

Another enterprise that also pays great attention to green criteria is PAN Group (HOSE: PAN). Speaking at the IR View Workshop, Mr. Nguyen Hong Hiep – Director of External Relations of PAN Group, shared about the group’s journey to “green” the supply chain more than 10 years ago.

Mr. Nguyen Hong Hiep – Director of External Relations of PAN Group speaking at the IR View Workshop

|

“Our journey to ‘green’ started in 2012 when the company shifted its focus to agriculture and food,” said Mr. Hiep. This vision is not only about developing the business but also about aiming to enhance the position of Vietnamese agricultural products in the world market.

Mr. Hiep pointed out a paradox: “Although Vietnam ranks high in agricultural export rankings, it ranks quite low in terms of position in the value chain, quality, and added value, especially for branded products”. Realizing this, the PAN Group’s leaders set a goal to invest in like-minded enterprises and participate deeper in the value chain.

Currently, PAN Group’s revenue is mostly from exports, contributing 50%, mainly to European markets, the US, and smaller markets such as Canada, Australia, and South Korea.

“To achieve this, we have to build a very strict production process, meeting international standards, especially sustainable development criteria,” emphasized Mr. Hiep.

In the context of ESG (Environment, Society, and Governance) being increasingly emphasized, especially after the Government’s commitment to net zero emissions by 2050 at COP26, PAN Group has been well prepared. In 2015, when the United Nations announced 17 sustainable development goals by 2030, PAN Group quickly set 9 private goals, focusing on sustainable consumption, production, and supply chain.

“To achieve the goal, PAN Group must establish a sustainable management system, which is correct from the beginning,” said Mr. Hiep.

“We started publishing separate sustainable development reports from 2015 and are one of the few pioneering enterprises to do so. This helps us to approach international investors very well,” Mr. Hiep shared proudly.

PAN Group not only applies these principles to itself but also encourages its member companies to orient themselves towards sustainable development. Depending on the level and listing status, member companies are required to publish sustainable development reports or have transparent internal reports.

PAN Group’s sustainable management model is organized formally with 3 levels: the Sustainable Development Subcommittee under the Board of Directors, the Steering Committee for Sustainable Development, and the specialized unit for Sustainable Development. This structure ensures the implementation of the sustainable development strategy from the highest level to each member unit.

“It can be said that PAN Group has been relatively successful in ‘greening’ its supply chain. We have gone through a formal process, overcome many difficulties and challenges, and are increasingly being recognized,” said Mr. Hiep.

VNM’s IR activities are built on 4 main pillars

Next is the story “Managing IR activities in enterprises” by Mr. Dong Quang Trung – Head of Investor Relations of Vietnam Dairy Products Joint Stock Company (Vinamilk, HOSE: VNM).

VNM is a listed company that has been honored with the IR Awards for 8 years in the period of 2011 – 2023. According to the Head of VNM’s IR, the IR model at VNM is built on 4 main pillars: transparency, accessibility, engagement, and crisis management.

Mr. Dong Quang Trung – Head of Investor Relations of VNM speaking at the IR View Workshop

|

With the first pillar, VNM understands that transparency is the foundation of trust. Provide information through various forms such as financial reports, annual reports, press releases, and all information is provided in both Vietnamese and English to ensure the rights and interests of domestic and foreign shareholders. VNM’s annual report is always among the top voted in the voting session held by the Ho Chi Minh City Stock Exchange.

VNM always complies with the information disclosure regulations. Disclosure of information on the website not only helps investors understand but also helps the company’s internal departments understand about information disclosure. In the process of information disclosure, a lot of information is provided by other specialized departments, if these departments do not understand, they will not be able to comply with the information disclosure regulations.

The next pillar is accessibility. VNM understands that time is valuable, so the company builds a system for investors to easily access VNM’s information and download it. Towards going beyond information disclosure, the company also discloses many diverse documents for investors. These documents are updated regularly every quarter to ensure that investors have the most accurate information about the business.

Determining that IR is a two-way process, VNM pays great attention to the third pillar, which is engagement. VNM always applies online meetings so that investors can participate in the company’s meetings. Previously, the company’s AGM had about 400-500 investors attending. This number increased to 1,300 investors thanks to the online organization. Online organization helps shareholders to easily participate. The number of 1,300 is still modest, and VNM will try to do better.

VNM conducts surveys with shareholders through the company-managed email list. VNM also invites investors to participate in quarterly meetings with the Executive Committee.

Crisis management is the pillar to protect the interests of investors. VNM uses crisis communication management systems. Every day, the system will send emails to manage information on social media and the internet. If there is any discrepancy, it will work with the communications and public relations department to rectify the information through communication channels.

Mr. Trung also shared about VNM’s approach to institutional investors.

Specifically, foreign investors are very interested in VNM, and currently, the company’s shareholder list has 500 foreign investors, including 300 investment funds. Every year, VNM still allocates resources to attend 10 investment events to attract capital in key markets such as Singapore, the UK, the US, and Hong Kong.

Currently, international investors are very interested in ESG. An important practice is that VNM is invited to participate in ESG rankings. Participation will help investors to easily assess. VNM has participated in the CDP ranking and has been positively assessed. In the future, VNM will try to participate in more rankings.

In addition, VNM also provides a lot of specific information about macro and industry issues to institutional investors. Investors are very interested in this information and often ask VNM.

“Vietnam and the EU to Discuss Pathways to a Green Future at GEFE 2024”

At GEFE 2024, pivotal discussions will revolve around pivotal topics that propel us towards a sustainable future: climate resilience, digital transformation for green finance, and sustainable energy transition. These are the key drivers for Vietnam to achieve its Net Zero target by 2050.

The Power of Words: Illuminating the ‘Station of Hope’ for Community Champions

The Human Act Prize 2024, an initiative by Nhan Dan Newspaper, was recently unveiled at the Sheraton Hanoi West Hotel. Building on the success of its inaugural edition, this year’s award continues to seek out and honor the selfless dedication and commitment of individuals and organizations across Vietnam.

“Elevating Ho Chi Minh City’s Intrinsic Capabilities: Enhancing International Collaboration for Industrial Transformation”

Industrial transformation is not just an option but an urgent necessity for Ho Chi Minh City. In this journey, the City must foster intrinsic motivation and seize global trends to propel itself forward.