The entire Hapaco team steps down, with the IT Deputy Room taking over as Chairman of the Board

The extraordinary general meeting held on September 21st approved the new list of members for the Board of Management and Supervisory Board for the 2021-2026 term, based on a list of eight candidates, including five candidates for the supplementary election of members of the Board of Directors and three candidates for the supplementary election of members of the Supervisory Board.

The list of five new Board members includes Mr. Ninh Le Son Hai, Mrs. Ly Thi Thu Ha, Mr. Le Ngoc Hai, Mr. Chu Viet Ha, and Mrs. Nguyen Thi Mai.

|

At the time of nomination, two members were holding positions at Haseco, including Mr. Ninh Le Son Hai, who was the IT Deputy Room, after spending his entire previous career at FPT IS Joint Stock Company, with the highest position held being Director of the Digital Finance and Banking Center from March 2019 to September 2024.

Mr. Hai is also known for his role as Deputy Project Manager for the HOSE trading floor overload treatment project in 2021.

The new Board member who is currently serving at Haseco is Mrs. Ly Thi Thu Ha, who holds the position of Director of the Enterprise Financial Advisory Block.

Of the remaining three members, Mr. Le Ngoc Hai is the Executive Director of VNHealthcorp One Member Co., Ltd .; Mr. Chu Viet Ha is the Chairman of the Board of Csell Global Joint Stock Company, Permanent Vice Chairman of the Board of Directors and Deputy General Director of Ravi Tourism Investment and Development Joint Stock Company; Mrs. Nguyen Thi Mai is the General Director of Ha My Consumer Goods Distribution Joint Stock Company.

In the new list, the Board of Directors of Haseco met and elected Mr. Ninh Le Son Hai as Chairman of the Board of Directors and legal representative, replacing Mr. Vu Duong Hien, who had resigned.

The list of three new Supervisory Board members includes Mr. Pham Minh Hieu, Mr. Nguyen Trung Kien, and Mr. Le Tuan. Of these, two are holding positions at EP Advisory JSC, including Mr. Le Tuan as Executive Director and Mr. Pham Minh Hieu as Senior Investment Banking Officer; Mr. Nguyen Trung Kien is currently an employee of the Finance and Planning Department of Almath Law Company Limited.

In the opposite direction, the General Meeting of Shareholders approved five resignations of members of the Board of Directors, including Mr. Vu Duong Hien (Chairman), Mr. Vu Xuan Thuy (Vice Chairman), Mr. Doan Duc Luyen, Ms. Nguyen Thi Nguyet and Ms. Vu Thi Thanh Nga.

The General Meeting of Shareholders also accepted the resignations of three members of the Supervisory Board, namely Ms. Nguyen Thi My Trang (Head of SB), Ms. Doan Thi Thuy and Ms. Khoa Thi Thanh Huyen.

|

Old Board of Haseco

Source: Haseco Website

|

|

Old SB of Haseco

Source: Haseco Website

|

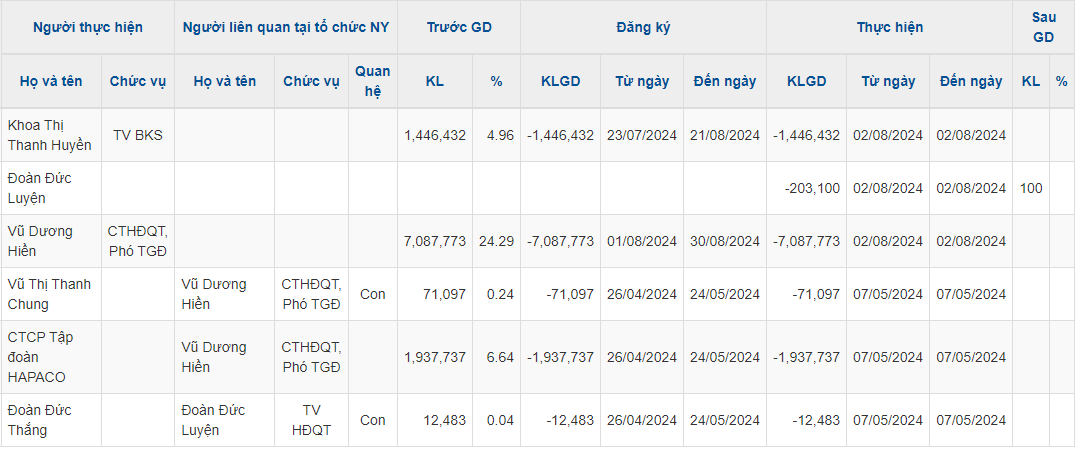

In the list of former members, recently, Mr. Hien, Mr. Luyen, and Ms. Huyen sold all the HAC shares they held in July and August. Mr. Hien and Mr. Luyen are also known as Chairman and Member of the Board of Directors of Hapaco Joint Stock Company (HOSE: HAP) – the organization that recently divested from HAC in May.

Not only that, in May, Mr. Doan Duc Thang – son of Mr. Luyen and Ms. Vu Thi Thanh Chung – daughter of Mr. Hien also sold all the HAC shares they owned by agreement.

With the above moves, it can be seen that members related to the Hapaco Group have withdrawn from Haseco, after consecutively divesting earlier.

|

Recent capital divestment transactions at Haseco

Source: VietstockFinance

|

Private placement of 100 million shares, capital increase by 4.4 times

The General Meeting of Shareholders also approved the plan to privately place 100 million shares directly to professional securities investors, with the entire amount restricted from transfer for 1 year from the date of completion of the offering.

The issuance is expected to take place in 2024 or Q1 / 2025 depending on the actual situation. If successful, Haseco will increase its shares to 129.2 million units, equivalent to a charter capital of VND 1,292 billion, 4.4 times higher than currently.

At a price of VND 11,000 / share, Haseco expects to raise VND 1,100 billion, of which 50% will be used to supplement capital for the provision of advance sales services, margin trading, and other activities; 30% will supplement securities proprietary trading activities, investment in securities on the market; the remaining 20% will be used to supplement investment in infrastructure development, system development, working capital supplement, and other legal activities.

Huy Khai