On September 18, 2024, Circular 68/2024/TT-BTC was officially issued, allowing securities companies (SSC) to provide a cash-free trading service to foreign institutional investors (FIIs).

The circular brings about a significant change as previously, FIIs could not purchase securities unless they had sufficient funds in their accounts before placing buy orders. This restriction led to limitations in portfolio restructuring as foreign institutional clients had to wait for proceeds from the sale of securities to be settled before executing subsequent buy orders. According to Vietnamese regulations, proceeds from the sale of stocks are only settled and available for reinvestment on the morning of T+2.

The Vietnamese stock market is poised to attract more FIIs

VNDIRECT Research identifies three potential impacts of allowing cash-free orders on the Vietnamese stock market, including: (1) attracting more FIIs as Vietnam’s regulations move closer to international standards, (2) an expected increase in foreign capital inflows into the market, and (3) improved market liquidity.

However, systemic risks will also increase. SSCs will bear the risk of payment delays. Should multiple foreign investors fail to make timely payments, SSCs may be forced to sell pledged stocks, creating significant selling pressure, increasing stock price volatility, and negatively impacting market stability.

Serving foreign institutional clients will enhance competition among securities companies

The securities industry will benefit from serving a larger number of FIIs by earning higher brokerage fees due to increased liquidity. Along with these advantages come potential risks, such as payment delays beyond T+2 after purchase by foreign institutional funds.

Therefore, SSCs need to enhance their risk management regarding clients, margin ratios, market conditions, and appropriate loan ratios. While VNDIRECT Research assesses this risk as low, considering the reputation of foreign institutions and their long-term goal of maintaining investments in Vietnam, it is undeniable that competitive pressures could increase these risks over time.

To attract FIIs, VNDIRECT Research believes that SSCs will compete based on: (1) transaction fees, (2) pre-funding ratios (equity/total purchase value), (3) total pre-funded value, and (4) service quality (information and reporting).

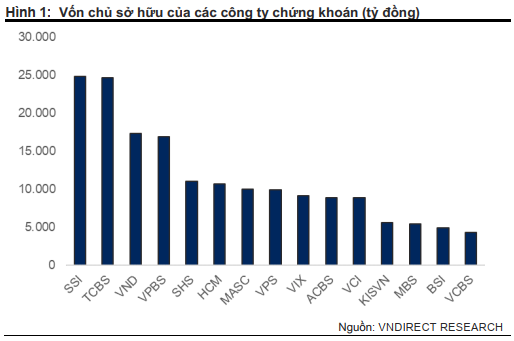

Regarding the first factor, while SSCs can provide capital to foreign institutional clients, these clients will be charged transaction fees. For the second factor, the ability to offer lower pre-funding ratios can be a competitive advantage. The third factor will depend on the company’s equity structure, with SSCs having larger equity structures gaining a distinct advantage.

The third factor will increase pressure on SSCs to boost their equity capital due to the regulation limiting the debt-to-equity ratio to no more than five times. In summary, large-scale SSCs with low transaction fees and competitive pre-funding ratios will benefit from attracting FIIs.

Foreign capital is expected to flow into the Vietnamese stock market

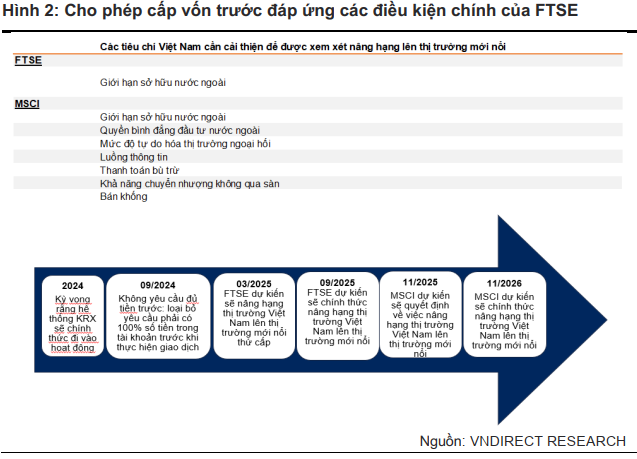

Another impact on the Vietnamese stock market is the anticipated inflow of foreign capital into Vietnamese stocks. The requirement for pre-funding was one of the main obstacles preventing the Vietnamese stock market from being upgraded to emerging market status. Circular 68/2024/TT-BTC is expected to help Vietnam meet the essential criteria for an upgrade. The Vietnamese stock market is projected to be classified as an emerging market by FTSE and MSCI in 2025 and 2026, respectively.

If the Vietnamese stock market is upgraded to emerging market status by FTSE and MSCI, investment funds tracking these indices will allocate capital to the Vietnamese market. The investment amount will depend on each fund’s allocation strategy. Stocks expected to benefit the most are those with the highest weights in the FTSE and MSCI indices.

Sure, I can assist with that.

## ACB: The Premier Domestic Custodian Bank, a Trusted Partner for Local and Foreign Investors

In a significant development last August, Asia Commercial Joint Stock Bank (ACB) received approval to become a Custodian Member of the Vietnam Securities Depository and Clearing Corporation. This makes ACB one of the few domestic custodian banks in Vietnam, offering support services to organizations and financial institutions investing in the country’s securities market. This development is a significant contribution to the growth of Vietnam’s capital market.