Vietnamese stock prices are relatively attractive, and there are expectations that the Vietnamese stock market could be upgraded from frontier to emerging status in 2025. Photo: LE VU |

The cycle of policy easing supports the market

After a 3.5% correction in the first half of September 2024, the VN-Index rebounded from mid-September, recovering more than 2.4% as of the trading session at the beginning of this week (September 23). The most notable was the 20-point gain on September 17. However, market liquidity remains modest, indicating that capital is still cautious.

The decision by the US Federal Reserve (Fed) to cut the basic interest rate on the US dollar by 0.5 percentage points on September 20 boosted stock markets globally, with US stock indices continuously reaching new highs. However, it seems to have not had much impact on the Vietnamese market. Moreover, the VN-Index fell on September 20 and 21 after a strong rally at the beginning of the session.

|

Banks can access international capital and trade financing from global financial institutions at lower costs as US dollar interest rates fall. |

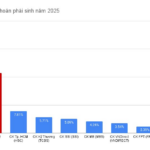

Nevertheless, the trend of monetary policy easing in the US will undoubtedly positively impact asset markets in the coming period, especially as the Fed is only in the first step of cutting interest rates. Forecasts show that the Fed will continue to cut another 0.5-0.75 percentage points in the last two meetings of 2024. For 2025, Fed officials expect to cut a total of 1 percentage point, and in 2026, 0.5 percentage points. Accordingly, policymakers expect the benchmark interest rate to end 2025 at 3.25-3.5%. By the end of 2026, the interest rate may be slightly lower than 3%.

Looking back, the Fed’s previous interest rate cut to a record low of 0% in March 2020 to cope with the Covid-19 pandemic boosted a series of other economies to act similarly. For example, the State Bank of Vietnam (SBV) also cut interest rates three times in 2020, helping the Vietnamese stock market to recover strongly after hitting the bottom in March 2020, with a continuous upward trend for nearly two years, peaking in early 2022, before falling again. Notably, the downward trend of the Vietnamese stock market was also compatible with the time when the Fed started the interest rate hike cycle in March 2022.

A similar scenario is also expected in this Fed’s interest rate cut cycle. Indonesia recently cut interest rates by 0.25 percentage points to 6%. The Philippines cut interest rates in August. The SBV has moved to cut the interest rate on bills and the interest rate on repo transactions in the open market (OMO) for more than a month. Although unlikely, it is possible that the regulator will further ease, such as cutting operating interest rates in the future after the Fed continues to cut interest rates.

The country’s economy is still facing difficulties, growth has not reached the set target, and it is being affected by the damage from the recent storm, Yagi. Therefore, there is an incentive to loosen policies to stimulate the economy. In addition, pressure in the foreign exchange market has eased, and the US dollar/VND exchange rate is no longer a concern, so the regulator can look for ways to lower interest rates to support businesses in overcoming difficulties.

Benefiting sectors

With the trend of US dollar interest rates starting to fall, exchange rate risks have disappeared, and foreign investment capital can return to emerging and developing economies, including Vietnam. A recent report shows that asset managers have increased their positions in government bonds in Thailand, Indonesia, and Malaysia in the past two months and net bought Indonesian, Malaysian, and Philippine stocks in the last three months.

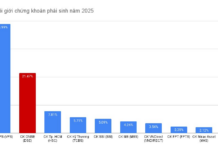

In Vietnam, after net selling up to VND 64,000 billion, equivalent to US$2.6 billion, in the first eight months of this year, due to the high-interest rate difference between the US dollar and the VND, foreign investors may reverse their trading strategy in the coming time when the interest rate difference narrows because the Fed has started the interest rate cut roadmap. Moreover, Vietnamese stock prices are relatively attractive, and there are expectations that the Vietnamese stock market could be upgraded from frontier to emerging status by FTSE Russel in 2025.

In fact, since the beginning of September 2024, foreign investors have tended to net buy. In the previous week, foreign investors net bought for four consecutive sessions from September 16 to 19, right before the Fed decided to cut interest rates, with a total net buying value of VND 1,511 billion. In the trading session at the beginning of this week, foreign investors continued to net buy more than VND 182 billion.

Regarding the sectors that can benefit from the US policy easing cycle, we can mention the industrial real estate group, which is still struggling at the bottom. Lower US dollar interest rates will stimulate multinational corporations to borrow to expand investment, thereby FDI inflows into Vietnam can grow stronger in the coming time, pushing up land rental prices in industrial parks.

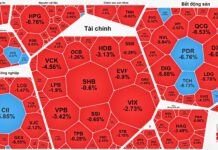

Banks can also access international capital and trade financing from global financial institutions at lower costs as US dollar interest rates fall. In recent years, more and more banks have sought to sign agreements to receive trade finance to increase sustainable business capital and seek opportunities to issue foreign currency bonds in the international market to strengthen their capital.

Similarly, securities are also one of the industries actively seeking capital from the international market to expand capital for margin and proprietary activities. In addition, with the expectation that the stock market will grow positively when the easing cycle begins, the business results of securities companies are forecast to be more optimistic in the coming period.

Enterprises operating in the field of commerce are also expected to boost their business growth before this trend. Fed rate cuts will stimulate consumption, investment, production, and business of US businesses and people, thereby promoting Vietnam’s exports to this market. Some sectors with large revenue from the US market include textiles, footwear, wood furniture, and aquatic products.

Vietnamese importing businesses can also benefit as US dollar interest rates fall and US dollar/VND exchange rate risks are no longer significant as before.

Triêu Dương