Illustration. Source: NLD.

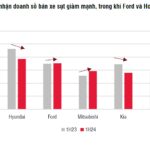

In recent years, Vietnam’s automotive industry has been undergoing a significant transformation as the demand for car ownership continues to rise. According to data from the Vietnam Automobile Manufacturers’ Association (VAMA), vehicle sales in 2023 increased by over 30% compared to the previous year, indicating a clear shift in consumer trends.

A recent report by the Coc Coc browser and search engine on the automotive market in Vietnam provides an overview of consumers’ car-buying trends in 2024, while also analyzing the factors influencing their purchasing behavior.

According to the Coc Coc survey, most consumers intend to buy cars for long-term use. Specifically, in 2023, 49% of car buyers expressed their intention to use the car for at least 12 months, and this percentage increased to 58% in 2024.

The intention to buy a car has not changed much in the past two years. The majority are first-time car buyers, accounting for nearly 60%. The remaining respondents are evenly split between those looking to replace or upgrade their current car and those wanting to purchase an additional car. According to 2024 data, the percentage of each group is 20% and 22%, respectively.

When it comes to choosing a vehicle, 78% of consumers prefer buying new cars over used ones. More than 60% of respondents indicated that they would choose a 4-5 seater vehicle. Meanwhile, 41% opted for 7-seater cars, and only about 6% chose larger vehicles.

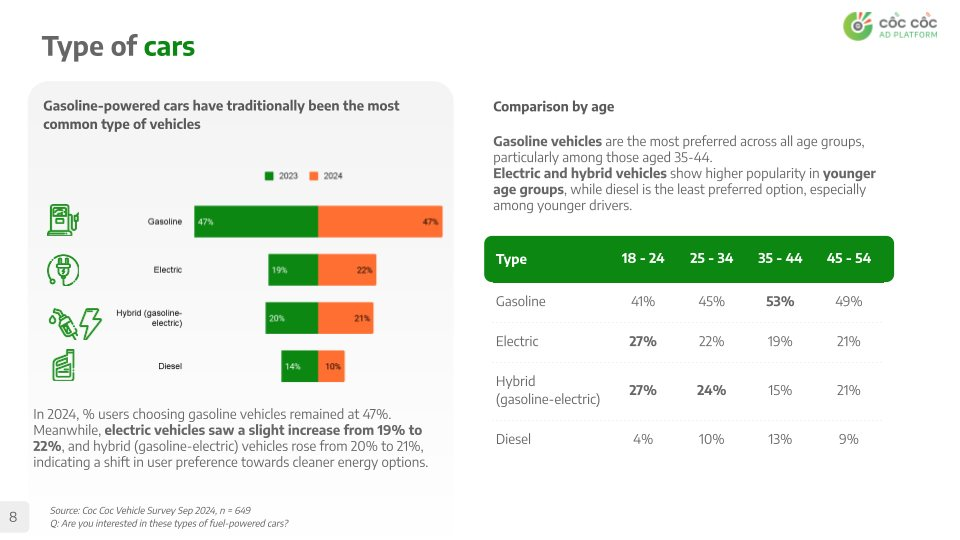

The survey also revealed that traditional gasoline-powered vehicles remain the most popular choice in the market with a percentage of 47%. Additionally, electric cars are gaining popularity, increasing from 19% to 22% in 2024. The preference for hybrid vehicles has also increased by 1% compared to the 2023 survey results.

” This shift indicates a growing consumer interest in environmental factors. They are opting for vehicles that use cleaner energy sources instead of traditional fuels ,” Coc Coc assessed.

Survey on car preferences by type of engine and age group. Source: Coc Coc.

The choice of vehicle type varies with age. Gasoline-powered cars are the most popular across all age groups, especially among those aged 35-44, with a percentage of 53%. Electric and hybrid cars are more favored by younger age groups, with both options receiving 27% among 18-24-year-olds. Diesel-powered cars are the least popular choice, particularly in the 18-24 age group, with only 4%.

Additionally, the survey found that over one-third of consumers have a special preference for SUVs due to their versatile design and agile maneuverability. This vehicle segment remains the top choice in 2024, with a percentage of 36%, while sedan and other car segments have declined.

In terms of brands, the top three choices are Toyota, Honda, and Ford. These are well-established and trusted automakers offering a diverse range of models from sedans to SUVs and trucks, catering to various customer segments. Luxury brands such as Mercedes-Benz and Audi are also popular choices due to their high-quality, advanced technology, and elegant designs.

Consumers’ car-buying decisions are influenced by various factors, including budget, brand reliability, safety features, and advanced technology. All these aspects play a crucial role in guiding consumers toward making suitable choices. The ideal budget that consumers are willing to spend on a car falls between VND 450 million and VND 600 million, accounting for 22%. More luxurious car segments priced above VND 2 billion account for a small percentage of only 12%.

The survey highlights that family needs have a significant impact on car-buying decisions, increasing from 52% in 2023 to 62% in 2024. Other factors such as personal needs and financial conditions also influence their choices, accounting for 36% and 29%, respectively.

Furthermore, safety features and vehicle attributes are the two most critical criteria, with over half of the respondents prioritizing them. This is followed by brand reputation and pricing, accounting for nearly 40%.

The Motorization of Vietnam: A Nation on the Move

A nation’s development is often reflected in its motorization rate. Vietnam is no exception, with a rapidly growing economy and a burgeoning automotive industry. The statistic speaks for itself: for every 1,000 people, there are now 63 automobiles on Vietnamese roads.

The Vietnamese automotive market holds significant growth potential from 2024 to 2030, based on the premise that a country is considered to enter the “motorization” stage when it reaches an average of over 50 cars per 1,000 inhabitants. With a population of over 90 million and a rapidly growing economy, Vietnam is poised to become a key player in the regional automotive industry. This potential has not gone unnoticed by global automakers, who are increasingly viewing Vietnam as an attractive destination for investment and expansion. As a result, the Vietnamese automotive market is expected to witness substantial development in the coming years, offering a plethora of opportunities for both local and international players.

The Domestic Auto Industry Under Threat

The imported car market is booming, and it’s outpacing the domestic automotive industry. But why are consumers increasingly opting for imported vehicles over locally-assembled cars? This intriguing trend warrants further investigation, as it could significantly impact the automotive landscape in the country.