The VN-Index rose by 0.31% to close at 1,291.49 points at the end of the trading session on September 26, 2024. The total trading value on the 3 exchanges reached VND 24,009.2 billion, a 4.7% decrease compared to the previous session. Meanwhile, the matched trading value reached VND 22,086.7 billion, down 2.0% from the previous session, but up 34.2% and 54.2% compared to the 5-day and 20-day averages, respectively.

In terms of industries, liquidity decreased notably in Real Estate, Securities, Steel, and Software, with the first two industries posting gains. In contrast, the Banking, Oil & Gas Production and Exploration, and Textile industries witnessed both price and liquidity increases compared to the previous day’s trading.

Foreign investors recorded a net buy value of VND 974.4 billion, with a net buy value of VND 941.7 billion in matched transactions. Their main net buy sectors were Banking and Real Estate. The top stocks in their net buy list included TPB, VNM, VHM, HDB, VCI, TCB, DXG, MSN, KDH, and SSI.

On the sell side, the Foreign investors’ net sell sectors were Basic Resources. The top stocks in their net sell list included HPG, VPB, POW, SCS, MSB, NKG, FUESSVFL, KDC, and BID.

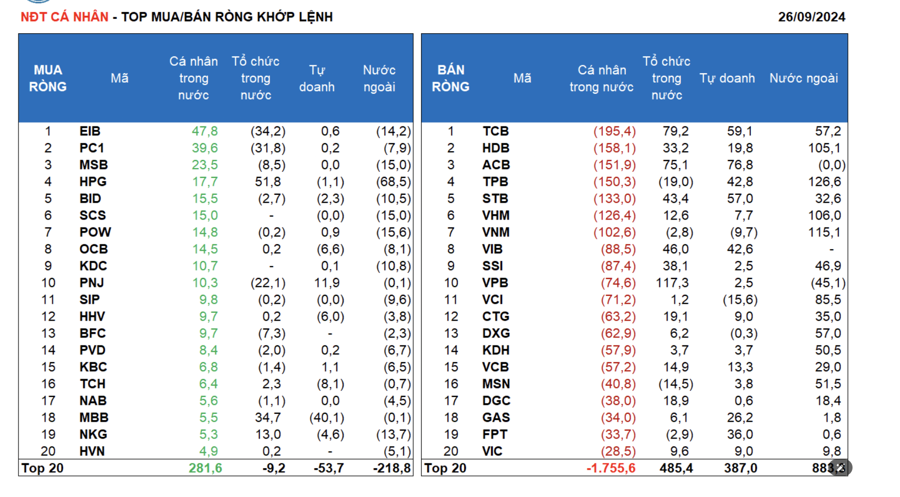

Individual investors recorded a net sell value of VND 1,727.6 billion, with a net sell value of VND 1,869.8 billion in matched transactions. In terms of matched transactions, they net bought in 6 out of 18 sectors, mainly in Construction and Materials. The top stocks in their net buy list included EIB, PC1, MSB, HPG, BID, SCS, POW, OCB, KDC, and PNJ.

On the net sell side, they net sold in 12 out of 18 sectors, mainly in Banking and Real Estate. The top stocks in their net sell list included TCB, HDB, ACB, TPB, STB, VHM, VIB, SSI, and VPB.

Proprietary trading recorded a net buy value of VND 148.9 billion, with a net buy value of VND 447.2 billion in matched transactions. In terms of matched transactions, Proprietary trading net bought in 13 out of 18 sectors, with the strongest net buys in Banking and Financial Services. The top stocks in their net buy list included ACB, TCB, STB, TPB, VIB, FPT, GAS, HDB, HCM, and BMP. Their net sell sector was Basic Resources. The top stocks in their net sell list included MBB, VCI, VNM, TCH, OCB, HHV, NKG, HSG, DBC, and PDR.

Domestic institutional investors recorded a net buy value of VND 620.6 billion, with a net buy value of VND 480.8 billion in matched transactions. In terms of matched transactions, Domestic institutions net sold in 11 out of 18 sectors, with the highest net sell value in Construction and Materials. The top stocks in their net sell list included EIB, FUEVFVND, PC1, MWG, PNJ, TPB, MSN, MSB, BMP, and HCM. Their net buy sectors were led by Banking. The top stocks in their net buy list included VPB, TCB, ACB, HPG, VIB, STB, SSI, MBB, CTG, and DGC.

Today’s matched transactions contributed 8.0% of the total trading value, a decrease of 28.0% compared to the previous session, with a value of VND 1,922.4 billion. Notable transactions included a domestic proprietary firm selling over 7.3 million BWE shares, worth VND 319.7 billion, to individual investors. Additionally, individual investors sold over 9.6 million TCB shares (valued at VND 215.4 billion) to domestic proprietary firms.

The money flow allocation ratio increased in Banking, Retail, Oil & Gas, and Textiles, while it decreased in Real Estate, Securities, Steel, Food & Beverage, Chemicals, Software, and Power Production & Distribution. Specifically, for matched transactions, the money flow allocation ratio increased for large-cap stocks (VN30) and small-cap stocks (VNSML) while decreasing for mid-cap stocks (VNMID).

No More Red Eyes: Hunting for Apartments Over $43,000 in Major Cities

The sub-2 billion VND apartments in Ho Chi Minh City have been absent for years, putting immense pressure on the housing market in Vietnam’s most populous city. The resurgence of apartments priced above 1 billion VND in near-central and satellite town locations will help alleviate this bottleneck. This new offering provides a glimmer of hope for homebuyers, promising a chance to secure a home in desirable locations without breaking the bank.