On September 26, as part of the 37th session, the National Assembly’s Standing Committee gave opinions on the draft Law on Special Consumption Tax (SCT) amendments.

Presenting the Government’s proposal, Deputy Minister of Finance Nguyen Duc Chi said that the bill has proposed a roadmap to increase SCT on alcohol and beer. Specifically, it suggests a percentage-based tax rate that will increase annually from 2026 to 2030, aiming to raise the selling price of alcohol and beer by at least 10%, as recommended by the World Health Organization (WHO).

For spirits with an alcohol content of 20 degrees and above, the drafting agency proposes two options. Option 1: Increase the tax rate from the current 65% to 70%, 75%, 80%, 85%, and 90% each year from 2026 to 2030. Option 2: Increase the tax rate from the current 65% to 80%, 85%, 90%, 95%, and 100% each year from 2026 to 2030.

The amended Law on Special Consumption Tax proposes to increase the tax rate on beer up to 100%. Photo: HOANG TRIEU

For beer, the drafting agency also proposes two options. Option 1: Increase the tax rate from the current 65% to 70%, 75%, 80%, 85%, and 90% each year from 2026 to 2030. Option 2: Increase the tax rate from the current 65% to 80%, 85%, 90%, 95%, and 100% each year from 2026 to 2030.

According to Deputy Minister Nguyen Duc Chi, the Government leans towards option 2.

Presenting the verification report on this content, Chairman of the National Assembly’s Finance and Budget Committee Le Quang Manh said that the majority of the Committee agreed with the increase in tax as proposed in option 2. Some opinions suggested that according to the impact assessment, even with the increase in option 2, alcohol and beer production would only slightly decrease by 1.6% in the whole period, so both options did not meet the set goals. Therefore, the verifying agency requested to consider calculating and proposing a reasonable increase.

In addition, there were also opinions suggesting considering the application of a mixed tax calculation method for alcoholic beverages.

The draft law also adds carbonated drinks according to Vietnamese standards (TCVN) with a sugar content of more than 5g/100ml to the objects subject to SCT to implement the directions of the Party and the State on protecting people’s health, and the recommendations of the WHO, UNICEF, and the Ministry of Health.

Regarding the above content, the verifying agency said that the majority of the Finance and Budget Committee agreed to add this product to the taxable objects to contribute to production and consumption orientation and expand the tax base.

Some opinions suggested considering the addition of sugary drinks to the objects subject to SCT because the consumption of sugary drinks in Vietnam is not high; the number of countries that impose SCT on sugary drinks is currently small. Along with that, sugary drinks are not the main and only cause of obesity. To limit obesity, the use of other solutions may be more effective.

The verifying agency also clarified that some opinions suggested that the addition of sugary drinks to the taxable objects would not only adversely affect the production and business activities of carbonated drink manufacturers but also affect auxiliary industries. Not to mention, this could increase the consumption of unofficially produced or handcrafted beverages.

The Longest Road Tunnel in South-East Asia: A Testament to Vietnamese Engineering.

A monumental feat of engineering, this tunnel stands as a testament to the skill and dedication of Vietnamese workers. Over 1,600 days and nights of labor, coupled with two technical challenges, resulted in a masterpiece that reduced travel time across the mountains to a mere 6 minutes.

With a length of over 21 kilometers, the Hai Van mountain pass was once a daunting challenge for drivers. However, the newly constructed Hai Van tunnel has revolutionized travel, reducing the journey time from a 45-minute treacherous drive to a mere 6-minute smooth transit, along with minimizing fuel consumption and vehicle wear and tear.

The Cost of High-Speed Rail in Vietnam: $43.69 Million for 1 km of Track, with 60% on Viaducts to Ensure a Straight Route

The pre-feasibility report for the high-speed North-South railway project by the Ministry of Transport estimates the project’s investment rate at $43.69 million per kilometer. This ambitious venture promises to revolutionize transportation in the region, offering unprecedented speed and efficiency. With a projected investment of $43.69 million per kilometer, this project is poised to become a landmark infrastructure development, shaping the future of travel and connectivity in the area.

The Rise of Imports: Chinese-Made Products Flooding In

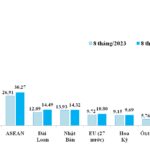

In the first eight months of 2024, imports from China surged to a staggering 92.5 billion USD, reflecting an impressive year-on-year growth of 34.4%. This translates to a significant increase of 23.66 billion USD compared to the same period in the previous year, as revealed by the latest data from the General Department of Vietnam Customs.