Services

Mr. Tran Vinh Dat, a 35-year-old resident of Ho Chi Minh City, enjoys a stable income. After 13 years of saving, he has accumulated VND 1 billion. With current deposit interest rates ranging from 4.7% to 5.5% per annum, this return may not be attractive when considering inflation and other risk factors. Thus, he seeks more profitable investment avenues.

A New Investment Avenue: Open-end Funds

Upon exploring various investment options like real estate, stocks, and gold, Mr. Dat discovered the advantages of open-end funds. Compared to other alternatives, these funds offer flexibility, lower risk, easier access with a small capital base, and, most importantly, higher long-term profits than savings accounts. Open-end funds also enable small investors like Mr. Dat to participate in the stock market more professionally and safely than direct investment.

Mr. Dat learned about the VCBF Leading Stock Investment Fund (VCBF-BCF), which has operated in the market for over a decade, yielding an average return of 13%/year (1). With its long history and reliable performance, VCBF-BCF instilled confidence in Mr. Dat to invest long-term through this open-end fund. Notably, VCBF is a subsidiary of Vietcombank, adding a layer of trust and assurance for investors.

|

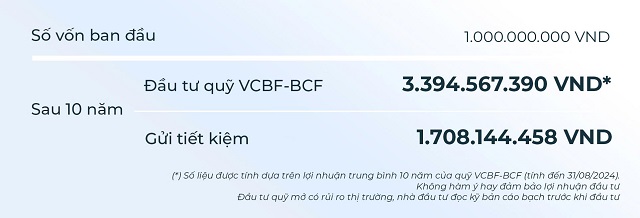

If the fund maintains its average annual growth rate over the next decade, Mr. Dat’s investment will grow to VND 3.39 billion, nearly 3.4 times his initial capital. In contrast, a savings account would yield approximately VND 1.97 billion over the same period. This significant disparity in investment outcomes, especially with a high-performing fund like VCBF-BCF, underscores the potential of open-end funds.

Why Not Opt for Direct Stock Investment Instead of Open-end Funds?

Mr. Dat chose open-end funds over direct stock investment because the former aligns better with his needs and busy lifestyle as a company manager. He doesn’t have the time to constantly monitor stock tickers or time the market for buying and selling. Analyzing potential stocks and valuing companies also require experience and expertise, which he lacks at the moment.

Mr. Dat opted for a simpler approach: investing periodically from his monthly income without worrying about market fluctuations or constant monitoring. He leaves the optimization to the experts.

|

Additionally, he appreciates the accessibility of open-end funds, which only require a small initial investment. In contrast, real estate or direct stock purchases demand more substantial capital. Open-end funds are also regulated by the State Securities Commission and supervised by a bank, ensuring transparency and safety, further reassuring Mr. Dat during his wealth accumulation journey.

Why “Investing Early” is a Must Before Turning 35

Mr. Dat shared, “If I had known about open-end funds earlier, I would have started investing as soon as I began working, instead of waiting until I had saved VND 1 billion. Early investment not only maximizes profits and harnesses the power of compound interest but also teaches me better financial management. For individuals with modest incomes and capital, open-end funds offer a straightforward and secure path to the stock market.”

————–

About VCBF Open-end Funds

VCBF Open-end Funds are investment funds managed by Vietcombank Fund Management Joint Stock Company (VCBF). These funds offer diverse investment opportunities in assets such as stocks and bonds. With features like low minimum investment, high liquidity, and transparency, VCBF open-end funds enable investors to enter the market without requiring extensive expertise.

VCBF-BCF is one of only 11 open-end funds with over a decade of operation, and it ranks second in performance among them. The 13.0%/year profit also surpasses the fund’s reference index, VN100, which averaged 8.5%/year.

(1) Average 10-year profit of the VCBF-BCF fund. This does not imply or guarantee future profits.

The Power of Planning: Unlocking the Development of South-East Vietnam

Effective provincial planning involves creating interconnected and cohesive strategies that enable each locality to thrive and showcase its unique strengths. The goal is to transform the Southeast region into the economic powerhouse of the country, with each province playing a pivotal role in this collective endeavor.

Unlocking Thai Binh’s Investment Potential: Transforming Transportation Isolation into Opportunity

The transport infrastructure is transforming Thai Binh, unlocking its potential as an emerging growth hub in the Red River Delta region. With improved connectivity, Thai Binh is poised to become an attractive “keyword” for urban developers, no longer an “island” but a vibrant and accessible destination.